Table of Contents

The Electronic Data Interchange software market size was valued at USD 1.78 billion in 2022 and is projected to grow to USD 4.52 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 12.5%. Electronic Data Interchange (EDI) enables businesses to automate document exchanges and data flows with trading partners through agreed-upon electronic standards. EDI transforms tedious manual processes into seamless digital transactions, driving efficiencies, cost savings, and competitive advantages. While traditionally used by larger companies, EDI solutions in small businesses are becoming more accessible and affordable, further expanding its reach. This complete guide covers the basics of EDI, its benefits and use cases, key concepts like documents, transactions, and standards, and the future direction of this critical technology for B2B integration.

What is Electronic Data Interchange (EDI)?

Electronic Data Interchange or EDI is simply a digital system for exchanging business documents like purchase orders, invoices, shipping notices, and payments between companies and organizations. EDI Solutions eliminates the need for paper documents, allowing businesses to automate data transfer and transactions between each other.

An EDI solution provider uses EDI to send and receive standardized electronic documents between their systems. Common documents transferred through EDI include purchase orders and order confirmations, shipment notices, invoices and billing data, payments, and remittance details. This helps streamline the flow of information between business partners and supply chain members.

For EDI to work, businesses need compatible computer systems that can electronically encode and transmit information in a standardized format. EDI messages and document types are typically defined using EDI standards like ANSI X12. The sending company encodes the document information into the standard EDI format and transmits it electronically to the receiving company. The recipient’s system then decodes the EDI data and loads it into their internal systems.

While emailing documents as PDF attachments can also replace paper documents, EDI offers higher efficiency by eliminating the need for manual data re-entry. Using EDI, businesses and their supply chains can achieve faster transactions, lower administrative costs, reduce errors, and improve cash flows by accelerating billing and payments. EDI can significantly reduce errors in data transmission compared to manual processes. Studies suggest a potential reduction in errors by as much as 80%.

What are EDI Solutions?

EDI solutions help companies implement and manage Electronic Data Interchange (EDI) processes to exchange business documents electronically with suppliers, customers, and business partners. EDI solutions convert traditional paper-based documents between organizations into standardized electronic formats that can be transmitted, received, and processed digitally.

There are two main types of EDI Solutions– on-premise and cloud-based EDI. On-premise EDI software is installed and runs within a company’s internal IT systems and private network. Companies have more control over security and system management but need to invest in hardware, maintain the infrastructure, and perform software upgrades.

Cloud EDI solutions run on external servers hosted by a service provider and accessed online via the Internet. Businesses benefit from lower upfront costs, no hardware investments, and minimal IT resource requirements. EDI Service Providers in the USA take care of maintenance, security, system upgrades, and performing data backups. However, companies relinquish some control of their EDI systems and data to the external cloud provider.

Key components of most EDI solutions include EDI mapping tools to translate data between different formats, EDI testing environments to validate electronic documents before the exchange, virtual trading partner directories for storing partner information, reporting modules to track transactions and monitor activities, and integration capabilities to link EDI systems with internal applications.

What are EDI Services?

EDI services involve a range of capabilities offered by third-party providers to help organizations implement, manage, and maintain their Electronic Data Interchange processes and infrastructure. These include the below:

EDI Outsourcing

Many companies outsource their EDI processes to dedicated EDI providers. These EDI outsourcing services handle all aspects of mapping, implementation, and ongoing transaction management. Companies benefit from lower costs compared to in-house EDI teams. Outsourcing firms also have expertise in updating document formats and integrating with new trading partners. However, companies have less control and visibility of EDI operations.

Outsourced EDI Services to a specialized third party can free up internal IT resources for strategic tasks. However, businesses still need to provide resources for governance, oversight, and communicating requirements to the EDI outsourcing provider. Overall contracts and service level agreements must also be put in place to ensure outsourcers meet performance targets and security standards.

EDI Consulting

Electronic Data Interchange consultants help businesses develop strategies and roadmaps for implementing or upgrading their EDI capabilities. Consultants assess clients’ requirements, identify appropriate EDI solutions, develop data mappings between trading partners, and provide recommendations to achieve the client’s business objectives. EDI consulting expertise is especially valuable for complex EDI initiatives involving multiple partners. However, consultants typically do not oversee ongoing EDI operations.

Although EDI consulting develops recommendations based on a business’s unique needs, the client’s internal teams are responsible for executing the suggested strategies and roadmaps. Consultants typically provide a time-bound engagement, after which businesses need to ensure proper implementation and management of EDI systems and processes on an ongoing basis. Regular audits may also be needed to assess progress and identify areas for improvement.

Eliminate the need for manual data entry. Contact our experts for EDI services

EDI Managed Services

These services involve managing a company’s entire EDI infrastructure and operations on an ongoing basis. EDI-managed service providers take responsibility for tasks like system administration, document mapping and transacting EDI, release management, interface testing, and partner onboarding. Electronic Data Interchange companies benefit from lower costs, expertise, and round-the-clock support. However, they lose direct control over some EDI operations and data.

While EDI-managed services handle day-to-day operations, clients still need some in-house expertise to create EDI mapping configurations, develop business rules, and validate data. Businesses also need to monitor service provider SLAs, conduct audits, and evaluate the managed service on an ongoing basis. Ultimately, businesses are still accountable for the accuracy and regulatory compliance of their EDI transactions.

EDI Staffing

EDI staffing agencies provide temporary or contracted EDI support specialists and consultants to support clients’ short-term or seasonal EDI needs. They help source, screen, and hire the required EDI talent which businesses may lack in-house. EDI staff augmentation is particularly useful when companies are ramping up EDI capabilities, transitioning EDI systems, or integrating a new partner. However, staffing agencies charge higher hourly or daily rates.

Companies using EDI staff augmentation need internal EDI experts to onboard and supervise contract staff, provide them access and training, and ensure work quality. In-house teams also need enough knowledge to integrate the work done by temporary EDI hires into their existing systems and processes. Proper change and release management procedures should also be followed when introducing resources sourced through EDI staffing agencies.

EDI Migration

The adoption of a new EDI system within an organization is referred to as an EDI migration. This procedure usually includes the smooth transfer of infrastructure, systems, and data from the current legacy framework to the new EDI environment. Reassessing alliances with fresh service providers or switching to a cloud-based solution can also be necessary.

Why do businesses decide to go to the cloud or change an EDI provider? Technological developments, the requirement for increased scalability and flexibility in response to a dynamic business or market environment, and increased demands on the technology resulting from new integration opportunities are some of the elements that have influenced this decision.

A company’s present EDI service provider may no longer be able to meet or support new industry-specific or regional standards when it expands into foreign markets. Furthermore, EDI migration becomes essential in certain cases when the current EDI provider stops offering its services. Choosing a cutting-edge EDI solution from a knowledgeable supplier in these situations creates a safe framework for easy data sharing inside a digital ecosystem.

