Table of Contents

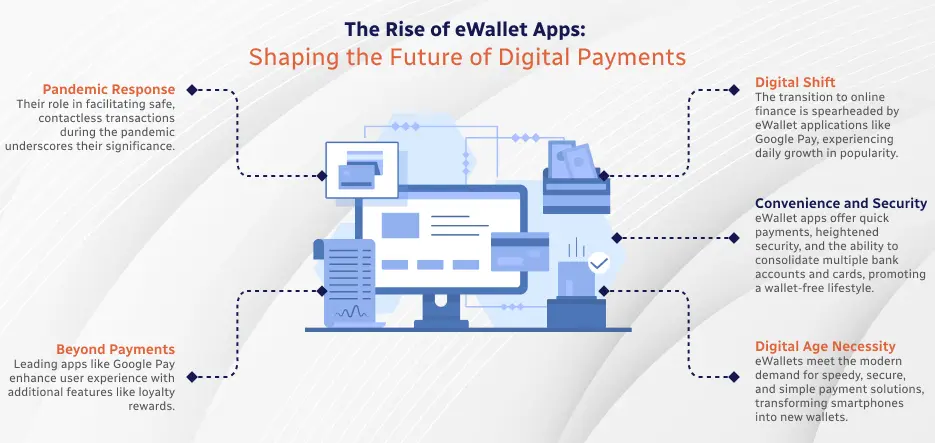

In our fast-moving digital world, finance has shifted online big time. EWallet app like Google Pay are leading this move, which is becoming more popular daily. Their growth shows how we’re changing how we handle and spend money. Let’s examine why eWallet apps are on the rise, why they’re important, and what it takes to make one.

eWallet apps are a big deal for digital payments worldwide. The world of mobile payments is booming. A study by Allied Market Research shows that by 2027, the global mobile wallet market could hit $7.6 trillion. This impressive growth, at a rate of 28.2% from 2020 to 2027, highlights how quickly digital wallets are being adopted worldwide. These apps are so popular because they’re super convenient. They allow quick payments, are very secure, and let you add all your bank accounts and cards in one place. The best eWallet apps mean you can go about your day without your physical wallet.

Why eWallet Apps Matter Today

The digital age loves fast, secure, simple solutions, and eWallet apps fit right in. They’ve changed how we shop, eat out, and pay bills, making our phones the new wallet. During the recent pandemic, more people used these apps to avoid cash or card payments, showing how vital they are for safe, contactless payments. An eWallet app like Google Pay doesn’t just handle payments and offers loyalty rewards, making it even better for users.

Making an eWallet app means looking closely at costs, what features to include, and how to build it. First, know that making Google Pay-like apps is a big investment. It’s not just about the tech; you must also follow financial laws. The app’s features are key to its success. From basic payment processing to high-tech security, each feature makes the app more complex and expensive to produce. A survey reveals that 64% of consumers used a digital wallet for online purchases in 2020, highlighting the importance of offering comprehensive features to meet user expectations.

Understanding how to build it is vital. Working with an On Demand App Development Company can make things smoother. They help keep the project on budget and ensure it meets the tough standards of the finance world. These experts are good at making secure, easy-to-use apps that last.

In wrapping up, making an eWallet app like Google Pay has challenges and big opportunities. Companies can make sense of this tricky area by focusing on costs, features, and how to build it.

What is an eWallet App?

eWallet apps are a game-changer in managing money in our fast-paced digital world. They’re digital tools that let us store payment details and make transactions from our phones. These apps connect our finances to merchants seamlessly, safely, and quickly, eliminating the need for physical cash or cards. They range from simple apps holding card info to complex ones using Blockchain Development Services for better security and transparency.

How eWallet Apps like Google Pay Transform Financial Transactions

Ewallet Apps like Google Pay have reshaped our financial habits. They’ve turned phones into wallets, letting us pay in stores, send money, and pay bills with just a few taps. This digital payment shift owes a lot to advances in app development.

These apps have made financial transactions much easier. For example, sending money internationally is quicker and cheaper than ever, thanks to eWallet Apps like PayPal. Adding Blockchain Development Services to these apps has upped security and transparency, making scams harder.

Key Features of a Successful eWallet App

Creating a top-notch eWallet app like Google Pay means adding key features that users need for safety, ease, and quickness. These main e-Wallet App Features make an app work well and attract users. Let’s explore the must-have features for apps like Google Pay, why they’re important, and how fintech app development boosts these features.

