Today, mobile wallets, or even digital wallets, are of the utmost importance. A mobile wallet does the same function as your phone; it serves as a virtual container for different payment details, loyalty cards, and tickets. This tech allows you to pay quickly and securely using your mobile phone. Mobile wallets are used more for the same reason: people use more smartphones and prefer contactless payment.

The global mobile wallet market was valued at USD 7.4 trillion in 2022 and is expected to grow at a CAGR of 28.3% from 2023 to 2030. Mobile wallets are popular because they are handy and safe, which is possible because of top mobile app development companies in USA.

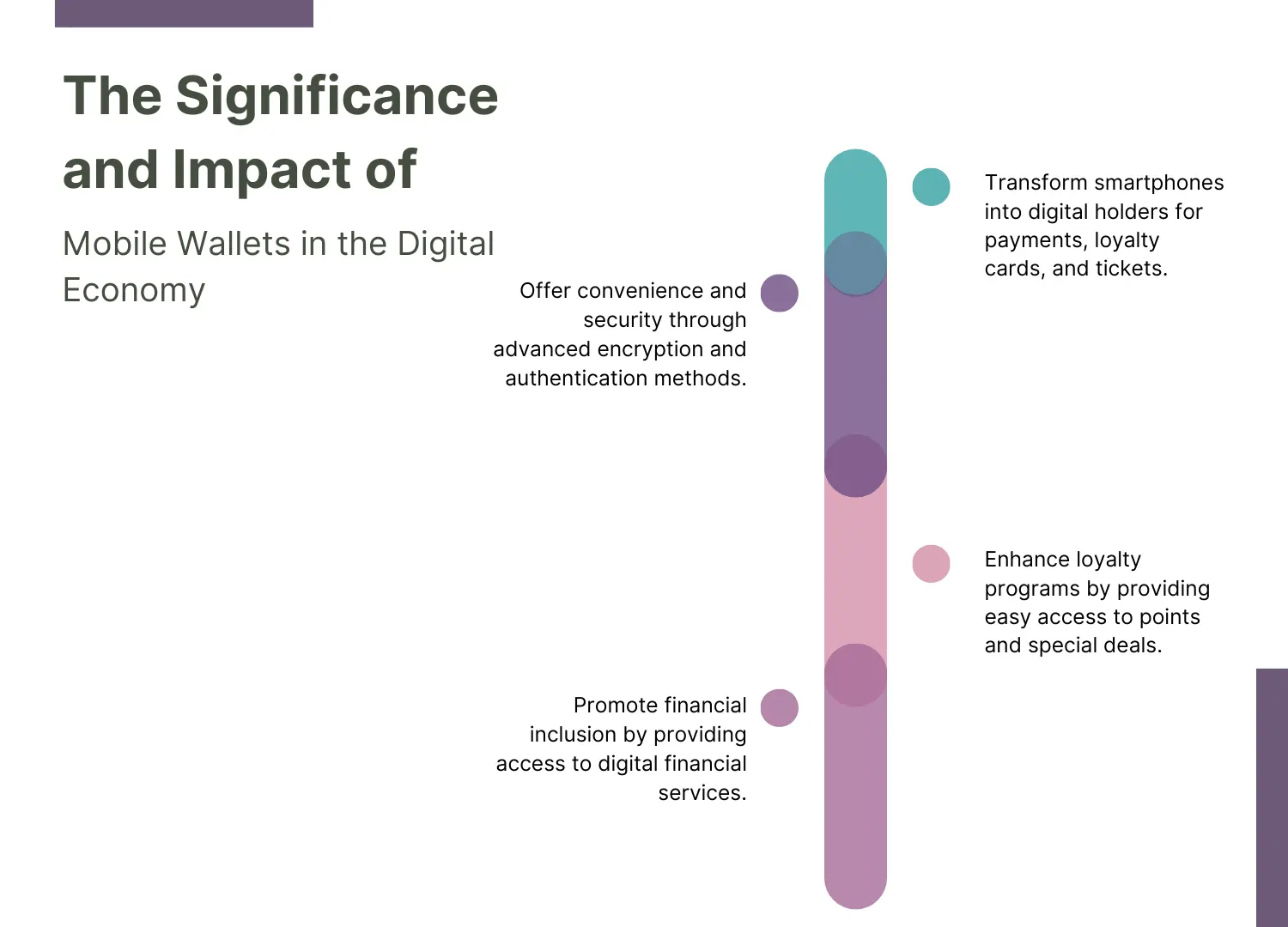

Why Mobile Wallets Are Important

Mobile wallets are key in today’s digital world. They offer benefits that old payment methods do not, and they are very handy. You can pay with a mobile wallet app anytime, anywhere, without cash or cards, which is great in today’s busy world.