Five steps make up an EDI migration strategy:

- To establish the present state, goals, and potential hazards, the project team must communicate openly and consistently with all stakeholders during the first planning and strategy phase.

- The focus of the second phase of EDI migration, which involves the analysis and design of the target architecture, is on the future cloud-based EDI ecosystem. This includes planning for security and compliance, integrating the target architecture into current systems, and analyzing data and processes.

- The goal of the third step, which is data evaluation and migration preparation, is to guarantee the data’s continuity, security, and integrity during the migration process. As part of this, the technical team and users will be trained, and the migration plan, test plans, and scenarios will be developed.

- After implementing the business procedures and starting the data migration, the fourth phase of migration execution concludes with testing to confirm the live environment.

- Functionality is ensured even after the move is finished with post-migration assistance and ongoing optimization as the fifth and final phase.

EDI Testing

To put it simply, EDI testing is the process of verifying that EDI documents are sent and received seamlessly between companies and internal systems before the actual implementation of EDI. It’s among the most crucial phases in the EDI implementation procedure as a whole. Most trading partners often encourage, follow, and require suppliers to confirm that they have the technology and software needed to send, receive, and translate standardized business papers as well as to ensure that manufacturing runs smoothly. The trade partner’s EDI testing is done internally, through an external tech business, or a managed EDI service. Typically, this also applies to their suppliers.

You will have the chance to thoroughly verify these components with your connected trading partners during the ensuing EDI test phase. In this stage, an iterative methodology is utilized to evaluate whether any modifications are necessary for the EDI solution or the process itself. The definition and documentation of the entire system are then modified as a result of these test runs. The system’s commissioning marks the end of this process.

EDI Security

Security protocols and procedures for Electronic Data Interchange (EDI) pertain to safeguarding critical business information transferred electronically between enterprises. It uses safeguards like blockchain to prevent unwanted access and cyberattacks. To preserve reliability and confidence during business transactions, EDI security also complies with the set guidelines. Cyber attacks are much more sophisticated. Malicious actors target vulnerabilities in EDI security systems with creative approaches including phishing attacks, ransomware, and complex malware. You need to be vigilant and fortify these systems’ security against these cunning attacks if you want to protect your digital data.

EDI Support Services

These involve providing on-demand technical assistance and troubleshooting for businesses’ EDI systems and operations. Services may include responding to incidents, resolving issues with document transfers, performing data corrections, re-sending failed transmissions, and monitoring system health. EDI support helps ensure uptime and maintains compliance with trading partners. However, businesses still need in-house resources for primary EDI management.

While specialized EDI support services may resolve technical issues quickly, businesses still require in-house experts who understand the bigger picture of their internal systems, operations, and trading partner requirements. In-house staff can also better prioritize support requests based on business impact. Companies should clearly define the scope, responsibilities, and escalation procedures when using external EDI support to ensure consistent performance and adherence to compliance and security standards.

EDI services aim to improve businesses’ efficiency, accuracy, and compliance when exchanging electronic documents with suppliers, customers, and partners.

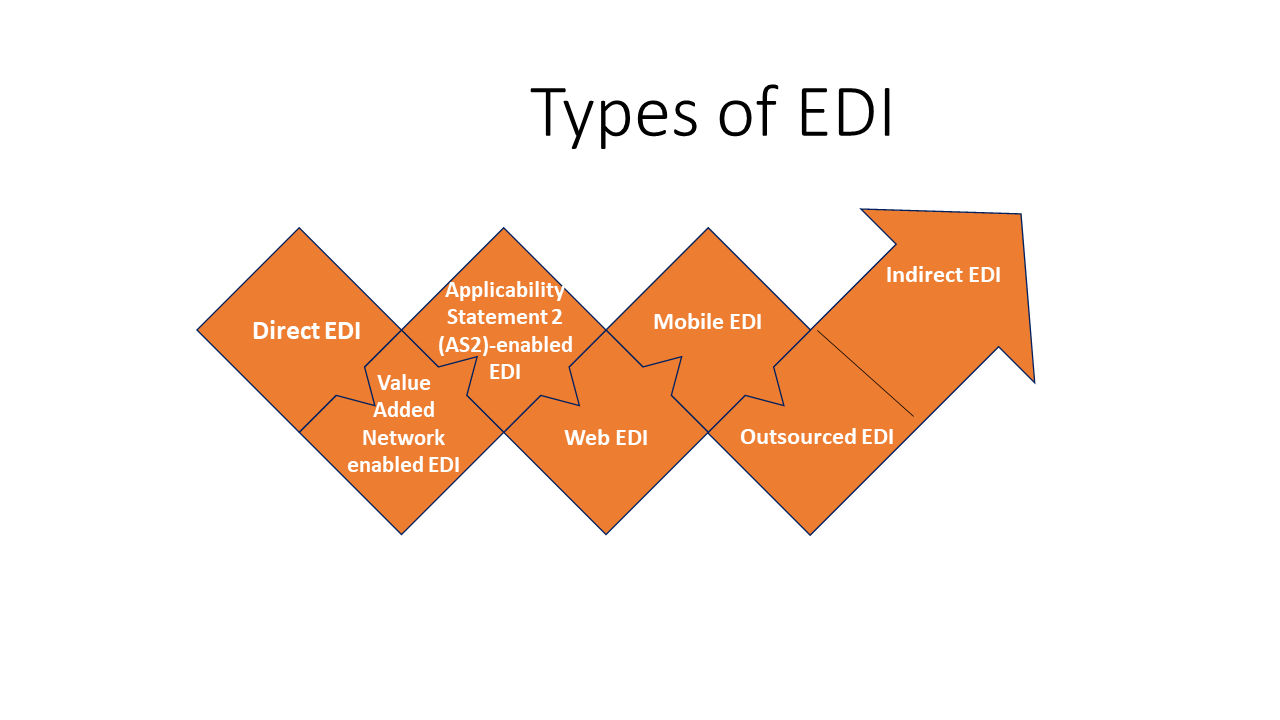

Types of EDI

There are different EDI Cloud Services for implementing Electronic Data Interchange between organizations based on how electronic document exchanges are facilitated. Some of the common types of EDI are as follows-

Direct EDI

In direct EDI, trading partners establish a direct electronic connection between their systems to exchange documents. No intermediary is involved. Direct EDI requires partners to agree on data formats, communication protocols, and security measures. While it has lower costs, direct EDI connections are complex to set up and maintain. Both partners need robust EDI capabilities and high network availability.

