In today’s rapidly evolving digital landscape, banks and financial organizations are embracing digital transformation services to streamline their operations, improve customer experiences, and stay competitive in the industry. The digital transformation wave has brought about significant changes in the way banks and financial organizations function, with technology at the forefront of their operations.

Technology must be incorporated into every aspect of a business, from back-office processes to customer interactions, in order to undergo digital transformation. For banks and financial organizations, this means adopting new technologies such as cloud computing, big data analytics, and artificial intelligence (AI) to drive innovation and improve business outcomes. With customer expectations rising and competition increasing, banks and financial organizations must keep up with the changing times to stay relevant. These services aid these businesses in improving customer experiences, boosting productivity, and cutting expenses.

This article aims to explore the key drivers for digital transformation in US banks and financial organizations. We will delve into the various ways that digital transformation is transforming the industry and highlight the potential benefits of embracing these changes. Through this article, readers will gain a better understanding of how these services can drive innovation and create opportunities for growth in the banking and financial industry.

The Key Drivers for Digital Transformation in US Banks & Financial Organizations

The adoption of Fintech Software Development Services is driven by a range of factors that can have a significant impact on business outcomes. By automating routine tasks and re-engineering business processes, banks, and financial organizations can reduce operational costs, improve accuracy and consistency, and deliver faster and more reliable services. Customers today expect personalized experiences that are accessible across various channels. These services can aid businesses in providing a more practical, effective, and tailored customer experience, resulting in raised client satisfaction and loyalty.

By using advanced analytics and machine learning algorithms, banks and financial organizations can gain a better understanding of customer needs and preferences, make data-driven decisions, and deliver more targeted products and services. These digital services can help banks and financial organizations reduce operational costs and improve efficiency by automating processes, streamlining workflows, and leveraging analytics to optimize resource allocation.

With the rise of digital-native competitors, traditional banks and financial organizations must embrace digital transformation to remain competitive. iOS App Development Company can help organizations stay ahead of the curve by adopting new technologies and business models and leveraging data to drive innovation. With the increasing complexity of regulations and the growing threat of cybersecurity, these transformation services can help organizations comply with regulatory requirements and manage risk effectively.

Automation and Process Optimization

The process of digital transformation entails integrating digital technology across the board of an organization, which has a profound impact on how businesses function and provide value to their clients. The ability of digital transformation to enable automation and process optimization is one of its most important advantages. This section explores how digital transformation consulting can help US banks and financial organizations achieve automation and process optimization and the benefits of doing so.

How Digital Transformation Enables Automation and Process Optimization?

The process of automating and streamlining routine chores using technology so that fewer people need to be involved in them is known as automation. Process optimization, on the other hand, focuses on improving the efficiency of existing processes, reducing the time and resources required to complete them.

By utilizing cutting-edge innovations such as AI, deep learning, and automated robotics, digital transformation allows automation and process improvement. By automating tedious, time-consuming, and error-prone tasks, these technologies free up workers’ time so they can concentrate on more important tasks that call for human interaction.

For instance, banks and financial organizations can use machine learning algorithms to automate credit risk assessments, fraud detection, and compliance checks. This can reduce the time taken to complete these processes while improving accuracy and consistency. Similarly, robotic process automation can handle back-end operations like data input, accounting journal, and document handling, increasing productivity and lowering the possibility of mistakes.

Examples

Many US banks and financial organizations have already started implementing automation and process optimization through transformation consulting. For instance, JPMorgan Chase has been investing heavily in automation technologies to streamline its operations and reduce costs. The bank uses machine learning algorithms to analyze data and automate compliance processes, reducing the time and effort required to complete them. Wells Fargo has also been using automation technologies to optimize its operations. The bank has implemented robotic process automation to automate data entry and reconciliation processes, reducing manual errors and improving efficiency. Similarly, American Express has been using machine learning algorithms to analyze customer data and automate credit risk assessments. This has reduced the time taken to complete these assessments while improving accuracy and consistency.

Benefits of Automation and Process Optimization

Automation and process optimization offers several benefits to banks and financial organizations. These include:

- Improved Efficiency: The amount of time and resources needed to complete tasks can be significantly decreased through automation and process optimization. Employees may have more time to devote to higher-value tasks as a result, increasing productivity and efficiency.