Setting Up and Managing User Profiles

First, create an account and manage a profile. This step should be simple, letting users easily sign up and set their profiles. It’s key for hybrid mobile app development to make this secure but easy to use. Managing a profile lets users change their info, handle security settings, and view their transactions. It’s a must-have for similar apps like Google Pay.

Linking Bank Accounts or Credit Cards

Adding bank accounts or credit cards safely turns a mobile app into a real eWallet. This needs top security and encryption to make users feel safe giving their financial information. cross platform mobile app development is important for a smooth device experience and for securing user data.

Safe Payment Processing

The center of an eWallet app like Google Pay, is safe payment processing. Advanced fintech app development with top-notch encryption and fraud detection is needed to keep payments safe. Users can pay and transfer money, knowing their cash and data are secure.

Instant Transaction Notifications

With real-time transaction notifications, users get instant updates about their accounts. Whether it’s a payment made, received, or a bill payment reminder, these updates improve the user experience. Making an ewallet app like Google Pay requires a backend system that can handle these notifications fast, a job for expert Ewallet App Development teams.

QR Code Scanning for Payments

QR code scanning for payments is essential, offering a contactless and quick way to pay. Users just scan a QR code to pay at a store. This feature’s popularity comes from its simplicity and speed. Adding this needs the know-how of an enterprise mobile app development company to handle QR codes safely and efficiently.

In summary, making a successful eWallet app like Google Pay is more than just an idea; it needs careful addition of key features that meet user needs for safety, ease, and speed. These technologies create a smooth and safe experience, like what you get with Google Pay and other top apps. As eWallet apps grow, so will the tech and methods used to make them, leading to even more clever and easy-to-use financial tools.

Advanced Features

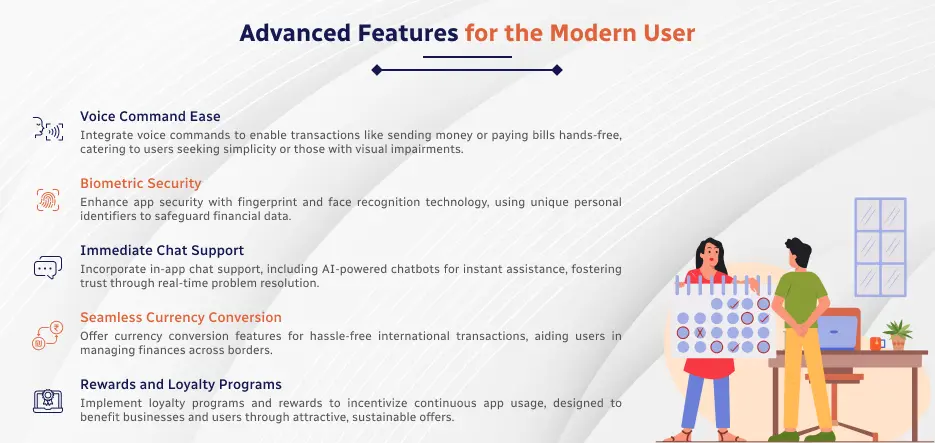

Voice Commands Integration

Adding voice commands can make eWallet apps much easier to use. Imagine saying, “Send money to John” or “Pay my internet bill,” without touching your phone. This smart feature appeals especially to those who prefer not to fiddle with their devices or have difficulty seeing. Creating this requires a fintech app development company good with AI and understanding human speech. It shows how fintech app development services are advancing to make handling money as easy as talking.

Extra Security with Biometrics

In today’s world, keeping digital information safe is a top priority. That’s why adding biometric security, like fingerprint or face recognition, is a big deal. This tech uses unique personal features to protect users’ financial data, making unauthorized access tough. A custom mobile app development service specializing in this technology can boost an app’s security, giving users peace of mind.

In-app Chat Support

Chat support in the app means users can get help immediately if they have a question or problem. This isn’t just about solving issues quickly; it’s also about building trust. Modern fintech app development services include AI-powered chatbots that can handle many questions, with complex problems passed on to real people.

Currency Conversion for International Transactions

Seeing costs in their home currency is essential for those who travel or make international transactions. It helps manage money across borders without worrying about exchange rates.

Loyalty Programs and Rewards

Offering rewards and loyalty programs makes using the app more appealing. These benefits encourage users to keep using the app, whether getting money back on purchases or earning spending points. Designing such programs thoughtfully is key to making them work for the business and the users. This is where expert fintech app development services come in, helping to create attractive, sustainable rewards.