Benefits:

Direct EDI connections are most suitable for partners with high volumes of transactions and strict data security requirements. They enable real-time EDI document exchange and faster resolutions of issues. However, businesses need the expertise to manage direct partner relationships and troubleshoot connectivity issues at both ends around the clock. Comprehensive security protocols also need continuous monitoring and updates.

EDI VAN

EDI VAN Services (Value Added Network) involves using a third-party intermediary to facilitate EDI document transfers between partners. VANs receive EDI messages from trading partners, store them temporarily, and then transmit the documents to their recipients on preset schedules. EDI VANs manage data formatting and communication issues, simplifying EDI adoption. However, they charge transaction and setup costs.

Benefits

EDI VAN services provide reliable messaging infrastructure along with value-added features like standardized routing, error correction, and auditing. VAN providers also regularly update data formats and protocols to support partners’ EDI compliance needs. However, the performance of VAN-mediated EDI depends on the uptime, speeds, and reliability of VAN networks. Businesses also lose control over when documents are transmitted to partners.

Web EDI

Web EDI Solutions uses the internet and web browsers as the medium for exchanging EDI documents. Trading partners access a centralized web portal to send and receive EDI data in standard formats. Web EDI is easier and less costly to implement than traditional EDI. However, internet speeds and uptime impact transaction performance. Web EDI also requires a large initial investment to develop the portal.

Benefits

EDI Web Services often serves as an initial stage for businesses to test out EDI before scaling up. It requires lower investments compared to traditional EDI and provides a familiar Internet-based user experience. However, web EDI implementations may not be able to scale to support higher volumes of transactions. Businesses also need to continuously monitor and upgrade their web EDI portals to address performance, security, and compatibility issues.

Cloud EDI

Cloud EDI refers to Software as Service solutions that host EDI systems and services online. Partners access these cloud-based EDI platforms over the Internet to exchange electronic documents. Cloud EDI offers benefits like flexibility, scalability, and lower upfront costs. However, partners must have consistent internet connectivity. Businesses also lose some control over their EDI data stored in the cloud.

Benefits

EDI Cloud Services enables easier integration of EDI processes with other cloud applications. Updates to cloud EDI systems can also be rapidly deployed to all trading partners. However, downtime of cloud EDI platforms will impact all connected businesses. Performance may also degrade with an increasing number of partners and transactions. Organizations, therefore, need redundancy and disaster recovery plans for cloud EDI services.

AS2 EDI

Applicability Statement 2 or EDI AS2 is an EDI security standard that defines how to securely transmit EDI documents over the Internet. AS2 uses encryption, digital signatures, and certificates to ensure data integrity and authentication between trading partners. AS2 overcomes the security limitations of traditional EDI while reusing existing document formats. However, AS2 implementation requires investment in compatible infrastructure and applications.

AS2 EDI enables automatic validation of sender and recipient identities through digital certificates. It also provides non-repudiation of transmitted documents through encrypted signatures. However, AS2 requires resources for the ongoing management of certificates, keys, and security policies between trading partners. Businesses also need the expertise to troubleshoot issues related to AS2 encryption, authentication, and non-repudiation.

How does EDI work?

For EDI to work,

- Trading partners first need to agree on the types of documents to exchange, their formats, and specifications. Common EDI standards define formats for documents like purchase orders, invoices, and shipping notices.

- Once standards are decided, organizations develop EDI mappings to translate the data in their internal systems into the agreed EDI formats and vice versa. Specialized EDI software handles encoding and decoding data during transmissions. Partners then set up a connection channel to electronically exchange EDI documents. They can either connect their systems directly or transmit documents via an EDI network service provider. Partners also configure settings like data transfer schedules, communication protocols, and security measures.

- When a sender prepares an EDI document to transmit, their EDI software encodes the data from their internal records into the agreed EDI format. Things like product codes, order numbers, and amounts are converted. The encoded EDI document developed by EDI solution providers in the USA is then electronically transmitted to the recipient’s system using the configured connection channel.

- At the receiving end, the recipient’s EDI software decodes the electronic EDI document by converting it back into data their internal systems can process. The decoded data is then updated in the recipient’s applications. For example, a purchase order received via EDI can auto-populate fields in the recipient’s order management system. Companies are required to consider affordable EDI Solutions to maintain their profitability.

- Errors in transmitted EDI documents are caught and corrected during decoding before updating recipient systems. Recipients also send EDI acknowledgments upon receiving error-free documents to confirm successful transmissions.

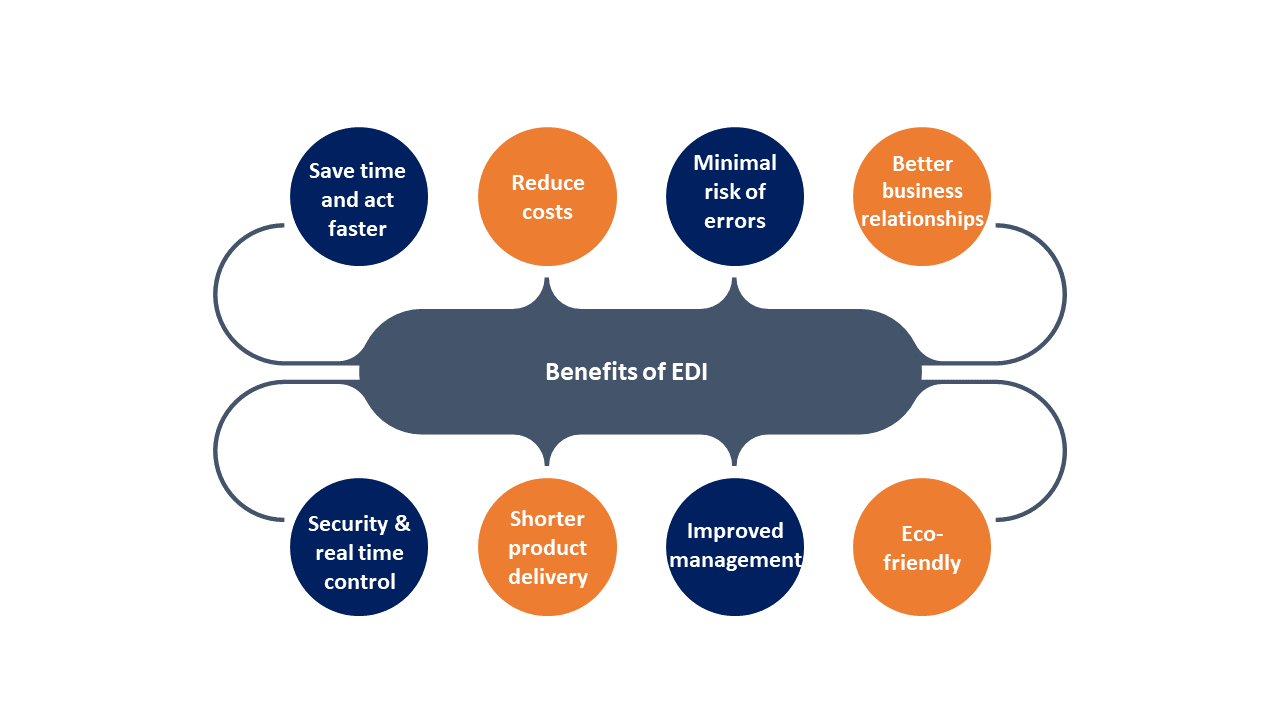

What are the Benefits of EDI?

