Deloitte Center for Health Solutions conducted a survey involving 35 technology leaders (chief technology officers, C.I.O.s, C.D.O.s, and CHAOs from health plans with at least 500,000 lives enrolled) of health plans with at least that population size in February 2021. Questions focused on investments made into technologies as well as overall organizational strategies so as to understand priorities and vision for Health insurance enrollment software providers. All 35 responding organizations participate in government programs, while 31 offer commercial health insurance products.

From February to April 2021, they conducted 10 in-depth qualitative interviews of 30-60 minutes duration. Each with technology executives from regional and national health plans in order to understand how they approach modernizing legacy platforms, along with any short or long-term goals they hope to attain in doing so.

Survey respondents expressed high hopes for customer engagement as one of the main benefits of digital transformation; 57% expected it as one of their three top outcomes. Other key outcomes included reduced regulatory and compliance risk (57%), as well as greater agility and Scalability regarding technology (54%).

Regulator requirements may create opportunities, for instance, by funding initiatives (like interoperability, price transparency, or automated prior authorizations ), which might have received less focus without them. Agility and Scalability around technology don’t traditionally figure as business goals themselves but were repeatedly highlighted as essential.

Consumer participation increased to over 16 million ahead of the 2023 open enrollment period in 2022, representing an 18 percentage point decrease from their high point in 2014. 42% were enrolled with Blues (down 18 points from their peak point), with Insurtechs accounting for 14% – representing an 11% jump since 2019. According to one executive: ‘Companies outside of software must behave more like software companies when pushing solutions out there or merging technology with business needs.”

Health insurance enrollment software offers a variety of services and products to help employers manage their health insurance plans. These services include assisting employers to compare programs, enrolling employees in the appropriate plan, and navigating the complexities of healthcare reform. They also provide tools for tracking plan usage, managing benefits, and reporting on utilization trends. By using these software solutions, employers are able to reduce their costs as well as improve employee health.

What is Health Insurance Enrollment?

Health insurance enrollment is the process of signing up for a health insurance plan. It typically includes selecting a plan, understanding the details of the policy, and making payments to maintain coverage. Insurance enrollment can be done either through an employer or by purchasing a private policy from an insurance provider. During the enrollment process, individuals are asked to provide personal information so that their eligibility for coverage can be verified and their premiums can be calculated.

Out-of-pocket health spending was responsible for pushing an estimated 89.7 million individuals into extreme poverty in 2015. Furthermore, COVID-19 worsened access to care significantly for an estimated total of 3.8-5 billion who did not have access to essential health services during 2017.

As health costs have become an increasing source of poverty in recent decades, government-run health insurance schemes and universal coverage programs have seen a growing surge in their popularity in order to increase access. Mitigate poverty risks associated with healthcare expenses. A key element in their effectiveness of increasing medical access, protecting individuals from financial strain, and remaining financially sustainable insurance schemes is take-up rates; individuals may adopt health coverage if the benefits outweigh the costs of enrolling individually.

A review of 11 randomized evaluations conducted across 10 predominantly low and middle-income countries has demonstrated that either decreasing health insurance costs or raising awareness about benefits can increase its adoption. Cost reduction initiatives, including lower premiums and copays, as well as simplified open enrollment software procedures or procedures to enroll or use insurance, are shown to boost take-up.

Regarding benefits, interventions that build trust within schemes or inform people about health risks have proven particularly successful at increasing take-up; providing individuals with information to compare the costs/benefits ratio has generally had little effect outside the USA.

Importance of Health Insurance Enrollment Software in 2023

As the healthcare and insurance industry continues to evolve. Many organizations are turning to health insurance enrollment software providers in order to streamline their operations and reduce costs. In 2023, this trend will likely continue as employers look for ways to manage their health insurance programs more efficiently.