- Increased Accuracy and Consistency: Automation can lower error risk significantly and increase process consistency.

- Cost Reduction: Automation can reduce the need for manual labor, leading to significant cost savings for banks and financial organizations. This could free up funds for spending on the company’s expansion and other initiatives, like innovation.

- Better Decision Making: Automation can provide real-time insights into business operations, enabling banks and financial organizations to make informed decisions quickly.

It is essential for banks and financial organizations to embrace digital transformation agency and take advantage of the benefits it offers.

Enhanced Customer Experience

The shift towards digitalization has transformed the way banks and financial organizations interact with their customers. This section will explore how digital transformation solutions improve customer experience, provide examples of US banks and financial organizations leveraging digital transformation, and highlight the benefits of enhanced customer experience.

How does Digital Transformation Enhance Customer Experience?

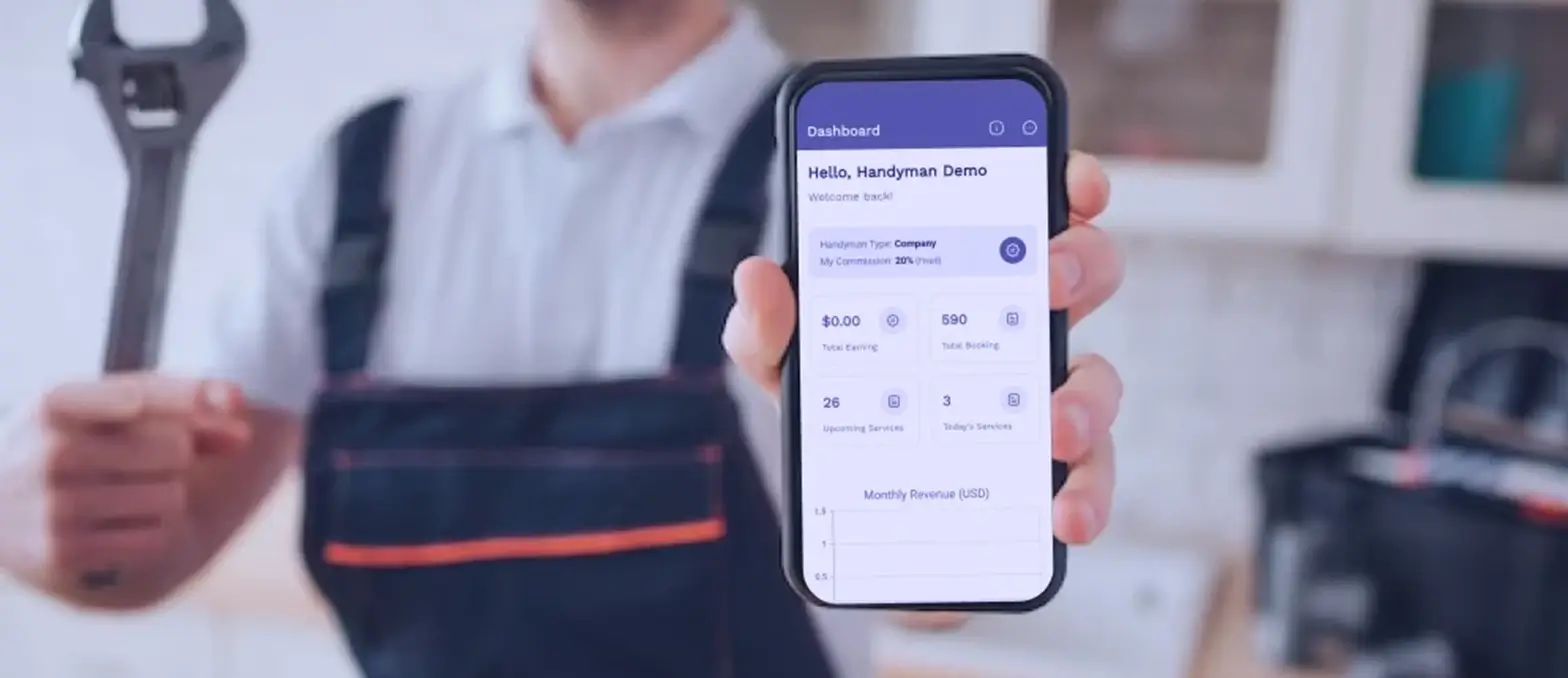

Digital transformation enables banks and financial organizations to provide personalized and seamless experiences to their customers. By leveraging technology such as mobile apps, chatbots, and artificial intelligence (AI), financial institutions can provide round-the-clock services that cater to their customers’ needs. Digital transformation also allows customers to access their financial information and conduct transactions at their convenience, eliminating the need to visit physical branches during business hours.

Moreover, digital transformation solutions can enable banks and financial organizations to offer more customized products and services to their customers. By analyzing customer data, financial institutions can gain insights into their customers’ preferences and needs, allowing them to create tailored products and services that meet those specific requirements. This not only enhances the customer experience but also helps banks and financial organizations build stronger relationships with their customers.

Examples

The following are some examples of how US banks and financial organizations are using digital transformation to improve customer experience:

JPMorgan Chase & Co. has developed a digital banking platform that allows customers to conduct transactions, access their account information, and manage their finances through their mobile devices. The platform provides real-time alerts, personalized financial advice, and customized offers based on the customer’s spending patterns. Capital One has developed a chatbot called Eno that uses AI to provide personalized financial advice to customers. Customers can also use Eno to manage their accounts, make payments on bills, and keep an eye on their spending. Wells Fargo has implemented a mobile app that enables customers to access their accounts, deposit checks, and transfer money between accounts. To keep users updated on account activity, the app also offers real-time alerts and notifications.

Benefits of Enhanced Customer Experience