Electronic Data Interchange provides numerous benefits that have convinced many businesses to digitize their document exchanges with suppliers, customers, and partners. EDI automates the transmission of electronic documents between organizations’ internal systems, replacing traditional paper-based processes. This transformation enables businesses to achieve meaningful benefits across various fronts. Some of these benefits are as follows-

Improved Operational Efficiency

Electronic data interchange offers significant improvements in operational efficiency through the automation of document exchange and data update processes. EDI eliminates the time and effort involved in printing, mailing, and processing physical documents. Data is electronically transmitted between trading partners’ systems, automatically decoded, and used to update internal records. This reduces manual data re-entry and the chances of errors. Complete EDI Solutions also validates documents during transmission to catch errors early, further improving efficiency. Overall, EDI allows businesses to complete transactions and fulfill orders much faster with higher accuracy.

Better Supply Chain Management

EDI Software Solution enables electronic linkages and real-time information flows between businesses and their entire supply chains. Partners get higher visibility into order statuses, inventory levels, shipments, and payments. Companies can more easily implement just-in-time processes and track fulfillment performance across supply chain members. EDI also simplifies the integration of suppliers’ and customers’ systems since data is exchanged in standardized electronic formats. Digital connectivity and data access improve inventory management reduce order cycle times, and support more responsive supply chains.

Faster Cash Flows and Billing Cycles

Since EDI-integrated business solutions automate the exchange of documents like invoices and payment advice, it speeds up billing cycles and associated cash flows. Businesses do not have to wait for paper invoices to arrive. Instead, billing details are transmitted electronically and automatically updated in financial systems. Similarly, remittance data from customers is received digitally via EDI. In some cases, EDI payment files can be automatically uploaded to banks for faster funds transfers. Overall, EDI shortens the time taken to raise, receive, and reconcile invoices as well as collect and allocate payments. This translates to accelerated cash flows and improved working capital.

Lower Operating Costs

EDI eliminates expenses associated with printing, mailing, storing, and manually processing paper documents. It also reduces labor costs by automating data capture and update processes. EDI minimizes rejections, errors, and rework through built-in validation checks and data standardization. This lessens reconciliation efforts and expenses. EDI also decreases the need for phone and email support to resolve issues arising from physical documents. Overall, EDI enables businesses to complete more transactions with each employee, driving higher productivity and lower operating costs.

Compliance with Standards

EDI Service helps ensure electronic documents are exchanged accurately and consistently under industry and government standards. EDI solutions provide tools to automatically audit and report on transactions to verify compliance. It uses data formatting and communication protocols that are standardized, regulated, and accepted across industries. This enhances regulatory compliance when transacting electronically with trading partners. In summary, EDI enables businesses to transact faster and more efficiently while meeting compliance requirements.

Improved Decision Making

EDI provides real-time visibility into order and fulfillment activities across the supply chain. Businesses get automated updates whenever a new document is received. This access to accurate and up-to-date transaction data helps companies make better-informed decisions. Managers can identify issues, bottlenecks, and inefficiencies earlier. EDI service providers also enable “what if” analysis based on historical transaction records to optimize processes and policies. Overall, EDI supports fact-based planning and data-driven decision-making.

Reduced Physical Space Requirements

Since EDI Service eliminates the need to store physical documents, it reduces storage space requirements for filing cabinets, shelves, and document repositories. Businesses also save on real estate costs for larger offices, warehouses, and offsite storage units needed to house paper records. EDI documents exist in electronic formats and are stored in databases, freeing up physical spaces for more productive uses. This space savings become more significant for companies with high volumes of paper transactions.

Common EDI Errors and How to Fix Them

Errors in the message’s content –

When information is inaccurate or missing, mistakes like this one occur. For instance, the item number is incorrect or missing (e.g., the purchase order creation date, the invoice number, or the GTIN). Updating and verifying the data in the ERP system is necessary to prevent these mistakes. Checking and testing of master data is necessary during the EDI onboarding phase. It is also necessary to set up automated data validation.

Message Sequencing –

When the intended message is refused because the preceding message was not received, this kind of error occurs. For instance, because he has not yet received an order response (ORDRSP), the buyer is unable to get a despatch advice message (DESADV). It is important to configure the message flow correctly to prevent this problem. If the prior message (related to this particular workflow) was not received, the system ought to be configured so that it is unable to accept the current one. The ERP and EDI systems ought to have explicit policies on this.

Wrong connection –

This EDI error may occur with the VAN or the EDI provider. For instance, a server disconnect can prevent the message from being transmitted. Typically, internal EDI teams are unable to resolve this kind of problem; instead, the provider or VAN should be contacted. Appropriate monitoring and alarms should be put up to promptly reestablish the connection (on the provider’s end) to prevent this problem. Selecting a provider/VAN with dependable monitoring and recovery strategies is advised for a business party.

EDI Scheduling –

When the transmitter or receiver is configured incorrectly, this error occurs. The incorrect sender/receiver ID, for instance. The relevant data in the data source has to be corrected to rectify this problem. ERP systems should be configured correctly so that the recipient cannot receive a message containing incorrect data.

Configuration errors –

This kind of EDI error addresses configuration issues in the system. The correct master data protocols, which need maintenance and updation regularly, provide the foundation of the workflow’s proper logic. To guarantee that an EDI solution is completely integrated into an ERP system, master data updates and technical labor are needed for configuration fixes.