Hiring a health insurance enrollment software provider is beneficial because it can automate and simplify many of the administrative tasks associated with enrolling employees in health insurance plans. By leveraging employee benefits enrollment software, employers can save time and money while providing a better experience for their employees.

1. Streamlining Processes

A health insurance enrollment software provider can help streamline the process of enrolling individuals into a health insurance plan. By providing a digital platform, they can manage paperwork and make it easier to compare programs. Automate tasks like eligibility verification and enrollment processes. This can save time and money for both employers and employees by eliminating manual data entry and reducing processing time for paperwork.

2. Customizable Solutions

Health insurance enrollment software providers offer customizable solutions that can be tailored to the needs of each employer and their employees. This allows them to provide a personalized experience for each person, providing them with tools and features that make it easier to understand and use the plan they have chosen.

3. Cost Savings

Using health insurance enrollment software can also help employers save money by reducing administration costs associated with managing health plans. By automating processes, they can cut down on paperwork and manual data entry and also reduce the amount of time required to compare and enroll in a plan. This can result in significant cost savings for employers.

4. Improved Efficiency

Health insurance enrollment software providers offer tools that make it easier for employers to manage their health plans. These tools can help employers track usage, identify trends, and make informed decisions about the programs they offer. It can lead to improved efficiency in managing healthcare costs and help employers provide better care for their employees.

5. Increased Accessibility

Health insurance enrollment software can also increase the accessibility of health plans for employees. By providing a digital platform, they can make it easier for individuals to find the best plan for their needs and budget and quickly compare different options. It can lead to greater satisfaction with their healthcare coverage and improved access to medical services when needed.

6. Enhanced Reporting

Health insurance enrollment software providers offer enhanced reporting capabilities that make it easier for employers to track employee benefits, decision support tools, plan utilization, and monitor trends. It can provide valuable insights into how the plan is being used, as well as enable employers to identify areas where they may need to adjust their offering or adjust their costs. Additionally, this data can be used to gain a better understanding of employee health needs and preferences.

Ready to Streamline Enrollment Processes? Contact Us for a 30-Minute Free Consultation

Top 11 Health Insurance Enrollment Software Providers in 2023

As the health insurance sector continues to grow, more and more organizations are turning to enrollment software to manage their client data. This software is designed to streamline the process of enrolling clients in health insurance plans, allowing users to keep track of all necessary information and quickly access any desired information. In 2023, there are a number of leading health insurance enrollment software providers that offer comprehensive tools for managing client data. These include:

1. A3logics

A3logics was founded in 2003 as one of the premier software development firms. Their headquarters is conveniently situated in the USA Since its formation, A3logics has kept up with rapid technological changes by upholding quality and exploring novel concepts.

The team has cemented themselves within tech, building custom-tailored software that meets specific customer requirements ranging from startups to Fortune 500 corporations. All recognize A3logics as their go-to partner due to the team’s impressive mix of tech know-how and emphasis on client happiness!

- Achievements

- Completed over 500 projects over 19+ years as an industry leader.

- A strong team of 350+ tech specialists offers robust service delivery.

- Clientele Highlights

- IXL Learning offers language education. Its Veteran-led freight matching company and leading E.H.S. software providers for corporations have over two decades of experience, respectively.

- Media intelligence pioneer, offering monitoring and analysis across platforms.

- IT benefits administration firms for mid-market employers.

- H.R. administration solution providers with a focus on H.R. administration/employee benefits management solutions as well as cloud-native Human Capital Management platforms.

A3logics offers a wide range of services, including web-based application development, custom software development, mobile app development, enterprise mobility solutions, and cloud computing. A3logics has an experienced team of professionals that provide comprehensive health insurance enrollment software tailored to the specific needs of each organization.

This software is designed to streamline the process of enrolling and managing clients in health insurance plans, providing users with advanced reporting capabilities and customizable options. Provide comprehensive, end-to-end benefit enrollment software that enables organizations to quickly and accurately enroll individuals in health insurance plans. Their software helps organizations streamline the process of registering members in health plans, manage eligibility information, track payments, and more.