Security is another big plus. Mobile wallets keep your money safe with strong encryption and ways to check who you are. Two-factor authentication and biometric checks make them even safer, lowering the risk of theft and fraud.

Mobile wallets also make loyalty programs better, improving how you experience them. They let you easily see your points and get special deals, which makes you want to use the mobile wallet app more. This is also good for businesses because it helps them keep customers and sell more.

Mobile wallets also help include more people financially. They offer a way for those without bank accounts to access financial services. Mobile wallets let people join the digital economy in places with few banks.

Mobile wallets change how we handle money, making things easier, safer, and better. As more people use mobile wallets, knowing what makes them work well is key. This article helps by looking at top mobile wallet apps and offering insights for those looking to make or improve their best mobile wallet solutions.

What is a Mobile Wallet?

This is the digital version of your physical wallet. It keeps your payment details, loyalty cards, and tickets on your mobile phone. Making quick and secured payments via mobile wallets. But you are unlikely because they have the typical goal – to make cash and credit cards obsolete with a simpler and more effective way of managing your money.

How Mobile Wallets Work?

Here’s a simple breakdown of how mobile wallets function:

- Users head to the mobile wallet app and load their credit or debit card numbers. An image of the card, or manual typing of the details can be done.

- The app will proceed to encrypt this payment information and store it securely on the device. This way, your data will be kept safe from unauthorized access.

- Users start their Mobile Wallet app and click on the payment method to make a payment. The app creates a transaction code specific to the user requesting payment and sends this code to the store’s payment system.

- Most mobile wallet apps need a fingerprint scan or PIN before processing the transaction.

- This, in turn, forwards the authorized purchase information to your store system, thus completing the transaction.

An ewallet app development company leverages the use of technologies such as Near Field Communication (NFC) and QR codes for facilitating simple touchless payments.

Benefits of Using Mobile Wallets

Mobile wallets offer several advantages:

- Convenience: They simplify payments. It is quick to pay, where you can pay with much comfort and convenience without cash or a card on your smartphone.

- Safety: When compared with traditional/routine methods, mobile wallets are secure. They employ high-grade encryption and authentication mechanisms to protect your data.

- Loyalty Program: Loyalty rewards can be linked directly to your mobile wallet, allowing you to earn and redeem rewards effortlessly.

- Contactless Payments: Due to COVID-19, Contactless Payments are the new normal. Mobile wallets are compatible with these transmissions, hence betting on their containment.

- Expenses Tracking: Your mobile wallet assists you in tracking your expenses, which is a great help for financial management.

Want to Create a Successful e-Wallet App?