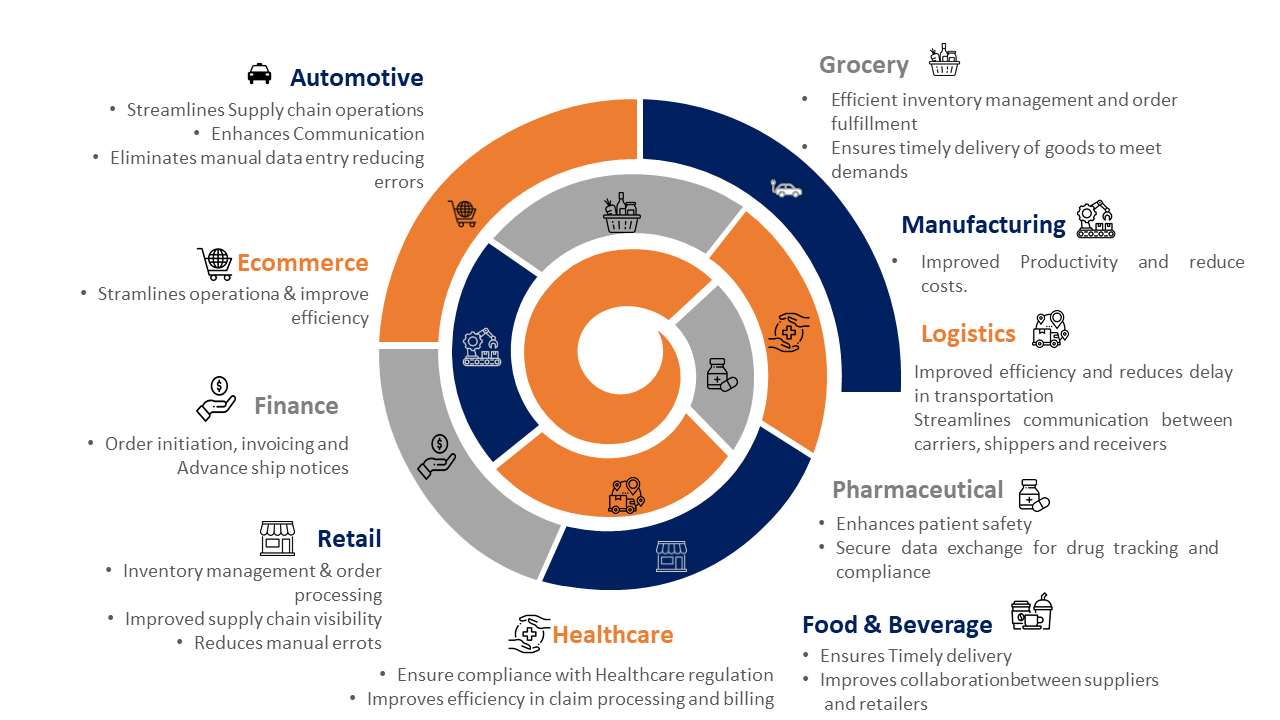

Industry Use Cases of EDI

EDI is used across diverse industries to simplify and automate electronic document exchange between businesses. Its use cases vary based on industry-specific requirements and the types of partner organizations involved. However, EDI generally aims to improve efficiency, reduce costs, and ensure compliance through the digitization of document-intensive processes.

EDI in Healthcare

Hospitals, insurers, labs, pharmacies, and medical device firms extensively use EDI to exchange documents like claims, referrals, prescriptions, and reports. EDI simplifies the management of large volumes of transactions while meeting regulatory mandates for privacy and security. It also cuts processing time and costs for healthcare stakeholders while improving the accuracy of data.

EDI enables the exchange of standardized documents that comply with the regulations. It also supports auditing and reporting needed for government programs. However, healthcare EDI requires frequent updates to document formats to address coding changes and compliance issues. Security is also critical given the sensitive nature of medical information. Providers must closely monitor EDI workflows to prevent data breaches.

EDI in Insurance

Insurers use EDI transactions to rapidly transmit claims, payments, and coverage verifications with healthcare providers, auto repair shops, employers, and policyholders. EDI reduces the manual efforts involved in mailing or faxing insurance documents. It also enables real-time access to policy data needed to promptly approve or deny claims. EDI thus helps improve fraud detection, speed up payments, and maximize administrative efficiency for insurers.

EDI reduces labor costs and speeds up claim cycles for insurers. However, EDI implementations often involve complex cross-industry mappings and document revisions. Insurers must also adapt EDI formats to support varying partner requirements. Data quality and partner compliance are continuously evaluated through EDI auditing and reporting.

EDI in Finance

Financial institutions use EDI to exchange vast amounts of documents related to transactions, payments, account verifications, and loans with corporations, merchants, and government agencies. EDI automates labor-intensive processes like check processing while integrating with core banking systems for straight-through processing and enables banks and financial services firms to achieve higher productivity, lower transaction times, and reduce costs.

EDI transaction helps financial institutions achieve straight-through processing and automation. However, EDI systems are increasingly integrated with digital channels and offerings like online banking. Updates to EDI standards and formats are thus combined with enhancements to digital customer interfaces. Financial institutions must also align EDI data with regulatory reporting needs.

EDI in Retail

Retailers rely on EDI to efficiently manage purchase orders, invoice processing, shipping notices, and inventory updates with suppliers and distributors. EDI integration enables real-time visibility into stock levels, order statuses, and deliveries. Thus, it supports faster replenishments, flexible logistics, and tighter supply chain collaboration to enhance retailers’ customer experience.

EDI supports faster inventory turns and out-of-stock reductions for retailers. However, disruptions or errors in EDI flow impact store operations. Retailers thus require fallback options and contingency plans. EDI implementations must also accommodate varying technical capabilities across retail supply chain partners.

EDI in Manufacturing

Manufacturers use different EDI transaction types for integrating key supply chain and logistics processes like order management, inventory tracking, shipping, and invoicing with suppliers and customers. EDI facilitates JIT manufacturing, traceability, visibility, and flexibility needed to optimize complex production processes and product flows. Electronic Data Interchange also helps manufacturers meet the compliance requirements of regulators and trading partners.

EDI enables real-time visibility and automated replenishment for manufacturers. However, complex supply networks involve many trading partners with different EDI maturity levels. Manufacturers must provide support and incentives to bring low-EDI suppliers on board. EDI systems are also integrated with industrial IoT platforms to gain real-time insights from production processes.

EDI Documents

Organizations involved in Electronic Data Interchange exchange a variety of standard electronic documents to automate business processes. Common EDI documents include Purchase Orders, Invoices, Shipping Notices, Payments, and Item Returns.

- -A Purchase Order is an electronic document sent by a buyer to a supplier, containing details of products or services requested along with quantities, prices, delivery locations, and terms. Suppliers respond with an EDI Order Confirmation upon acceptance.

- -An Invoice is sent electronically from a supplier to a customer, listing products sold or services provided along with pricing, taxes, and the total amount owed. Customers then send EDI Remittance advice when making payments, detailing how funds are allocated against specific invoices.

- -A Shipping Notice is an EDI document issued by a supplier to notify customers about items dispatched and provide tracking details. Customers then generate Advance Ship Notices to inform suppliers about inbound shipments.

- -EDI Payment documents and EDI transaction sets include items like Disbursement advice containing payment details sent from customers to suppliers, and Payment Order Advice issued from banks to notify payees about incoming funds.