2. eHealth Solutions

eHealth solutions are digital healthcare initiatives designed to improve patient access to medical care. Reduce the burden of paperwork and administrative tasks, and increase the overall efficiency of healthcare organizations. These solutions can involve software applications, hardware systems, or a combination of both. Examples include electronic medical records (E.M.R.s), telemedicine services, health information exchanges (HIEs), remote monitoring devices, and secure messaging platforms. eHealth Solutions is a provider of such technology, offering comprehensive health insurance enrollment software solutions.

eHealth Solutions is a leading provider of health insurance enrollment software solutions. Their platform enables employers to easily manage their health plans, streamline the enrollment process, and quickly access data. eHealth Solutions offers comprehensive tools for managing employee enrollments, tracking eligibility, verifying coverage, and more.

3. HealthPlanOne

HealthPlanOne is an online health insurance marketplace that allows users to compare and purchase health plans from licensed providers. It’s designed to make shopping for health insurance easier by offering personalized recommendations based on your individual needs. HealthPlanOne allows you to compare plans side-by-side, see benefits and coverage details, and read plan reviews from other customers. With access to a variety of affordable health plans, HealthPlanOne is an excellent option for finding the perfect health insurance plan.

HealthPlanOne is an innovative health insurance enrollment software provider that offers a comprehensive suite of solutions for businesses, individuals, and families. The company provides a variety of tools to help customers find the best coverage for their needs. From online quote comparison tools to customer support and benefit administration. HealthPlanOne makes it easy for customers to select the right plan while providing quality service. HealthPlanOne also offers a variety of educational resources to help customers learn about their coverage and health plan options.

4. Welltok

Welltok is a healthcare technology company that provides personalized health optimization solutions for individuals and organizations. Founded in 2009, Welltok’s mission is to empower people to achieve their best health. The company offers products and programs that enable users to take proactive steps toward improving their overall wellness.

Welltok’s platform consists of three main components:

- A personalized health optimization engine

- A comprehensive health data platform

- Healthcare enrollment software

The custom software development services simplify the process of enrolling for health insurance plans by providing users with easy-to-use tools to compare and select the best method for their needs.

Welltok is a leading health insurance enrollment software provider that enables employers to enroll. Also to manage, and monitor their employee benefits quickly. The platform helps companies optimize the cost. Administration of their health plans while providing employees with access to the best methods. Welltok also offers a variety of educational tools to help employees learn more about their coverage options and make informed decisions.

5. Benefitfocus

Benefitfocus is a cloud-based software platform that provides employers with an integrated technology solution for managing employee benefits. It helps employers streamline the process of designing, enrolling, and administering their benefit plans. The platform offers users access to the latest industry best practices, including automated enrollment and compliance processes. With Benefitfocus, employers can customize their benefits offerings to meet their specific needs. Employers can also use the platform to track employee enrollments and utilization, as well as monitor plan performance.

Benefitfocus is an innovative health insurance enrollment software provider that provides employers with a comprehensive platform for managing employee benefits. Their platform helps companies quickly enroll and manage. Monitor their employee benefits while providing employees with access to the best plans and educational tools. Benefitfocus also offers a variety of administrative features. To streamline the enrollment process and help employers ensure they are compliant with applicable regulations.

6. GetInsured

GetInsured is a leading online health insurance marketplace that helps individuals and families find the right health plan for their needs. Founded in 2005, GetInsured has helped millions of people find the right health coverage by providing an easy-to-use platform and comprehensive product selection. GetInsured offers plans from over 150 carriers across the United States, including major national insurers such as Aetna and Cigna. Their platform is also integrated with leading health insurance enrollment software providers to streamline the enrollment process.

