The insurance industry continues to change because of new emerging technologies. One of the biggest changes is electronic data interchange (EDI) which helps insurance companies do a better job.

EDI or Electronic Data Interchange was first introduced in order to help companies exchange business documents during the 1960s. Over time EDI formats and protocols are becoming more and more standardized. Businesses have integrated their internal systems with their trading partners, which has enhanced efficiency and reduced errors.

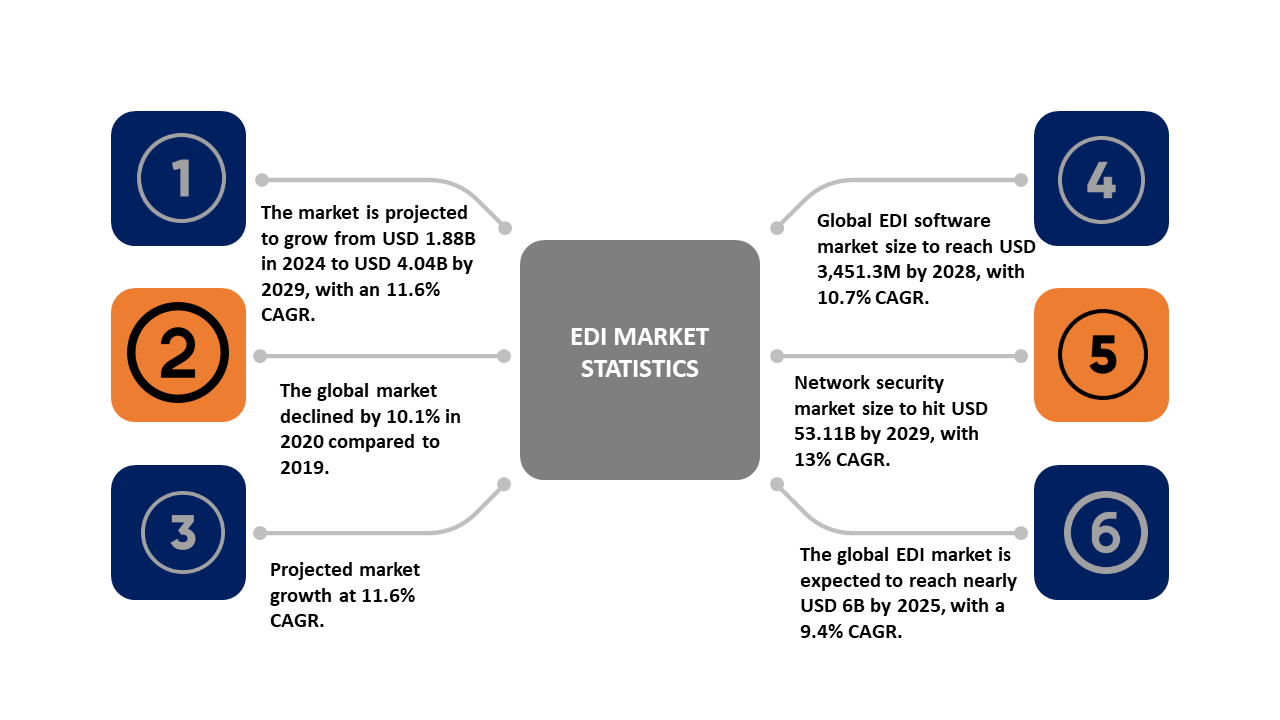

With a compound annual growth rate of 12.5%, the size of the global market for Electronic Data Interchange (EDI) software is expected to increase from $1.98 billion in 2023 to $4.52 billion by 2030.

Single-source EDI reduces information turnaround times, safeguards data exchanges, and removes delays in claim processing for medical businesses. Due to this implementation, EDI is important to delivering high-quality healthcare. There are various documents that are transferred using EDI, including purchase orders, insurance invoices and other shipment details are a part of EDI transactions. Thanks to this it is simpler for both the sender and receiver to read due to the EDI format.

What is EDI?

The electronic transmission of corporate data in a defined format is known as electronic data interchange, or EDI. This procedure enables businesses to communicate electronically with one another instead of utilizing paper documents. Trading partners are companies that conduct commerce electronically. Purchase orders and invoices are the two most often exchanged business documents using Electronic Data Interchange (EDI). EDI, at the very least, takes the place of the mail preparation and handling involved in conventional commercial communication. The true strength of EDI, however, lies in its ability to standardize information sent in business papers, enabling “paperless” exchanges.