- -Item Returns are also handled via EDI using documents like Return Material Authorizations generated by customers to approve product returns, and Debit Advices created by suppliers to record return adjustments against invoices.

All EDI documents are formatted according to standards defining data elements, EDI transaction codes, and processing rules. Standardized documents ensure compatibility between trading partners’ EDI systems and software applications.

EDI Implementation

Implementing Electronic Data Interchange within an organization and with trading partners can be a complex process. However, the following key steps can help make EDI implementation more manageable:

- Assess current processes to identify which business documents to convert into EDI format first. Determine key partners to implement EDI with based on volumes, complexity, and priority.

- Research EDI solutions that suit specific needs. Options include on-premise software, cloud-based platforms, or EDI network services. Evaluate features, costs, support, and compatibility with internal systems.

- Select trading partners to start EDI with and obtain their requirements related to data formats, encryption standards, communication protocols, and document specifications. Ensure commitments from selected partners to implement EDI.

- Configure the selected EDI solution based on partner requirements and internal IT infrastructure. Develop or acquire data mappings to translate internal data formats to EDI standards and vice versa.

- Test EDI transactions and documents and connections extensively with trading partners to validate data accuracy, validate transactions, and resolve issues. Make necessary mapping changes and system updates.

- Go live with EDI for selected documents and trading partners. Monitor transactions closely in the initial stages to identify and fix problems. Provide support to partners.

- Expand EDI implementation by adding more documents, partners, and systems over time. Periodically review EDI processes, technology, and standards to identify improvements.

- Train relevant staff on using the EDI solution and understanding partner-specific formats. Require security protocols to restrict EDI system access.

- Monitor EDI performance through metrics like volumes, processing times, savings, and compliance. Use data to optimize processes, rectify issues, and justify further investments.

EDI Transactions

An EDI transaction represents the electronic exchange of a single EDI document between trading partners to complete a business process. Organizations involved in Electronic Data Interchange regularly execute various EDI transactions with their suppliers, customers, and logistics service providers.

Common types of EDI transactions include order placements, invoice payments, shipping notifications, and item returns. EDI enables high volumes of automated transactions to happen smoothly without human intervention.

How Do EDI Transactions Work?

- The sending organization first generates the EDI document as per defined standards.

- Their EDI software then encodes the data from internal systems into the standard EDI format.

- The encoded EDI document is transmitted electronically to the recipient organization using an agreed communication channel like a direct link, EDI network, or web portal.

- At the recipient’s end, their EDI software decodes the incoming EDI document by converting it back into data their internal systems can process.

Common data used in EDI transactions includes product codes, order numbers, shipment details, payment amounts, and item returns. The decoded data is then updated in the recipient’s relevant applications. For example, a purchase order received via EDI can auto-populate fields in their order management software.

Issues in EDI transactions are identified and resolved during decoding before internal systems are updated. Recipients also send EDI acknowledgments upon receiving error-free documents to confirm successful transmissions.

EDI Transactions in Healthcare

EDI is widely used in the U.S. healthcare industry to streamline the exchange of administrative and financial documents between insurers, providers, labs, and clearinghouses. Common transactions involve enrollments, claims, payments, and eligibility checks. Details regarding these transactions are as follows-

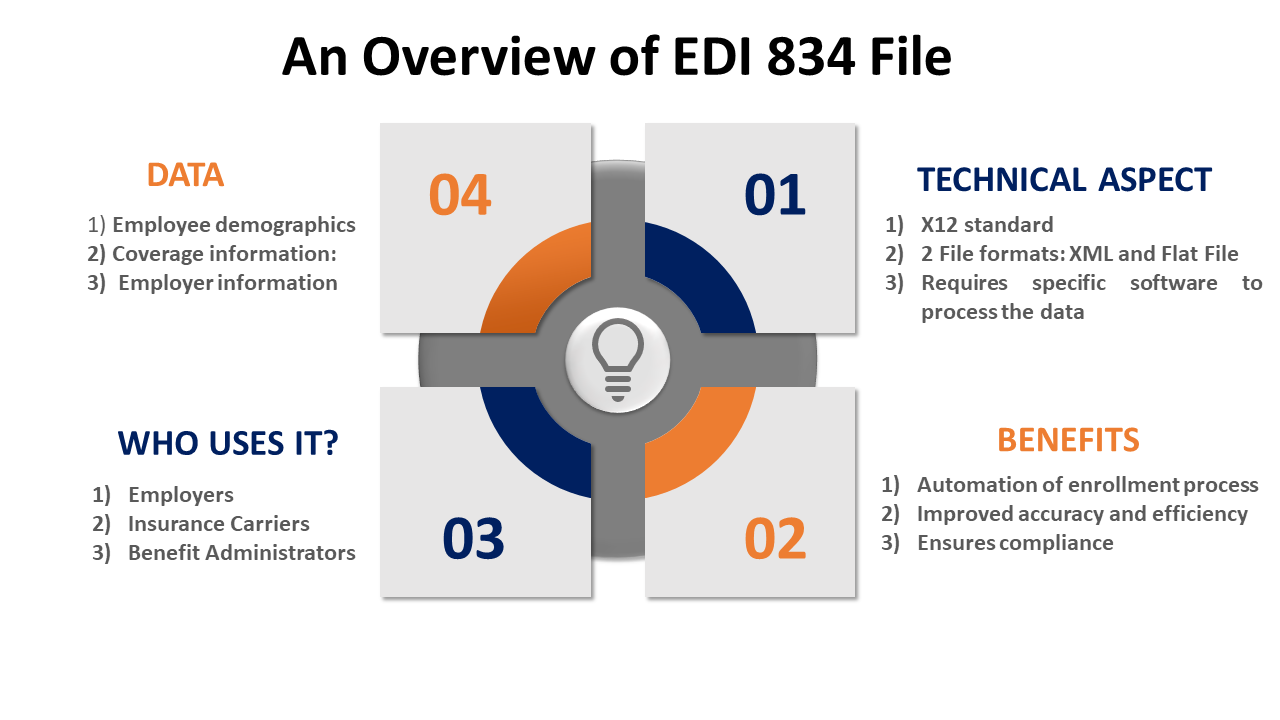

EDI 834 – Enrollment and Change Transactions

The EDI 834 transaction format is used by health insurers and providers to exchange patient enrollment data. Using EDI 834, insurers notify providers about new enrollments, plan changes, terminations, and other updates. This electronic enrollment data helps providers verify patient eligibility and insurance coverage before administering care. The EDI 834 transaction aims to automate patient verification processes and reduce claims rejections.

Implementing EDI 834 requires healthcare providers to develop data mappings and system interfaces to decode electronically received patient enrollment details. Providers must also maintain HIPAA compliance when storing and using patient information received via EDI 834. Regular audits and reporting are required to ensure insurers’ EDI 834 transactions adhere to standards and contain accurate data.