GetInsured is an online health insurance enrollment software provider that helps customers find, compare, and enroll in health plans. With GetInsured, customers are able to easily reach the various options available to them and make informed decisions about their coverage. GetInsured eliminates the need for lengthy paperwork and complex phone calls as custom software development companies in the USA allow consumers to apply for coverage online. The platform also offers a variety of features, such as plan comparison tools and personalized recommendations. Customer support to make the enrollment process easier and more efficient.

7. Collective Health

Collective health is a term used to describe a system of healthcare that focuses on health and wellness. An entire population rather than individual patients. This type of healthcare takes into account the shared characteristics. Needs of a group, such as age, gender, race, ethnicity, location, and socioeconomic status. Its main goal is to improve the overall health of those within the collective by providing greater access to healthcare services and resources. Joint health often utilizes technology to create more efficient systems, such as through the use of health insurance enrollment software. This type of solution can help streamline the process of enrolling individuals in health plans, manage eligibility information, track payments, and more.

Collective Health offers comprehensive health insurance enrollment software solutions designed to simplify the process of enrolling individuals in plans and managing their benefits. Their platform helps employers quickly access data, track eligibility criteria, verify coverage, and more. They also offer a variety of educational resources to help employers understand their options and make informed decisions about their health plans.

8. Zenefits

Zenefits is a cloud-based platform that offers businesses a comprehensive suite of HR services. The platform provides companies with HR management software, payroll, benefits, and compliance services. Founded in 2013, Zenefits has become one of the most popular HR solutions for companies of all sizes.

One of the key features of Zenefits is its intuitive dashboard, which allows employers to manage their employee’s benefits, including health insurance enrollment. The platform provides employers with a comprehensive set of tools to enroll quickly. Also, manage their health plans while providing employees with access to the best methods.

Zenefits is a cloud-based health insurance enrollment software provider that offers employers an efficient way to manage their employee benefits. Their platform enables businesses to access data quickly, track eligibility criteria, verify coverage, and more. They also provide customers with educational resources to help them understand their options and make informed decisions about their health plans.

9. Aetna

Aetna is a diversified healthcare benefit company that provides health insurance plans for individuals, families, and businesses. Founded in 1853, Aetna is one of the oldest and largest US insurance companies. They are offering coverage to over 22 million people worldwide. Aetna’s products include major medical coverage. Medicare Advantage plans long-term care insurance, life and disability insurance, and health and wellness services. Aetna also offers an online enrollment platform to help customers quickly find the best coverage for their needs.

Aetna is a leading health insurance enrollment software provider that offers employers a comprehensive platform for managing their employee benefits. The software development frameworks help businesses quickly access data, track eligibility criteria, verify coverage, and more. Additionally, Aetna provides customers with educational materials to help them understand their options and make the best decisions when it comes to their health plans.

10. BizInsure Solutions

BizInsure Solutions is a leading provider of business insurance solutions. Founded in 2009, the company offers a variety of products to protect businesses from any unexpected risks and liabilities they may face. From general liability insurance to property and workers’ compensation, BizInsure Solutions provides comprehensive coverage for businesses of all sizes.

The company works with over 125 carriers to provide custom-tailored solutions for each customer. They also offer a comprehensive health insurance enrollment software platform that simplifies the process of enrolling employees in plans and managing their benefits. With BizInsure Solutions, businesses can quickly access data, track eligibility criteria, verify coverage, and more. They also provide customers with educational resources to help them understand their options and make informed decisions about their health plans.

11. UnitedHealthcare

UnitedHealthcare is a leading provider of health insurance solutions for individuals, families, and businesses. Founded in 1977, the company offers a variety of products to help customers. Finding the coverage that best meets their needs, from medical and dental plans to vision care and supplemental coverage. UnitedHealthcare provides comprehensive benefits packages and digital transformation services that can be tailored to each customer’s unique needs.