A better customer experience has numerous advantages. Banks and financial institutions can foster brand loyalty and boost customer retention by offering personalized and seamless experiences to their clients. Furthermore, satisfied customers are more likely to recommend their banks and financial institutions to their family and friends, helping to attract new customers. Moreover, by leveraging customer data to provide tailored products and services, banks and financial organizations can increase revenue and profitability. These solutions also enable financial institutions to reduce costs by automating routine tasks and improving operational efficiency. These solutions are revolutionizing the financial services industry by enhancing customer experience. This not only builds brand loyalty and increases customer retention but also helps to attract new customers.

Data-Driven Insights and Decision-Making

Banks and financial institutions can use the power of big data and analytics to gain insightful data that can guide their business strategies and decision-making by implementing these transformation solutions.

Digital technology must be incorporated into every aspect of a business, including data collection, storage, and analysis. This allows banks and financial organizations to gather and analyze large volumes of data in real time, enabling them to make informed decisions and stay ahead of the competition. By utilizing data-driven insights, banks, and financial institutions can improve customer service, increase operational efficiency, and identify new business opportunities. Through these transformation solutions, data can be analyzed in real-time, which allows for quicker and more accurate decision-making.

Examples

One example of how US banks are leveraging data to make informed decisions is through the use of predictive analytics. By analyzing customer data, banks can identify trends and predict future behavior, allowing them to tailor their products and services to meet the needs of their customers. By analyzing enormous amounts of data and spotting patterns that might point to fraud, machine learning algorithms enable banks to stop fraudulent transactions and safeguard their customers.

Benefits of data-driven insights and decision-making

Implementing these transformation solutions and utilizing data-driven insights can provide numerous benefits for banks and financial organizations. Some of these benefits include:

- Improved customer service: By analyzing customer data, banks can gain insights into their customer’s needs and preferences, allowing them to provide personalized service and tailored products that meet their customers’ needs.

- Increased efficiency: These transformation solutions can automate many tasks and processes, reducing the time and resources required to perform them. Costs may be decreased while operational efficiency is increased.

- Better risk management: By analyzing data in real time, banks can identify potential risks and respond quickly to mitigate them, reducing the likelihood of losses and improving overall risk management.

- Enhanced decision-making: Data-driven insights can provide banks and financial organizations with valuable information that can inform their business strategies and decision-making processes. Better decisions may result from this, which increases the likelihood of successful outcomes.