What this can mean is demonstrated by the conventional invoice. The majority of businesses use computer programs to generate invoices, which are then printed on paper and mailed to clients. The invoice is often marked up by the customer upon receipt and entered into its own computer system. Information is transferred from the seller’s computer to the customer’s computer during the entire procedure. The manual procedures in this transfer can be reduced to almost nothing with the use of EDI. The process gains that EDI provides are substantial and sometimes quite noticeable.

EDI Standard Formats

Some of the major EDI standards:

-

- UN/EDIFACT recommended by the United Nations is the only international standard and is the predominant one outside of North America.

-

- U.S. standard ANSI ASC X12 (X12) is available in North America.

-

- GS1 EDI standards developed by GS1, are a milestone in the global supply chain.

-

- Developed by ANA (Article Number Association, now known as GS1 UK), the TRADACOMS standard is a milestone in the UK retail sector.

-

- The ODETTE standard for the European automotive industry. VDA standards are used in the European automotive industry, especially in Germany.

-

- HL7 is a semantic communication standard applied to health information.

-

- HIPAA, The Health Insurance Portability and Accountability Act (HIPAA) requires millions of healthcare organizations that transmit data electronically to use EDI within the standard HIPAA framework.

-

- IATA Cargo-IMP, IATA Cargo-IMP means International Air Transport Association Interchange Message Protocol.

-

- It is an EDI standard based on EDIFACT designed to streamline and standardize data exchange between airlines and other units.

-

- The NCPDP script, SCRIPT, is a standard developed and maintained by the National Council for Prescription Drug Practice (NCPDP).

-

- The standard defines documentation for electronic dispensing of prescription drugs in the United States.

-

- The NCPDP telecommunications standard covers eligibility requirements, claims and fee-for-service negotiations, priority benefits, prior authorization, and information, and is used primarily in the United States.

-

- Edig@s (EDIGAS) are standards for trading, transportation (by pipeline or injection), and gas storage.

Evolution

Many of these standards first appeared in the early to mid-1980s. The standard specifies the types of characters, fonts, and data objects used to exchange business documents and documents.

The complete set of X12 documents contains all major business documents including purchase orders and invoices. Furthermore, the EDI standard specifies mandatory and optional information for a particular document and provides rules for formatting the document. Overall, standards are like building codes.

Just as two kitchens can be designed “to code” but look completely different, two EDI documents can follow the same standards and contain different types of information.

For example, a food manufacturer might specify an expiration date for a product while a clothing manufacturer might choose to send color and size information.

Streamline Data Management and Boost Productivity With Our Comprehensive EDI Solutions

EDI in Insurance: Benefits, Significance and Use Cases

EDI in insurance has no doubt simplified various processes and eliminated paperwork. But the benefits of EDI go far! Here’s how EDI can change your insurance experience:

1. Faster decision, faster payment:

No more waiting weeks to hear back about a claim. EDI automates data transfer, allowing insurance companies to process claims faster, so you get the money you need faster. No more frantic phone calls or endless form filling.

2. Accuracy is paramount:

Manual data entry is a common error. EDI keeps information electronic, reducing typos and mistakes. This ensures that your application details are accurate and prevents delays or rejections due to errors.

3. Improves Communication:

Thanks to EDI there is a smooth flow of documents between various stakeholders. Hospitals, insurers and the policyholder, are able to receive real-time updates on the claim status. Furthermore, no more tracking information – everyone is on the same page.

4. Overall cost savings:

Businesses that employ EDI report improved financial results. With a wealth of claim data at their disposal, they can act more quickly and decide wisely. If you took away the costs of paper, printing, reproduction, storage, filing, postage, and document retrieval, just imagine the savings on operating expenses! This ultimately results in savings. Customers may then witness the savings for themselves, increasing your company’s competitiveness.

5. Enhanced Customer Experience:

The use of EDI results in quicker service payments. Consequently, this helps companies and their customers. To put it succinctly, EDI allows for a great degree of precision, effectiveness, and speed. Features such as “track-and-trace” enable doctors to get real-time updates regarding the progress of their insurance reimbursement. They may now rest easy knowing they will be reimbursed. As a result, adding EDI boosts the quantity of money that goes into your bottom line!

6. Improved Fraud Detection:

EDI allows for faster data analysis, enabling insurers to identify potentially fraudulent claims better. Furthermore, this saves all unnecessary costs and makes them worth paying for.

7. Reduce Human Error

Individual paper forms are no longer a problem for businesses utilizing EDI. Paper is a major source of errors throughout your revenue cycle, therefore getting rid of it will be quite beneficial. You just need to enter data into your system once when you use EDI. Users can eliminate the need to manually enter information again from forms thanks to this. Businesses can also quickly identify and follow claim problems thanks to EDI. An automated alert to a designated user, for instance, would be triggered by a typo in the ICD 10 code.