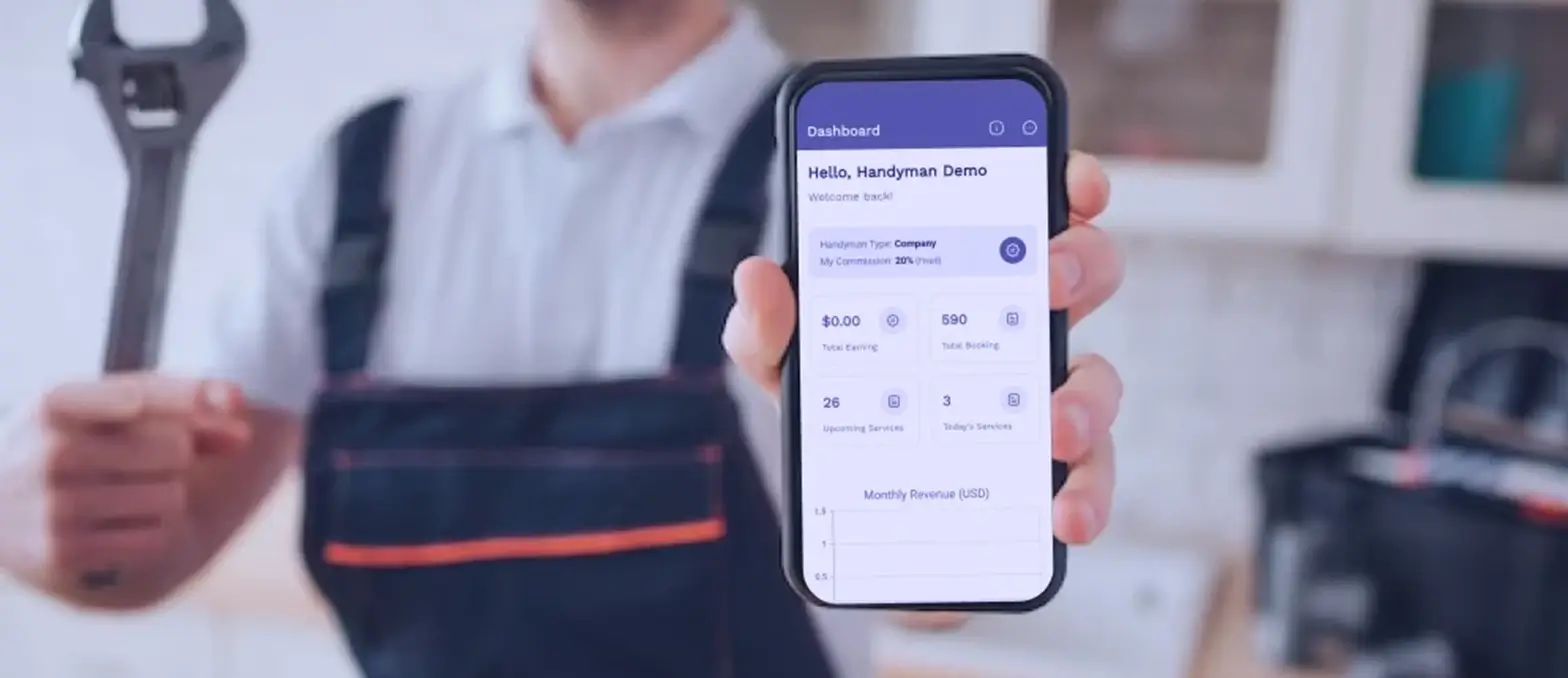

Key Features of a Successful Mobile Wallet

Security Features

Encryption

Security is crucial for any successful mobile wallet. Encryption is a key security feature. It turns sensitive data, like credit card information and personal details, into a secure code. Only a specific key can decode this. Strong encryption in a mobile wallet application protects user data during storage and transmission. This ensures peace of mind and builds trust.

Two-Factor Authentication

An additional security feature has been provided by two-factor authentication (2FA). It enhances security (you will be required to have two identifiers to open the mobile wallet). Typically, that is something you, as a user, know (password) along with something the user has (phone). It lowers the risk of unwanted access even if someone somehow manages to get the user’s password. This makes users feel secure, knowing their financial information is well-protected.

User-Friendly Interface

Easy Navigation

A mobile wallet must be easy to use. Users should find what they need quickly and without confusion. Clear labels, simple icons, and an easy menu help everyone navigate the app. This is important so even those unfamiliar with technology can use it effectively. Custom mobile app development services focus on creating such user-friendly interfaces.

Intuitive Design

The app’s design should be intuitive, meaning it behaves in ways users expect. Things like buttons and icons should be easy to find and use. This design approach makes the app simple to learn and enjoyable to use. Custom mobile application development companies often do extensive user testing to ensure their designs work well.

Integration with Banks and Merchants

Bank Partnerships

Successful mobile wallets work closely with banks, allowing users to connect their bank accounts directly to their mobile wallets. This allows for easy fund transfers and quick access to money, and working with well-known banks makes the mobile wallet more trustworthy.

Merchant Support

Supporting a wide range of merchants makes a mobile wallet more useful. This means users can shop at many places using their mobile wallets. E-wallet app development companies need to ensure smooth transactions with these merchants. Good merchant support helps more people adopt the mobile wallet because of its convenience.