As eWallet apps evolve, the role of Fintech App Development companies becomes increasingly important as they bring these sophisticated features to life.

Basic E-Wallet apps can start from $30,000, while more sophisticated ones with advanced features may surpass $100,000. Sofia Victoria

The Cost Elements of Building an eWallet App

Initial Planning and Market Research

Starting an eWallet app like Google Pay requires careful planning and knowledge of your market. This work begins long before any coding or design. Early planning and research are key to ensuring a successful e-wallet App.

Early planning is like drawing a map for your journey. It’s where you decide what you want to achieve, who the app is for, and what makes it special. This step is critical for the top mobile app development companies in the USA. They think about the app’s goals, its users, and how it’ll stand out.

Research helps guide the way. It means looking into who will use the app and what the competition is like. It’s about understanding people’s likes and needs and finding spots where the app can shine. This research isn’t just a one-time thing. It keeps going even after the app launches, helping it stay relevant and competitive.

Why Knowing Your Market Matters

- Smarter Marketing: If you know your audience well, you can target your marketing better. This means your messages hit home with the right people.

- Staying Ahead: Good research can show you where you can be different from others. This is a chance to do something new with a mobile app development company in the USA that sets your app apart.

- Dodging Risks: Knowing the market well helps you see changes coming and adapt. It also stops you from making big mistakes.

- Finding New Chances to Make Money: A deep dive into your audience can reveal new ways to make money, like through partnerships or extra features.

Design and User Experience

Creating an eWallet app like Google Pay involves smart design and understanding users’ needs. Making an app simple to use can help it become popular. This piece examines how great design is key to making users love and use an app daily.

Good design means making an app easy and natural for people to use. For eWallet apps, this means letting users do things like pay for shopping or send money to friends without any trouble. Everything in the app, from how it looks to how users move through it, is made to be user-friendly.

iOS App Development Companies that make apps for iPhones and iPads are very good at ensuring eWallet apps work well and look nice. They use their design skills to create apps that meet iPhone users’ expectations.

Sometimes, getting mobile application consulting services on how to make an app can make a big difference. They can offer tips on improving the app and making it even easier for users to enjoy.

Good design is very important for eWallet apps. It helps ensure the app is easy and enjoyable, making more people want to use it. Teams that focus on making their apps simple and effective can see great success.

Development Phases

Creating an eWallet app like Google Pay involves many steps. Each step is key to making the app work well, perform fast, and be easy for people to use. This process needs a lot of tech know-how and costs a good amount.

Frontend Development Costs

The part of the app you see and use is made during front-end development. This part is super important because it’s what people see and touch. It must look good, be easy to use, and work well on various devices.

The cost here depends on how complicated the design is, how many special features it has, and if it needs any fancy effects. Ensuring the app works the same on all devices and systems can also change costs. Companies specializing in making apps will use different tools to create a great experience, always considering how much money you have to spend.

Backend Development Costs

The backend is the app’s brain. It tracks users, handles money moves, ensures everything is safe, and connects with banks. This part is essential for the app to work properly, handle many users, and keep everything secure.

How much this costs can change a lot. Things like making sure the app is very secure, can talk to other financial systems, and has a way for you to manage it can all affect the price. Fintech app development needs special skills in finance rules and ensuring everything is legal, which can also make it more expensive.

API Integration Costs

API integration lets the app integrate with other software. This means linking bank accounts, processing payments, and getting financial information. Connecting to payment systems, banks, and other tools is common.

The cost can vary depending on how difficult the APIs are to work with, how much custom work is needed, and how many services need to be connected. Some APIs are free, but others might cost money. Sometimes, you might need to create a special API for your app, which can cost more. A company with fintech app-making experience will know how to do this well, ensuring the app is smooth for users.

Making an eWallet app like Google Pay means spending money on making the app look good, work well, and connect to other services. These steps ensure the app does what users expect, is safe, and is easy to use. Working with a custom mobile application development company that knows fintech app development is key. They can help you through these complex steps, keep costs in check, and make a great eWallet app.

Testing and Quality Assurance

Testing and quality assurance (QA) are pivotal in creating an eWallet app similar to Google Pay. They ensure the app works well and is secure. This stage is vital in fintech, where users’ trust and finances are at stake.

Testing and QA are ongoing processes that keep the app working smoothly, easily, quickly, and securely. They find and fix issues that could hurt the user experience or pose security risks. For eWallet apps, any slip-up could mean big losses for users and damage the app’s reputation.