8. Reduced Paperwork

Numerous sectors are dependent on endless paper forms. If you operate in the healthcare industry, you may consider forms such as HIPAA permission forms, insurance information forms, or onboarding forms. There is a greater chance of human error if one of these paper forms is manually entered into a computer. Along the road, these features can also disappear. This causes needless delays in the logistical system. Consequently, less time is spent on tiresome chores.

Significance Of EDI

Businesses use EDI within their organization for a variety of purposes. Not only can EDI save a tons of money, but it can also increase productivity, accuracy, and speed. Let’s take a look at some of the significant advantages of why EDI is important:

Data accuracy:

You can do away with the necessity for human data entry by automating EDI transmission to your business partners as well as data ingestion and transformation into your ERP. Because human data entry is rife with mistakes, automating data flows helps you stay EDI compliant by preventing errors from happening in the first place.

Business cycle speed:

Your company can reduce processing time by integrating EDI. Business cycles from order to shipment can be shortened by as much as 50–60%. A quicker completion time is associated with EDI transactions that are exchanged in minutes as opposed to days.

Trading partner visibility:

A well implemented EDI integration frees up more time for your company to concentrate on its operations. You can quickly see how your EDI partners are impacting your entire business when you have accurate, automated, and easily accessible data within your ERP.

Real-World Applications for EDI in Insurance

The influence of EDI on the healthcare sector has been enormous. Healthcare institutions deal with a lot of paperwork every day, including patient data, insurance claims, and payment records. Manual labor by employees is decreased by an EDI program that eliminates the need for paper. Physicians, insurers, and pharmacy staff all benefit from the increased precision of the transmitted information, data security guaranteed, and time and effort savings. Now that we understand the importance of EDI in insurance, let’s explore its practical applications and see how it facilitates various processes:

Preserving PHI

Any healthcare system must include protected health information, whether it takes the form of a patient’s medical record or a payment for medical services. To solve that, you may implement:

- User identification systems are becoming more secure and impervious to hackers because of the usage of smart keys, biometrics, secure user IDs, and PINs.

- Precautions include automated sign-off, emergency access, security alerts, and data restoration procedures.

Utilizing high-level encryption to secure communication

To safeguard patient confidentiality and privacy, the Centers for Medicare & Medicaid Services (CMS) mandates the use of encrypted, secure systems. Encryption ensures that data remains unreadable to cybercriminals, even if intercepted.

Constructing an accurate architectural design

Construct a robust system architecture or enhance an already-existing one to:

- Permit efficient data processing (storage, production, updating, retrieval, and saving) for users. Data exchange (EDI)

- To guarantee business continuity, put in place resilience scenarios and a backup mechanism.

- Make sure that questions are answered and transactions are completed quickly.

Using access based on roles

A key component of application security for healthcare is access control. Users need to be assigned role-based credentials and separated into groups and categories (e.g., administrators, care providers, patients, etc.) in order to prevent unauthorized access to data.

Say No to Manual Process. Adopt EDI Services

How to Implement EDI in Your Insurance Company

The insurance world is embracing the power of EDI, and for good reason! But how do you go about the process of implementing EDI in your insurer? Here is a breakdown of the keywords involved:

1. Planning and Needs Analysis:

- Define your goals: Clearly define what you want to accomplish with EDI. Is it faster payment processing, improved communication, or reduced costs? Knowing your goals will guide you the rest of the way.

- Review your current systems: Take a look at your current software system to identify and get rid of any possible compatibility issues with EDI integration services.

- Choose your team: Have a team that includes representatives from IT, information management, and other departments.

2. Partner Selection and Onboarding:

- Research EDI providers: Identify top EDI solution providers that specialize in the insurance industry. Consider factors such as experience, industry expertise, and safety measures.

- Review vendor solutions: Compare products and EDI services offered by different providers. Make sure the solution fits your specific needs and budget.

- Contract negotiation & onboarding: Once vendors are selected, create negotiations that clearly outline services, costs, and timelines for implementation.

3. Data Mapping and Standardization:

- Define data standards: The insurance industry complies with specific data exchange standards such as HIPAA (healthcare) and ACORD (property & casualty). Make sure your approach meets these standards.

- Data Mapping & Translation: Work with your EDI provider to map your existing data formats to a standard EDI format. This ensures a seamless exchange of data with other people.

- Testing and Certification: Rigorously test EDI systems to identify any potential mismatches and ensure accurate data transmission.

4. Approval of Training and Use:

- Create training materials: Create training materials and workshops to teach your employees how to effectively use the new EDI system.