Rewards and Loyalty Programs

Cashback Offers

Mobile wallets that leverage rewards programs, such as cashback offers, are more attractive to customers. Incentives might include 5% back on groceries purchased through the app (for example). These rewards draw new users and keep existing ones coming back.

Points System

Another good rewards program is a points system. Users earn points with each transaction. They can redeem these points for discounts, gift cards, or cash. The well-structured points system keeps users engaged and motivates them to engage more through Mobile Wallet. A Custom mobile application development company often designs loyalty programs that fit their users’ likes and habits.

Key features of a successful mobile wallet Various security measures are in place, like encryption and two-factor authentication, to secure user data. The app can be got at by all because of its easy navigation and intuitive design. Working with banks and merchants makes the wallet more useful and trusted, as well as incentivizes and encourages user retention with rewards/loyalty programs. By focusing on these important features, mobile application consulting services can develop mobile wallets that meet modern consumers’ needs and stand out in a competitive market.

A good mobile wallet not only offers convenience but also earns trust with solid security and valuable partnerships. It improves the user experience with smart design and rewards that keep users returning. As demand for mobile wallets grows, these key features will help the best e-wallet app development companies create products that truly connect with users.

Top Mobile Wallet Apps

1. Amazon Pay

Amazon Pay, launched in 2007, is a digital payment service created by Amazon.com. This service makes online payments easier and offers users exciting cashback and gift rewards. Designed for Amazon’s extensive customer base, Amazon Pay allows shoppers to pay on other merchants’ websites using their Amazon accounts. It is known for its quick and easy online purchase process.

Amazon Pay handles many transactions, including food orders, mobile recharges, travel bookings, and purchases on Amazon itself. The platform is particularly user-friendly for those who shop online often.

Working with fintech firms like ZestMoney, Amazon Pay provides no-cost EMI options. This lets customers spread the cost of their purchases over several months, which helps manage their budgets better. Amazon Pay is available in many countries and uses advanced technologies like blockchain to improve its services.

Are you thinking of launching a mobile wallet similar to Amazon Pay? We offer ready-to-use e-wallet app solutions that can help you make a significant impact in the app market. Find out why we are considered one of the best mobile app development companies in California for creating top e-wallet apps.

2. Google Pay

Though Google Pay entered the e-wallet scene after some competitors, it quickly grew its user base and secured a strong market position. This mobile wallet provides a comprehensive solution for financial transactions. Users can easily send and receive money, pay bills, shop online, top up phones, and pay in stores with just one app.

Seamless integration is one of the strengths of Google Pay, which is supported by other Google services such as Gmail. A lot more- you can also transfer money via email by integrating your Gmail with Google Pay. Compatible with credit/debit cards and bank accounts: American Express, Visa, MasterCard. It even works with PayPal to provide more robust and flexible security.

Google Pay’s easy setup has helped it gain widespread popularity, with over 100 million installs quickly. To start, all you need is a Google account. This setup skips the usual steps like adding funds repeatedly and completing KYC checks, common in other e-wallet apps. Google Pay is free to use, simple to link with debit cards, and quick to set up, making it a top choice among the best e-wallet app development services.

If you are considering developing an e-wallet app like Google Pay, tap into our expertise in mobile wallet solutions to capture this growing market.

3. PayTM

Launched in 2010, PayTM has become a leader in India’s mobile commerce industry, setting a standard for many fintech app development services. It’s one of the biggest and most successful e-wallet companies, offering services in eleven languages. This makes it easy for customers to manage their money and complete transactions smoothly.

PayTM uses a semi-closed model where users can add money to their digital wallets and pay affiliated merchants. The platform is versatile, supporting a variety of activities. Users can pay bills, book flights and hotels, transfer money, and buy items across sectors like retail and entertainment. It also allows for online recharges and shopping.

A key to PayTM’s success is its use of advertising and paid promotions, which bring in about $120 million in revenue. The company also partners with leading educational institutions in India to support cashless payments for tuition and other fees. Moreover, PayTM has adopted blockchain technology, which enhances the security and efficiency of fund storage and transfers.