Security is the foundation of an eWallet app like Google Pay. Fintech Software Development Companies in the USA put much effort into keeping user data and transactions safe. This includes using strong encryption, secure connections, and checking for fraud. Security testing checks for weak spots that hackers could attack, ensuring the app is safe for financial transactions.

Testing and QA continue even after the app launches. New updates or features can cause issues. Companies continuously check and fix problems using agile methods, keeping the app reliable and secure with each update.

Automation is key in today’s quick development cycles. It lets developers run many tests quickly, covering more ground and finding issues faster. For eWallet apps, automation helps ensure every part of the app is checked and meets high standards.

The success of an eWallet app depends on how well it works and its security. Testing and QA are essential to meet these needs. Android app development companies need a thorough and ongoing approach to testing. By carefully checking every part of the app, these companies can create an app that exceeds user expectations. In the competitive fintech market, this focus on quality and security makes successful eWallet apps stand out.

Deployment and Maintenance

Launching an eWallet app like Google Pay is just the beginning. Keeping the app running smoothly and securely and ensuring it stays useful for users involves ongoing work and costs. This part covers what comes after launching an eWallet app for Android, focusing on the importance of planning for future expenses to keep the app competitive.

Putting the app out there for users, usually on places like Google Play for Android, involves a few steps. This includes ensuring the app follows store rules, setting up accounts for developers, and getting the app ready for release. While some costs, like Google Play’s one-time $25 developer account fee, are small, the real task is in the final tests, ensuring the app works on all devices and meeting all the rules, which takes a lot of effort.

After launch, keeping the app in good shape is crucial. This means regular updates, fixing bugs, improving the app, and keeping it safe. How much this costs depends on a few things:

After launching an eWallet app like Google Pay, the work to improve and keep the app up-to-date never stops. The money spent after launch is a big part of the total cost, but it’s essential for maintaining the app safe, working well, and relevant. Planning for these expenses is key for anyone looking to launch an eWallet app for ios, as it affects how well the app can attract and keep users and stay ahead in the market.

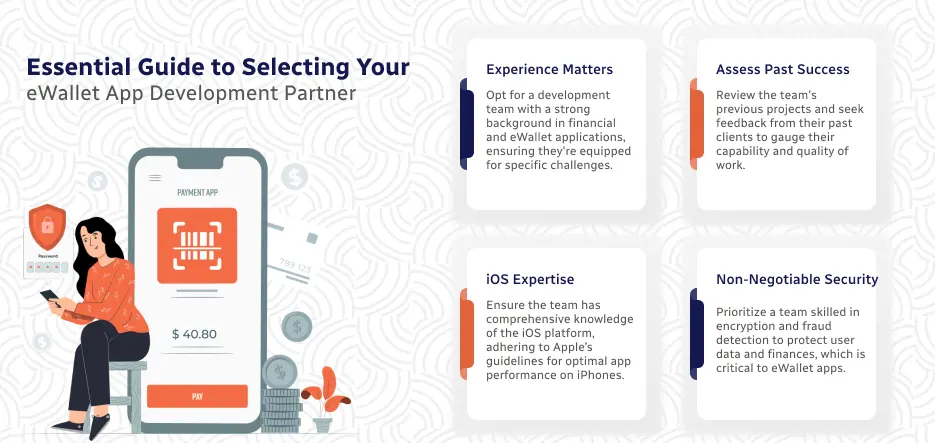

Choosing the Right Development Partner

Picking the right team to build an eWallet app like Google Pay is a big deal, especially for iPhone users who expect a lot in terms of how easy and secure an app is. This choice hugely affects the app’s quality, how well it works, and its success among similar apps.

What to Look for in a Development Team

Choosing who will help make your eWallet app for iPhone involves several important factors to ensure your app idea becomes a great product that people will want to use.

- Know-How and Past Work: Find a team that’s made financial apps before, especially eWallet ones. This background will prepare them for the specific challenges of these apps.

- Past Projects and Feedback: Look at what the team has made before and talk to their old clients. This will help you understand what the team can do and whether their work quality is what you’re looking for.

- Knowledge of iOS: The team should understand the iPhone platform, including how to make apps that follow Apple’s rules and use iPhone features well. This is crucial for making sure your app works great on iPhones.

- Security: This is super important for eWallet apps. The team must be skilled at protecting user information and money using encryption and fraud detection.