- User Onboarding & Support: Provide ongoing support to your team as they transition to using EDI systems. Address any questions or concerns.

5. Go-Live & Evaluation:

- Launch & Monitoring: After completing the test, start the EDI system and monitor its operation closely.

- Continuous Optimization: Continuously analyze system performance and identify areas for improvement. Regularly update your EDI solution to adapt to changing industry standards.

How to Choose The Right EDI Implementation Partner – Questions to Consider

1. What combinations and connections are supported?

There are many possible combinations in the solution. Therefore, you should find out what types of connections your business needs and cross-check if the EDI service provider can help you with those.

Next, you need to consider what kind of integration you need between ERP business processes and EDI. Make sure you want to upgrade your ERP system, especially if you are looking at an integrated solution.

We recommend an integrated solution under ERP because it is easier to manage and track than isolated technology islands that will need to be connected to other software. When you decide this factor whether the solution is Internal or external to ERP and if it is yours Check if it can integrate with ERP.

2. Do you prefer an on-premise or cloud-based EDI solution?

Developing EDI on-site requires in-house EDI support specialists in addition to infrastructure to support the implementation. This service therefore works for fewer merchants and is best for merchants using the same EDI standards and policies.

For cloud-based EDI solutions, the process takes place over an external network. This EDI framework works for businesses without EDI experience or in-house resources to manage EDI transactions, with a wide variety of business partners combined across processes and standards as well as for businesses seeking scalability.

Once a decision is made, you should test the performance of their solution with the list of EDI provider options and whether it works for you. Whichever method you choose, make sure the solution can integrate with your current and future design.

3. What pricing strategy works best for you?

Pricing is usually the determining factor for most businesses. Most EDI managed service providers offer three pricing plans: pay-as-you-go, monthly, or annually. If you decide to use an embedded solution internally, most EDI providers will charge you an annual fee.

However, if you decide to hire a VAN Provider that offers everything from EDI mapping to translation, you have to pay on a case-by-case basis. When you discuss pricing with your EDI provider, check for any hidden or excessive costs such as character limits, free VAN service, EDI mapping, record length, etc.

When dealing with data exchange handling multiple items, it’s probably best to look for an all-inclusive package. So, to reduce the price, you first need to check your data conversion rate. That way you can choose the pricing that best suits your business situation.

4. What EDI offerings are available in the software?

Older EDI technologies that require manual entry processing are less efficient as your company grows in scale and business transactions. EDI solutions with pre-configured maps can facilitate data exchange. For example, the EDI user places the packing slip, the system determines the format and the appropriate EDI message is processed and sent to the appropriate backend personnel.

As a best practice, discuss management systems with your employees. You can then inquire with the EDI provider about the various offerings including their solutions. In addition, it is also important to check if translation services are provided when importing or exporting documents from customers or vendors you have acquired.

5. Does the EDI service provide a secure platform?

EDI Security is a major concern as cyberattacks can disrupt operational stability and lead to losses. Therefore, it is important to ensure that EDI users have a secure environment because you and your employees will be exchanging sensitive documents using EDI. Ask for proof of accreditation and certification as well.

6. How much customer support and downtime can you expect?

Testing the EDI solution would be important because its compromise can prevent you from receiving or sending important documents. For example, you receive a sales order and need to send a contract but if the customer doesn’t respond, it could be a business loss.

Make sure your EDI contract includes a response time to protect your business from downtime, ensuring you can reduce SLA fines and penalties. Maybe you have an idea of what break time you would be ok to handle. But you need to look at the backup and options available to the EDI solution in such a scenario.

Also make it clear, if your teams are required to contribute any time off. Another important consideration is ensuring business continuity especially if your global operations are running at different times. Also, if different characters are used in EDI solution providers in the USA, you will need an EDI translation service.

7. Are EDI vendors customer-centric?

And is the solution user-friendly? When requesting a demonstration with an EDI provider, review available resources and their procedures for addressing issues and concerns during and after implementation. If you need a change, check with the EDI vendor to see if that’s possible.

EDI mapping and data management on an automated platform should be simple and intuitive so that you don’t have to spend any time entering data manually. It should be easy for you to add employees and use the solution. For example, our customers often share feedback about courses in EDI Solution, because it makes onboarding easier.

8. Does the EDI provider have relevant experience in your industry?

EDI has been able to make communication incredibly easy for businesses thanks to existing systems. In the automotive industry, standard vehicles differ from, for example, food or retail. An experienced EDI practitioner in your industry will already understand the process and have existing relationships with your employees in your industry.