For companies looking to outsource app development, PayTM provides an excellent example of how advanced technology and comprehensive functionality can be integrated into a mobile wallet. This offers important lessons for developing competitive e-wallet solutions.

4. PayPal

Launched in 1998, it is now the frontrunner in e-commerce services. Still, since it was heralded as a leading mobile wallet, it immediately caught on among eBay users. The greatness of it is in how BASIC and FAST usefully it may be. This payment system has numerous features that anyone has by owning a PayPal account.

PayPal is the crown of mobile wallets that protects your purchases when you shop online. Members can use their account to store their card numbers or upload a picture of their debit or credit card. The institution has almost all the banks in the country, making it more flexible. Uniquely, PayPal lets users send and receive money to and from U.S.-based and various international banks without charging fees for transfers to friends and family.

Inspired by how PayPal functions? If you want to develop apps like PayPal, consider hiring mobile app developers from our team. We are experts in creating digital wallet solutions that mirror the success and functionality of established platforms like PayPal.

5. Venmo

Venmo, part of PayPal, became a social commerce platform and quickly gained popularity. What makes Venmo stand out? It’s tailored for smartphones, making it easy for users to store their debit or credit card information and keep a balance for fast transactions with friends.

Venmo is about managing money within your social circles—like splitting dinner bills or sharing cab fares. You just need to log in with your email, and Venmo will smoothly manage your contacts and transactions. The app also handles business payments and connects to your cards for free, proving its effectiveness as a mobile wallet. This innovation makes Venmo a key topic in discussions about app development programming languages and mobile wallet solutions.