In addition to offering individual and family health plans, UnitedHealthcare. It also provides employers with access to a comprehensive health insurance enrollment software platform. This platform enables businesses to enroll, manage, and monitor their employee benefits quickly. At the same time, they are providing employees with access to the best plans and educational tools.

Furthermore, UnitedHealthcare offers a variety of administrative features. To streamline the enrollment process and help employers ensure compliance with federal and state regulations.

Optimize Enrollment Efficiency – Contact Us For a Customized Solution

How to choose the best Health Insurance Enrollment Software Providers in 2023

1. Research Health Insurance Enrollment Software Providers

Before choosing the best health insurance enrollment software provider for your needs, it is important to research different providers and their offerings. Look for those that offer an online platform that can be easily customized to fit your specific business needs. Make sure to compare features such as customer support, Pricing, ease of use, and system integration.

2 . Assess Your Healthcare Requirements

When choosing a health insurance enrollment software provider, it is essential to assess your healthcare needs and budget. Think about the type of coverage you want to offer and any additional features that may be necessary. Additionally, consider the size of your organization and the number of employees that will be enrolled in the plan.

3. Check Security and Privacy Measures

With health data being sensitive and valuable, Security and privacy measures. Should be a priority when selecting a health insurance enrollment software provider. Make sure to research the provider’s security protocols and confirm that they are compliant with relevant healthcare regulations, such as HIPAA.

4. Evaluate Customer Service

Another factor to consider is customer service. Look for providers that offer friendly and helpful support to ensure you can get help quickly should any issues arise.

5. Read Reviews

Before making a decision, it is important to read reviews from current and past customers to get an unbiased opinion of the provider’s services and offerings. This can help you make an informed choice about which health insurance enrollment software provider best meets your needs.

6. Compare Pricing

Cost is another important factor to consider when selecting health insurance enrollment software. Compare the prices of different providers to determine the best value for your organization.

7. Consider Scalability

When choosing a health insurance enrollment software provider, consider the Scalability of the platform. Look for providers who offer solutions that can easily adjust as your organization grows or changes over time.

8. Look for Integrations

Health insurance enrollment software providers integrate with other systems and services, such as payroll, HR management, and customer relationship management (C.R.M.) software. This will make it easier to manage all of your health insurance needs from one platform.

9. Review Customization Options

Make sure to review the customization options that are available with the health insurance enrollment software provider you are considering. Look for providers that offer a wide range of features and functionality so you can tailor the system to meet your specific needs.

10. Ask for a Demo

Ask the health insurance enrollment software provider for a demo of their platform so you can try it out before making your final decision. This will allow you to get an idea of how the system works and determine if it meets all of your needs.

The Benefits of Streamlined Health Insurance Enrollment Software for Consumers

1. Increased Efficiency

Use API to integrate data and enrollment components that you require into existing tools, making the most out of existing infrastructure. A streamlined health insurance enrollment software enables consumers to rapidly compare and enroll in affordable health plans without manually inputting data. All information necessary for enrollment is kept securely stored, saving both time and paperwork while streamlining the enrollment process.

2. Accessible Information

Agents and agencies offer more direct access to an expansive variety of products available both on and off government exchanges. Health insurance enrollment software makes it easier for consumers to quickly and easily understand the details of their plan information such as coverage details such as deductibles, co-pays, and out-of-pocket expenses – helping them make informed decisions regarding their healthcare coverage needs.

3. Convenience

Customize an online enrollment system to fit into the unique workflows and processes of your business without needing IT’s input. Health insurance enrollment software offers consumers an easy and hassle-free method for shopping for and enrolling in health plans. They can quickly compare plans from multiple providers at the same time to quickly identify which plan suits their individual needs best; plus they can complete enrollment online, saving both time and effort from having to visit an insurance office in person or make phone calls during the enrollment process.