9. Is your growing EDI solution scalable?

A good EDI solution should make it easy to expand or increase the number of EDI business relationships such as customers, suppliers, and warehouses. So, if you decide to scale your business, the solution must be able to handle the changes. An EDI provider who offers an agile onboarding process for both your vendors and your customers can help you get started with EDI faster if you implement a solution.

10. Do you need any additional EDI services?

Beyond EDI solutions, what does your EDI service provide? For example, does it include your ERP integration, data mapping as needed, and EDI translation? It can be time-consuming and frustrating for you to approach multiple vendors for EDI.

As your business grows, if you decide you need a new service like Master Data Management for example, can your EDI processing service help with that in the future, and can the software cope with that the additive has coalesced prematurely?

We Make Your Processes Simple With Our Complete EDI Solutions

Future of EDI in Insurance

EDI has revolutionized the insurance industry, transforming business processes and increasing productivity. But the future holds even more exciting things! Here’s a peek at what’s on the horizon for EDI in insurance:

1. Integrate API and EDI

Business connectivity is improved and overall business performance is raised when EDI is integrated with APIs in a cloud platform. Numerous customers attest to this fact. A B2B integration platform of this kind can link digital ecosystems and technologies, provide doors for corporate expansion, and improve the flexibility and agility of your system. An EDI/API integration solution of today can maximize your company’s overall performance.

Your EDI procedures don’t have to be abandoned. However, including them into our state-of-the-art B2B integration platform can assist your business’s ongoing evolution, customer support, and future readiness.

2. Cloud-Based EDI Systems

Due to the fact that cloud EDI solutions are more cost-effective than storing the required infrastructure on-site, they are growing in popularity. Businesses can save money on software and hardware purchases and maintenance by utilizing cloud-based EDI solutions.

In addition, cloud-based EDI offers accessibility, scalability, and ease of implementation. As businesses grow, cloud-based EDI solutions may simply scale to accommodate increased transaction volumes. Businesses that migrate to cloud-based EDI solutions eliminate a large number of the technical aspects of EDI operations. Cloud computing services achieve better disaster recovery results than on-premises alternatives. This makes it possible for companies to carry on even in the event of a data loss incident or system failure.

3. Advanced Security Protocols

To protect EDI transactions, many technologies and protocols are being used. EDI transactions are protected in transit via end-to-end encryption. Data security is further ensured through encryption, both on site and in the cloud. File transfer protocol secure (FTPS) and secure file transfer protocol (SFTP) are two ways to achieve end-to-end encryption.

EDI transaction security is further enhanced by the combination of multi-factor authentication (MFA) and access control measures. The least privilege concept combined with strict access control measures guarantees that users have the minimal amount of access necessary to do their tasks. Access to specific EDI processes is not provided to individuals who do not require it, and those who do must follow up with MFA.

4. EDI’s Integration of Blockchain

A growing trend in EDI is the integration of blockchain technology, which is gaining popularity since it solves some of the issues with the systems that are in place now.

Blockchain can facilitate increased security and transparency, which will boost EDI procedures. Data integrity is further enhanced by blockchain since once data is recorded, it cannot be changed. Transparency is ensured by allowing any employee with authorized access to the blockchain to view transaction records. Consensus protocol is necessary for even permissioned blockchains. This makes trading partners on both sides of an exchange in EDI processes even more trustworthy. EDI agreements can be automatically executed with the use of smart contracts, which are agreements encoded in computer code.

Parting Thoughts

The insurance industry has seen a significant transformation because of EDI. It has streamlined real-time communications and sped up the claims processing process, EDI gives a variety of benefits to insurers, healthcare providers, and policyholders. EDI is going to be always necessary to promote a simple, transparent, and customer-focused experience even as the insurance sector evolves. Now, let’s explore some basic questions about EDI in insurance:

FAQ

1. What are the main advantages of EDI in insurance?

EDI provides insurance companies with faster claims processing, error reduction, improved communication, cost savings, and a competitive edge.

2. How can EDI be used to process claims?

EDI facilitates the electronic exchange of patient information, billing information, and updated billing information between hospitals, insurance companies, and policyholders.

3. Does EDI impact program management?

Exactly! EDI facilitates new policy offerings, policy changes, renewals, and even automatic payments.

4. How does EDI improve communication in insurance?

EDI enables access to real-time data and communication regarding prior authorization requests, medical record exchange, and regulatory compliance.

5. Is EDI implementation difficult?

While it requires planning and collaboration, a step-by-step approach including needs assessment, partner selection, data mapping, and EDI training can ensure successful implementation.

6. What is the future of EDI in insurance?

The convergence of AI, blockchain, and IoT with EDI is on the horizon, leading to improved automation, real-time data exchange, and a more customer-centric experience