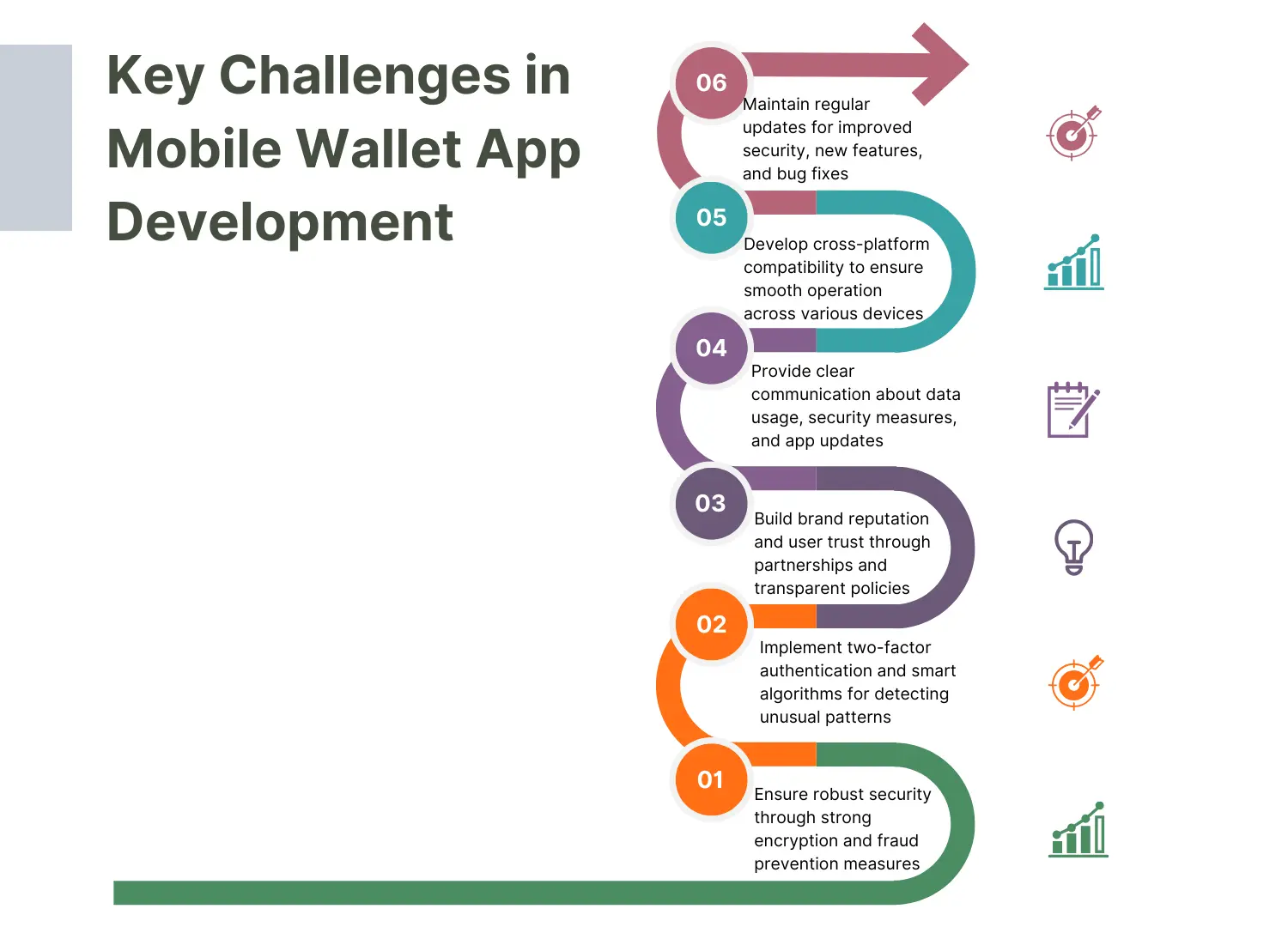

Common Challenges in Developing Mobile Wallets

Ensuring Security

-

Protecting User Data

Security is crucial. The app must protect its users’ financial details. Strong encryption is one way to do this. It scrambles sensitive data so only specific keys can unlock it, keeping the data safe from hackers.

-

Preventing Fraud

Stopping fraud is also important. If fraud happens, users lose money and trust in the app. Using two steps to log in is a good solution. For example, users might need a password and a fingerprint to access their accounts. Smart algorithms can also help spot unusual spending patterns and alert users quickly.

Achieving User Trust

-

Building Brand Reputation

Trust is essential. Users prefer apps from brands known for being safe and reliable. Android app development companies should work hard to build and keep a good reputation. Partnering with well-known banks can make the app seem more trustworthy.

-

Transparent Policies

Clear policies are key. Users should easily understand how their data is used and protected. Being open about the app’s policies helps build trust. Regular updates on security measures and new features are also important. Good customer support improves trust further.

Maintaining Compatibility

-

Cross-Platform Support

Apps must work well on different devices, such as smartphones and tablets, and with different operating systems. Developers must use cross-platform development services to ensure the app works smoothly everywhere.

-

Regular Updates

Keeping the app updated is crucial. Updates should improve security, add new features, and fix any bugs. Developers should test updates carefully and tell users what benefits the updates bring.

Future Trends in Mobile Wallets

Contactless Payments

-

NFC Technology

Contactless payments cannot be made without Near Field Communication (NFC). It allows devices to talk to each other, typically within a few centimeters. Mobile wallets have adopted this technology to allow fast and secure transactions. All this means is that users have to place a simple tap on the device using their smartphones, and voila! NFC is becoming increasingly popular due to the security of NFC transactions and their clean, efficient operation. Fintech app development companies are incorporating it into their mobile wallets because it offers convenience.

-

QR Code Payments

QR code payments are becoming more common, too. Unlike NFC, QR codes don’t need special hardware and can be scanned by any smartphone camera. This method is accessible and cost-effective, making it popular, especially in areas without NFC infrastructure. Users scan a QR code shown by the merchant, and the payment processes quickly, often faster than traditional methods. Fintech app development companies are incorporating QR code capabilities into their wallets for better Fintech Software ROI.

AI and Machine Learning

-

Personalized User Experience

AI and machine learning are making mobile wallets smarter. These technologies use data about how we behave as users to provide personalized recommendations or services. For example, a mobile wallet might prompt discounts according to the user’s shopping pattern. This personalization improves engagement and satisfaction. Enterprise app development companies use AI to create mobile wallets that adapt to individual needs, enhancing user experience.