EDI 837 – Health Care Claim Transactions

The EDI 837 EDI healthcare transactions are used for submitting healthcare claims electronically from providers to insurers. Using EDI 837, providers transmit professional, institutional, and dental claims along with relevant details like patient information, diagnoses, procedures performed, itemized services, and charges. Insurers then send EDI 835 Claim Payment/Advice transactions to providers detailing payment amounts, adjustments, and remaining patient liabilities. EDI 837 helps expedite claims processing, reduce rejections, and accelerate payments.

HIPAA compliance is critical for EDI transactions when implementing EDI 837 to exchange protected health information. Providers must validate that EDI 837 claim details match patients’ medical records. They also need to track and report on performance metrics like claim acceptance rates, processing times, and payment ratios obtained through EDI 837 and 835 transactions. However, the automation of claims submission reduces labor costs and payment delays for providers.

EDI 835 – Health Care Claim Payment/Advice

The EDI 835 healthcare EDI transactions format is used by health insurers to send electronic Explanations of Benefits (EOBs) and remittance advice to healthcare providers. Using EDI 835, insurers notify providers about claim statuses and payments made against previously submitted EDI 837 claims. EDI 835 advice documents contain details of covered charges, non-covered charges, adjustments, patient liability amounts, and remuneration totals. EDI 835 helps automate payment posting and reconciliation for providers.

Providers rely on EDI 835 remittance data to automatically post payments and reconcile accounts receivable balances. They need regular system maintenance to accommodate format changes in EDI 835 documents over time. Providers may also implement audit procedures to verify that EDI 835 advice details match what insurers paid for submitted claims. Overall EDI 835 speeds up payment reconciliation cycles and cash collections for providers.

EDI 270-271 – Health Care Eligibility Benefit Inquiry and Response

The EDI 270 format is used by healthcare providers to electronically submit patient insurance eligibility inquiries to insurers, while the EDI 271 format carries eligibility responses from insurers to providers. Using EDI 270-271 transactions, providers verify patient coverage and benefits before administering care or scheduling procedures. Eligibility details include health plan identification, coverage types, copay amounts, deductibles, and prior authorization requirements. EDI 270-271 automates the eligibility verification process and reduces the need to contact insurers by phone.

Providers can use real-time eligibility data from EDI 270-271 transactions to reduce the percentage of non-covered services delivered to patients. They must develop workflows to route EDI 271 responses to relevant staff and departments. Only authorized users should have access to patient eligibility information received via EDI. Providers may also conduct audits to ensure EDI 270 inquiries adhere to standards and contain appropriate data.

EDI Standards

Various EDI standards have been developed to define formats for electronic documents and ensure interoperability between the EDI systems of trading partners. Common EDI standards include HIPAA for healthcare, UN/EDIFACT for global trade, ANSI X12 for North America, and AS2 for secure transmissions. Details regarding these standards are as follows-

HIPAA EDI

HIPAA EDI standards govern how electronic healthcare transactions like claims, payments, and eligibility checks must be formatted for security and compliance with regulations. It defines standard transaction code sets and data elements for transmitting patient information electronically between insurers, providers, and clearinghouses. Using HIPAA-compliant EDI aims to reduce administrative costs while protecting patient privacy. However, HIPAA standards must be periodically updated to accommodate changes in policies and EDI Integration.

Checklist

Healthcare organizations implementing HIPAA EDI must obtain and maintain National Provider Identifiers (NPIs) for electronic transactions. They need software solutions that generate HIPAA-compliant EDI documents with required security and audit features. Regular audits and breach reporting are mandated to ensure sensitive patient data transmitted through EDI adheres to HIPAA policies. However, automation through the HIPAA helps providers improve accuracy, reduce claim denials, and accelerate payments.

UN/EDIFACT

UN/EDIFACT or United Nations Electronic Data Interchange for Administration, Commerce and Transport is an international EDI standard developed by the UN. It defines standard formats for electronic documents like purchase orders, invoices, and shipping notices to facilitate global trade between businesses. UN/EDIFACT mapping guides and recommended practices are continuously updated. While it supports multi-language EDI, UN/EDIFACT implementations require additional time and expense.

Implementing UN/EDIFACT EDI involves understanding different EDI integration formats, code values, and structures required for global compatibility. Businesses need the expertise to translate EDIFACT standards into formats compatible with their internal systems. They must also regularly update mappings and interfaces to support ongoing changes to UN/EDIFACT. However, EDIFACT supports the integration of international supply chains through the standardization of electronic document exchanges across borders.

ANSI X12 EDI

The ANSI X12 EDI standard specifies data formatting structures for commonly exchanged electronic business documents between U.S. organizations. X12 defines various EDI transaction sets for documents like healthcare claims, insurance payments, and logistics updates. New and revised ANSI X12 transaction sets are regularly developed and published by accredited standards development organizations. Many businesses and government agencies in the U.S. mandate the use of ANSI X12 EDI to reduce costs and improve compliance.

To implement these EDI Integration Services, organizations require mapping tools, integration software, and debugging expertise to develop reliable ANSI X12 interfaces. They must acquire or develop the ability to encode internal data into defined X12 formats and decode incoming ANSI X12 documents. Regular updates will accommodate new X12 releases over time. Nevertheless, ANSI X12 automation helps businesses reduce costs, errors, and delays associated with paper-based documents.

EDI AS2

Applicability Statement 2 or AS2 is an EDI security standard that defines how to securely transmit EDI documents over the internet. AS2 uses technologies like encryption, digital signatures, and certificates to ensure data integrity and authenticity between trading partners. AS2 complements existing EDI standards like ANSI X12 and HIPAA by securing electronic document exchanges over public networks. However, proper implementation and management of AS2 security features require investments and expertise.

Implementation of EDI Integration Solutions

EDI AS2 involves obtaining digital certificates, configuring encryption utilities, and developing security policies between trading partners. Organizations need resources to manage and troubleshoot AS2 features like encryption, authentication, and non-repudiation. Regular audits are required to ensure EDI data transmissions comply with security standards. However, when properly implemented, AS2 provides a secure channel for mission-critical EDI document exchanges over public networks.

EDI Integration

For organizations to implement Electronic Data Interchange, they need to integrate their internal systems with EDI-enabled trading partners and service providers. Successful EDI integration requires connecting internal applications to EDI software that can generate standard EDI documents for transmission and decode incoming EDI files.

- Organizations first identify key internal systems involved in business processes that will be automated through EDI. These systems typically handle functions like order management, inventory, billing, and payments.

- Next, an EDI solution is selected that can integrate with the identified internal systems. Options include on-premise EDI Integration Solutions, cloud-based EDI platforms, or managed EDI network services.