4. Increased Security

Protect HIPAA and PCI compliance by creating an efficient platform designed to uphold regulatory requirements. Health insurance enrollment software that utilizes streamlined processes helps safeguard consumer data by offering a safe environment in which to store personal information in encrypted form, so only authorized individuals have access to it. Moreover, advanced fraud detection methods help detect unapproved access or transactions that occur via fraudulent methods.

5. Automated Benefits

Modern health insurance enrollment software enables consumers to take advantage of automated features, including automatic renewal, easy access to plan documents, and updates about changes or coverage enhancements. With these features in place, users are easily kept up-to-date on their plans without the hassle of manual processes.

6. Cost Savings

Automated processes can help consumers save money on administrative costs by eliminating manual data entry tasks that result in reduced labor expenses for providers; in turn, providers pass these savings directly to customers through features like automatic renewal. Finally, automated features may prevent accidental coverage gaps which lead to penalties or fees being assessed against your policy, and prevent you from accidentally falling out.

7. Improved Customer Service

Allow your customers to quickly compare benefits, rates, providers and complete enrollment without ever leaving your website. It helps ensure customers experience only the highest-level service from their provider. Automated processes reduce wait times and offer faster responses whenever assistance is required, while customer service representatives have access to complete and up-to-date information regarding each plan at their fingertips for improved assistance.

How much Does Health Insurance Enrollment Software Providers cost?

When it comes to the cost of health insurance enrollment software providers, the price will vary depending on the complexity and customization of the software. Some factors that can affect the cost include the number of users, features, and functionality needed, as well as any additional services such as support or training.

Basic healthcare software development companies may offer their services for free or at a low cost. But more advanced solutions can cost thousands of dollars. It would help if you also considered any additional costs, such as implementation fees, maintenance fees, and other associated costs.

1. Average Cost of Health Insurance Enrollment Software Providers

On average, health insurance enrollment software providers cost around $500 to $2,000 per month. For a basic package and up to $5,000 or more per month for an enterprise-level solution with all the bells and whistles. Depending on the provider, there may be additional setup fees and subscription costs associated with the service.

2. Factors Affecting Price

The price of health insurance enrollment software can vary depending on the features and functionality offered by the provider. As well as the size of your organization and the number of users. Additionally, some providers may offer discounts for longer-term contracts or bulk orders.

3. Additional Fees

In addition to subscription fees, some health insurance enrollment software providers may charge additional fees for implementation, training, and support. It is important to discuss upfront with the provider any additional charges that may be incurred.

4. Cost Savings

Health insurance enrollment software can help save time and money by streamlining processes such as health insurance application processing and renewal management. It can also reduce administrative costs associated with handling paper-based applications.

5. Ensure Security

When selecting a health insurance enrollment software provider, it is important to make sure the platform offers secure data encryption and security features to protect confidential information. Check with the provider to determine what type of security measures are in place and if any additional steps need to be taken.

6. Look for Automation

Automation is key when it comes to health insurance enrollment software. Look for providers that offer automated processes such as electronic signature capture, automatic renewal reminders, and real-time updates to ensure the accuracy of your organization’s health insurance data.

Speak With A3logics Experts to Supercharge Your Enrollment Management Process

Conclusion

Consumer participation increased 25% to approximately 16 million from 2020-2022, coinciding with longer enrollment periods and enhanced subsidies implemented under the American Rescue Plan Act of 2021 and extended through 2025 by the Inflation Reduction Act. When it comes to choosing health insurance enrollment software, there are a number of options available in the USA. From comprehensive and complex systems to more basic solutions, there is something for everyone. After researching 11 top health insurance enrollment software providers, it is clear that each one offers its unique advantages and features.

When it comes to choosing health insurance enrollment software, there are many factors to consider. For example, businesses should evaluate the user-friendliness of the software and the features offered. In addition, healthcare software development providers should provide a comprehensive system that can handle employee data securely and efficiently. Additionally, customer service and support should also be taken into account as this will provide peace of mind in case any technical issues arise.