- Talking and Working Together: Good communication is key. You want a team that keeps you updated, listens to your ideas, and works through problems together.

Cost vs. Quality

Balancing how much you spend with what you get back is tricky. Even though staying within budget is important, you shouldn’t cut corners on important parts of the app.

- Don’t Skimp on Key Features: Things like security, a good design, and meeting legal rules are must-haves. Saving money shouldn’t mean making a less safe or harder-to-use app.

- Think About Long-Term Benefits: Paying more upfront for a great team might seem expensive but can mean fewer costs later. A well-made app needs less fixing, lasts longer, and can make users happier and more likely to stick around.

- Be Smart About How You Build: Some teams use approaches that let them easily change or add things without huge cost jumps.

In summary, choosing who will help you create an eWallet app like Google Pay means carefully examining their skills, past work, and ability to deliver a high-quality app without going over budget. By focusing on must-have features and picking a team that fits your project’s needs, you can make an app that stands out in the crowded eWallet market.

Marketing Your eWallet App

Marketing your eWallet app in today’s fast-paced digital world means navigating a sea of competitors. To get your eWallet app like Google Pay noticed, you need smart marketing strategies and to use user feedback wisely for improvements. Let’s explain how to make your app shine and why listening to users is key to its growth.

How to Make Your App the One Users Choose

- Spotlight What’s Different About Your App: What makes your app special? It might be a cool new feature, a smoother experience, or easier for a specific group of users. Make sure potential users know what sets your app apart immediately.

- Use Social Media Wisely: Social media is your friend for reaching people. Create posts that highlight what your app does best. Targeted ads can also help you get the right people based on what they like, do, and where they are.

- Share Helpful Content: Write articles or make videos about managing money or the perks of digital wallets. This can help show you’re an expert in the space and draw in people looking for financial tips.

In short, getting your eWallet app noticed requires showcasing its unique features, engaging with your audience through various channels, and embracing user feedback for continuous improvement. By doing these things, your eWallet app can carve out its spot in the market, build a dedicated user base, and enjoy lasting success.

Conclusion

Setting out to create an eWallet app like Google Pay is a big but rewarding challenge. It’s about making a tool that fits into users’ digital lives today. In wrapping up, let’s review the key steps for creating such an app and the lasting benefits of crafting a secure and feature-packed eWallet solution.

Building and Launching an eWallet App: Key Steps

- Getting to Know eWallet Apps: Start by understanding the basics and importance of eWallet apps in modern finance. These apps make paying for things and transferring money simple and secure.

- Important Features: Your app should have both essential and advanced features. User sign-up, safe payments, and instant alerts are just the start. Adding high-tech options like biometric locks or currency exchange can make your app stand out.

- The Development Journey: Making an app involves many steps – designing the front end, setting up the back end, integrating APIs, and focusing on security. Planning and careful execution are key in each phase.

Making an eWallet app like Google Pay involves planning, skill, and dedication. But the potential rewards – changing how people handle money and carving out a space in the digital finance world – are huge. If you’re up for the challenge, now’s the time to start shaping your vision into an eWallet app like Google Pay with A3Logics that could be the next big thing.

FAQs

What is the Google Pay App?

Google Pay is a digital wallet and online payment system by Google, designed for quick, secure transactions on mobile devices. Users can add their card details to Google Pay and use their phones or tablets for payments at stores and online where it’s accepted. Here’s a quick look at how to integrate Cash App with Google Pay and some frequently asked questions about eWallet apps.

How to Add a Cash App to Google Pay?

To add a Cash App card to Google Pay:

- Open the Cash App on your device.

- Tap the Cash Card tab on your Cash App home screen.

- Select the image of your Cash Card.

- Choose “Add to Google Pay” and follow the instructions to finish adding your card.

This setup lets you spend your Cash App balance using Google Pay.

How do you Transfer Money from Google Pay to a Cash App?

While Google Pay doesn’t directly send money to Cash App, you can use a shared bank account with both services or move money from Google Pay to your bank and then to Cash App.

Can You Send Money from Google Pay to Cash App?

Directly sending money from Google Pay to the Cash App is not supported. The workaround involves transferring the amount first to a common bank account linked to both apps and then moving it to the Cash App.

Can eWallet Apps Work Internationally?

Many eWallet apps are built for use worldwide, supporting different currencies and linking with international payment systems. Their global reach depends on agreements with banks and financial networks across countries. Always check if the app fits your international payment needs.