- The chosen EDI solution is then configured to connect with target internal applications via APIs, file interfaces, or built-in adapters.

- Data mappings are created to translate data fields between internal system formats and EDI Integration Solutions.

- The EDI solution is tested to ensure it can accurately generate standard EDI documents based on data from internal systems.

- Incoming EDI files are decoded and processed correctly to update internal records.

- Once testing is complete, the EDI solution goes live and internal systems are configured to automatically route applicable documents and data to the EDI software for transmission and processing.

- EDI integration requires ongoing maintenance to adapt to changes in internal systems and EDI standards.

- Regular monitoring is also needed to identify and resolve integration issues affecting EDI performance.

EDI vs API

Both EDI and APIs enable the exchange of digital data between organizations. However, there are key differences between Electronic Data Interchange and Application Programming Interfaces in terms of standards, technologies, uses, and costs.

Enables on-demand data exchange and real-time integration between websites, apps, devices, and internal systems. Supports contextual transactions.

Enables on-demand data exchange and real-time integration between websites, apps, devices, and internal systems. Supports contextual transactions.

| Aspect | Electronic Data Interchange (EDI) | Application Programming Interfaces (APIs) |

|---|---|---|

| Standards | Relies on industry-defined standards for specific electronic document formats. Trading partners must agree to use these standards. | Uses standard protocols like HTTP, REST, and SOAP, but does not mandate specific data formats. Flexible design based on companies’ requirements.. |

| Technology | Implements standards using proprietary software, EDI network services, or vendor products. Data exchange in batches through pre-defined documents. | Exposes data and services through self-contained components, sharing data in real-time over the web. Leverages modern technologies like JSON, XML, and HTML. |

| Uses | Automates high volumes of routine business transactions (e.g., orders, invoices, payments) between established trading partners. | Enables on-demand data exchange and real-time integration between websites, apps, devices, and internal systems. Supports contextual transactions.. |

| Costs | Can be high for setup, ongoing network fees, and software maintenance. Costs reduce with scale. | Largely upfront for development and testing. Ongoing costs are marginal but can rise with the number of integrated partners and complexity. |

The Future of Electronic Data Interchange (EDI)

EDI has been useful for decades in automating business transactions between organizations. Here are some trends that will shape the future of Electronic Data Interchange.

Integration with APIs

More businesses are complementing traditional EDI with APIs to enable real-time data exchange. While EDI handles high-volume batch transactions, APIs support on-demand requests and contextual interactions. This allows organizations to automate routine processes with EDI and provide interactive services through APIs, overcoming EDI’s limitations.

Adoption of Cloud and SaaS EDI

Cloud-based and software-as-a-service EDI solutions are gaining popularity due to their scalability, ease of use, and lower upfront costs. These cloud EDI platforms simplify implementation, integration, and management for businesses. The transition to cloud-based EDI will continue and drive adoption among smaller players.

Integration with IoT Devices

The integration of EDI with the Internet of Things devices will help automate more business processes. IoT sensors can trigger EDI transactions based on real-world events. Conversely, EDI data can be used to optimize the operations of connected devices and machines. This combination will create new use cases for EDI in industries like manufacturing, logistics, and healthcare.

Use of Blockchain and AI in Electronic Data Interchange (EDI)

Blockchain is a technology that could have an impact on EDI. An extra degree of security and confidence between trading partners can be provided by blockchain technology, which can produce safe and unchangeable records of EDI transactions. Real-time tracking of items in transit is another feature that blockchain can provide, increasing the supply chain’s visibility and transparency.

Another technology that could improve EDI’s capabilities is artificial intelligence (AI). Businesses may make better judgments by using AI and ML in EDI to examine vast volumes of data and spot patterns and trends. AI and ML in EDI can also be used to automate tedious jobs, like data entry, giving workers more time to concentrate on more strategic endeavors.

IoT in EDI

The Internet of Things is a potentially very useful tool for B2B connectivity for EDI support specialists. IoT in EDI can enable rapid data interchange by providing partners with direct access to centralized data hubs fed by IoT devices, even though it has no bearing on EDI standards or how they are used. Trading partners can benefit from increased end-to-end visibility and instantaneous, secure updates of EDI data thanks to the Internet of Things.

IoT devices essentially make real-time data collection and monitoring possible. When used in supply chains, IoT in EDI can enable monitoring at almost every level by sensing variables like temperature, humidity, and speed as well as incidents like a lost package or missed delivery.

EDI and Data Analytics

To optimize your business processes, make faster decisions, and react swiftly to changing market and customer demands. To stay at the top of your industry and maintain your competitive edge, you need to have access to data analytics solutions, a kind of business intelligence into the B2B deal flow. You need rapid and simple access to a variety of information kinds, including analytics, to make well-informed and useful business decisions. All this is achieved by combining EDI and data analytics.

Greater Adoption Across Industries

EDI will continue spreading to more industries and use cases that require automation of high-volume document exchanges at scale. New standards will emerge to accommodate industry-specific requirements. Even traditionally “paper-based” sectors will turn to EDI to remain relevant in the digital economy. The future would be promising with new EDI trends and innovations in 834 and other standards.

Connect with our EDI experts to achieve efficiency in your business process

ROI of EDI

The size of the company, the industry, and the use of the type of EDI solution (web-based or fully integrated) can all have a significant impact on the return on investment (ROI) of an EDI system. Nonetheless, EDI has several advantages, and many businesses that use EDI systems report higher profitability, lower expenses, and enhanced efficiency. Research by IDC projects that organizations will gain a 335 percent ROI with modernized B2B integration – or more than USD 4 in benefits per USD 1 invested. Is it possible to allocate the funds required to calculate the ROI for EDI investment? This boils down to the distinction between two disciplines: maximizing cost efficiency and determining return on investment for a function such as EDI.

Why Calculate EDI ROI?

The purpose of ROI is to assist a company in making decisions about whether its investments and efforts are worthwhile. This is not the same as weighing possibilities and making decisions on which procedures, instruments, and techniques to employ to enhance a process’s functionality. To optimize the ROI of EDI investment, it is necessary to not only choose the most appropriate EDI system and set up effective processes but also to offer all team members participating in the EDI process thorough training and assistance.

Conclusion

In summary, EDI provides a time-tested approach for digitizing manual business processes involving the exchange of structured documents and data between organizations.

While EDI standards and technologies have evolved, its core value of automating high-volume routine transactions remains critical for optimizing supply chains, minimizing costs, and ensuring regulatory compliance. The future of EDI lies in leveraging complementary technologies to enhance traditional capabilities, enable new use cases, and expand adoption across sectors. Overall, EDI will continue serving as the foundation for digital connectivity and efficiency gains within and between businesses.