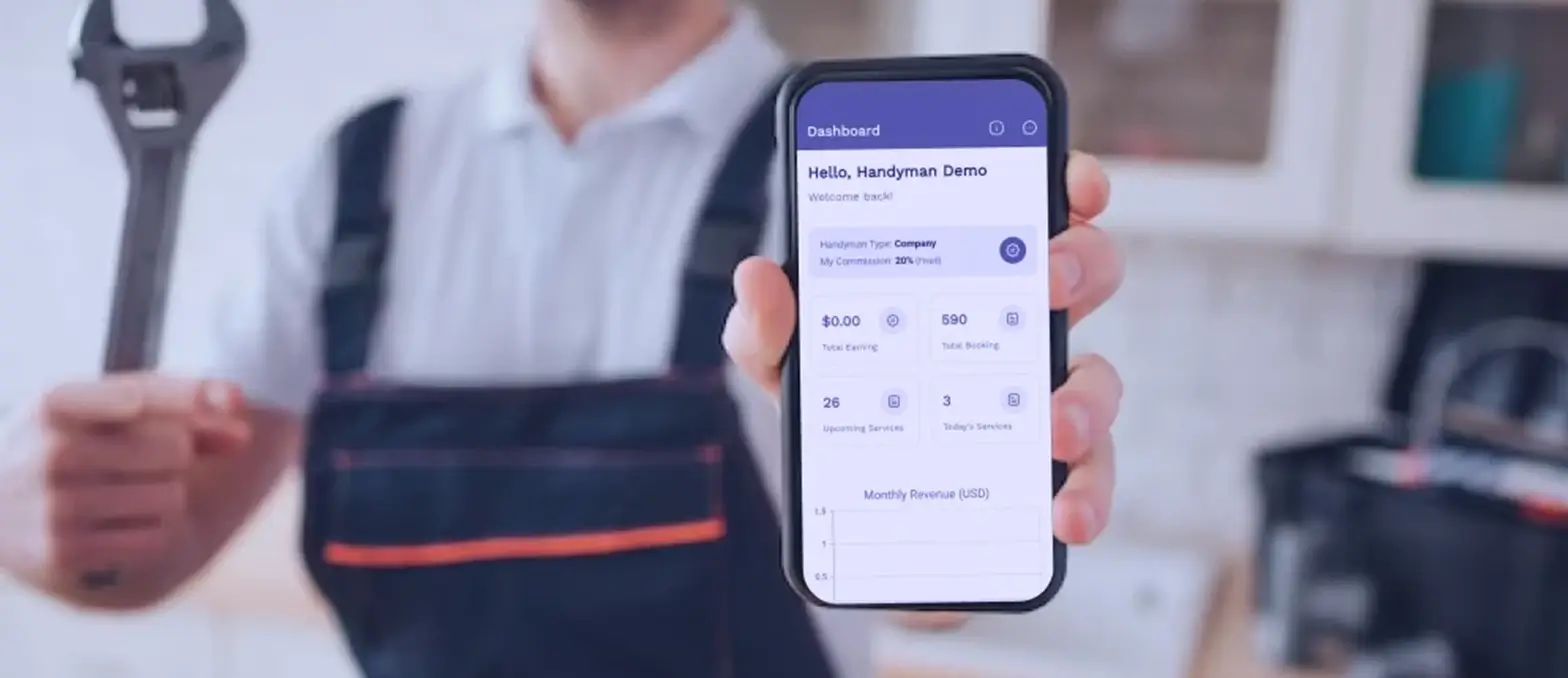

For example, A3logics provides an integrated system that allows for customer and employee self-service. A3logics provides an integrated system designed to streamline the process of enrolling employees in health insurance plans. The system helps businesses manage their customer and employee self-service needs, as well as providing a user-friendly mobile app and customer portal for efficient enrollment. Ultimately, businesses should carefully consider their needs before selecting a health insurance enrollment software provider. To ensure they get the best possible solution at the best price.