-

Fraud Detection

Artificial intelligence development is also crucial for spotting fraud. It examines vast data to detect unusual patterns and prevent fraud. These AI models learn from past data to identify and stop fraud as it happens. Mobile wallets with AI-driven fraud detection alert users to suspicious activities, reducing financial risks and boosting user trust. As AI technology advances, more fintech companies will use it to secure their wallets.

Blockchain Integration

-

Enhanced Security

Blockchain is proving valuable for mobile wallet security. A Blockchain App Development Company might use this technology to create a system where transactions are recorded on a distributed ledger that nobody can change or delete. This setup, immune to hacking, uses sophisticated cryptography, making mobile wallets much safer. As data security concerns rise, more mobile wallets will likely use blockchain.

-

Transparent Transactions

Blockchain also makes transactions transparent. Every transaction is visible to all network members, ensuring accountability and building trust. Users can verify transactions themselves, which boosts confidence. Blockchain simplifies auditing and compliance, helping enterprises meet regulations. An enterprise app development company can use blockchain to make secure and transparent wallets, meeting modern demands.

Conclusion

Mobile wallets have changed how we handle money. They offer top convenience, letting users pay quickly and safely using their smartphones. Features like solid security, user-friendly design, connections with banks and shops, and rewards programs make them popular. Strong security measures like encryption and two-factor authentication protect user data and prevent fraud. Easy-to-use interfaces help make the app simple for everyone. Linking with banks and merchants boosts the app’s usefulness, and loyalty programs keep users returning.

The outlook for mobile wallets looks bright, with several new trends set to boost their features and appeal. Powered by NFC technology and QR codes, contactless payments add more convenience and security. They make transactions quicker with just a tap or a scan. AI and machine learning personalize user experiences and improve fraud detection. They analyze how users behave to offer customized suggestions and spot suspicious actions, ensuring a safer and more engaging experience.

Blockchain is another key trend, and Blockchain Development Services are increasing the security and openness of mobile wallets. With its decentralized approach and advanced encryption, blockchain secures user data and ensures that transactions are clear and unchangeable. This tackles data privacy and fraud concerns, making mobile wallets more reliable.

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your App Journey Today!

Final Thoughts

Mobile wallets are more than just a passing trend; they represent a significant change in managing our finances. Their ease, security, and improved user experience make them a core part of the digital economy. Ongoing innovations in mobile app development, such as AI, machine learning, and blockchain, are pushing mobile wallets forward.

Tapping into these advancements can offer a competitive advantage for both businesses and users. Mobile wallets will continue to influence the future of digital payments, presenting new opportunities and challenges for e-wallet app development companies and fintech innovators.

Looking ahead, the focus will be on developing mobile wallets that are even more secure, easy to use, and integrated. Companies like A3Logics are leading these innovations, providing top Mobile App Testing Services that meet the changing needs of users and businesses.

Stay ahead in the digital economy with A3Logics, your partner in mobile wallet innovation.

FAQs

What is a Mobile Wallet?

A mobile wallet is a digital version of your regular wallet. The application is where you can house all your payment methods, loyalty cards, and tickets on your phone. These are built-in wallets on your mobile phone with which you can pay instantly and securely from your phone, apart from cash or cards.

How Secure are Mobile Wallets?

Mobile wallets are the secure, safe way to make your payment. Information is also secure from hackers as they employ state-of-the-art encryption. Most Mobile Wallets are feature-first to be two-factor authentication (2FA). It secured the account by requiring two different forms of ID, say a password and fingerprint, which makes it difficult for thieves to access your account.

What Happens if I Lose My Phone with a Mobile Wallet Installed?

If you lose your phone with a mobile wallet, act fast to secure your information. Most wallets let you lock or erase your phone remotely to stop thieves. Mobile Wallets often need a fingerprint or a PIN to open, which adds security. Also, inform your wallet provider and bank immediately.

How Do Mobile Wallets Earn Revenue?

Mobile Wallets make money in several ways. They often charge merchants a fee each time a payment is made using the wallet. Some offer paid features like instant transfers for a fee. They also might earn commissions from promotions with businesses.

What Are the Best Practices for Using Mobile Wallets Safely?

When using, always use two-factor authentication and create strong, unique passwords. Monitor your account for unapproved transactions. Updating your wallet and phone system for maximum security. Common Wi-Fi is unsafe!