FAQ: Quick Answers to Common Questions

Q1. Why Hire A3logics as your Health Insurance Enrollment Software Provider?

A3logics is an established name in the health insurance enrollment software industry. With a long history of providing reliable and secure solutions for businesses and organizations. A3logics is a trusted provider of comprehensive enrollment software that meets the needs of both employers and employees alike.

A3logics provides a full suite of services that make it easy to enroll members in employer-sponsored health plans with ease. From real-time data integration to automated enrollment and employee self-service features. A3logics provides the tools necessary to streamline the enrollment process and increase efficiency.

Q2. What types of payments are accepted by the 11 Top Health Insurance Enrollment Software Providers in The U.S.A.?

The 11 top health insurance enrollment software providers in the USA. generally accept a variety of payment options. These include credit and debit cards, electronic funds transfers (E.F.T.), prepaid cards, A.C.H. deposits, wire transfers, and cash. Many providers also offer options for online payments using PayPal or other healthcare software solutions with digital wallet services. Additionally, some providers may also accept checks or money orders. Depending on the provider, additional payment options may be available. Be sure to contact the provider directly for more information.

Q3. What types of services do these software providers offer?

Software providers offer a wide range of services, including software development, customization, integration, implementation, maintenance, and support. Software development involves the creation of software applications or programs to meet specific business needs.

Customization is the process of modifying an existing application or program to fit a customer’s particular requirements. Integration entails connecting different software programs to work together as one system. Implementation involves setting up the system and training users. Maintenance and support involve troubleshooting any technical issues or upgrades to the software.

Q4. What are the advantages of using health insurance enrollment software?

Health insurance enrollment software provides a number of advantages for both insurers and their customers. This type of software makes it easier for customers to purchase health insurance plans, enabling them to shop around and find the best option for their needs. It also streamlines the process of enrolling in a program, providing an automated system that can save time and reduce paperwork. Finally, this type of software helps insurers keep track of customer data, allowing them to serve their customers better and make more informed decisions.

Q5. What should I consider when selecting a health insurance enrollment software provider?

When selecting a health insurance enrollment software provider, there are several factors to consider. First and foremost, it is important to ensure that the provider has the necessary experience and expertise in dealing with health insurance enrollments. The provider should also have a solid reputation for providing reliable and secure software solutions. Additionally, the provider should offer a wide range of customization options so that you can tailor the system to meet your specific needs. Finally, the provider should offer adequate customer support and maintenance services to ensure that any problems are quickly addressed.

Q6. Can I use health insurance enrollment software to bill customers directly?

Health insurance enrollment software is a useful tool for businesses to manage the process of enrolling customers in health insurance plans. However, it cannot be used to bill customers as this requires an entirely different system directly. Instead, health insurance enrollment software can assist with calculating premiums and deductibles, tracking customer information, and processing payments. In order to directly bill customers for their health insurance plan, companies must utilize a separate billing system.

Q7. How quickly can I get up and running with health insurance enrollment software?

Getting up and running with health insurance enrollment software can be a relatively straightforward process, depending on the platform you choose. Most cloud-based health insurance enrollment software providers have robust onboarding processes designed to help customers get their systems up and running quickly.

Q8. Do these software providers offer customer support?

Many software providers offer customer support. However, the level of service and the methods of communication can vary significantly. Some companies may provide a customer service line or online chat feature to help customers with their software issues. Other providers may have forums or user groups where customers can ask questions and get answers from other users.

For businesses that use enterprise-level software, customer service is typically more comprehensive. These providers may provide dedicated account management, technical support teams, and even on-site assistance for more complex issues.

Q9. Is there a way to test out health insurance enrollment software before purchasing?

Yes, there is a way to test out health insurance enrollment software before purchasing. Various providers offer free trials of their software, allowing potential customers to get an in-depth look. At the features and capabilities of the program before making a final decision.