- Competitive advantage: By leveraging data to make informed decisions, banks, and financial institutions can gain a competitive advantage in the market. They can identify new business opportunities, improve their products and services, and respond quickly to changing market conditions.

By implementing these transformation solutions, banks can improve customer service, increase operational efficiency, and gain a competitive advantage in the market.

Increased Efficiency and Cost Reduction

Digital transformation has revolutionized the way that banks and financial organizations operate, enabling them to become more efficient and reduce costs in a multitude of ways. In this section, we will discuss how digital transformation is driving increased efficiency and cost reduction, provide examples of how US banks and financial organizations are using digital transformation to achieve these benefits, and highlight the advantages of implementing digital transformation strategies.

How digital transformation increases efficiency and reduces costs?

Employees can now concentrate on more crucial tasks like customer service and strategic planning because automation lessens the need for manual intervention in routine tasks. With real-time data insights, organizations can respond quickly to market changes and adapt their strategies accordingly, reducing the risk of losses and increasing profitability.

Examples

Bank of America is one example of a US bank that has embraced digital transformation to increase efficiency and reduce costs. The bank introduced Erica, its virtual assistant, in 2018. Erica uses artificial intelligence to give customers individualized financial advice. By providing a self-service option for simple transactions, Bank of America has been able to reduce the workload of its employees, freeing them up to focus on more complex tasks.

Another example is JPMorgan Chase, which has implemented robotic process automation (RPA) to automate routine tasks such as data entry and processing. This has allowed the bank to reduce errors and improve the efficiency of its operations, ultimately leading to significant cost savings.

Benefits of increased efficiency and cost reduction

Implementing digital transformation strategies to increase efficiency and reduce costs provides a range of benefits for banks and financial organizations. These benefits include:

- Improved customer experience: By automating routine tasks, financial organizations can free up employees to focus on providing a better customer experience.

- Faster time-to-market: By streamlining workflows, organizations can bring new products and services to market more quickly, giving them a competitive advantage.

- Increased profitability: By leveraging data insights to make more informed decisions, organizations can increase profitability and minimize losses.

- Improved compliance: Financial institutions can comply with regulatory requirements more quickly and easily due to digital transformation, which lowers their risk of fines and other penalties.

Custom mobile app development services can also help financial institutions to stay ahead of the curve by providing innovative solutions that enhance the customer experience and improve efficiency. Banks and other financial institutions can set themselves up for future success by embracing digital transformation.

Competitive Pressure and Staying Relevant

The rise of fintech companies and the increasing demand for digital banking services has put pressure on traditional banks to adapt and modernize their operations. One of the key drivers for digital transformation in US banks and financial organizations is the need to stay ahead of the competition. In this section, we will explore how digital transformation can help banks and financial organizations stay competitive and relevant, provide examples of how US banks and financial organizations are using digital transformation to their advantage, and discuss the benefits of staying competitive and relevant.

Banks & Financial Organizations Benefit from Digital Transformation

By adopting new technologies and modernizing their operations, banks can improve their agility, responsiveness, and efficiency. They can also gain a better understanding of their customers and their needs, which can help them develop more targeted and personalized products and services. Digital transformation can help banks and financial organizations stay competitive and relevant in several ways. One of the main advantages is that it enables them to provide their customers with a wider range of goods and services. By leveraging new technologies, such as mobile apps and online platforms, banks can provide their customers with convenient and seamless access to a range of financial products and services, including banking, lending, insurance, and investments.

Another way that digital transformation can help banks and financial organizations stay competitive and relevant is by improving their customer engagement and loyalty. Banks can strengthen their relationships with their customers and raise customer satisfaction and loyalty by offering them personalized experiences and tailored recommendations. Digital transformation can also help banks and financial organizations stay ahead of the curve when it comes to compliance and regulatory requirements. By automating compliance processes and leveraging data analytics, banks can ensure that they are complying with regulations and mitigating risks in a more efficient and effective way.

Examples

Many US banks and financial organizations are already leveraging digital transformation to stay ahead of the competition. For example, JPMorgan Chase has made significant investments in projects related to the digital transition, including smartphone banking and electronic payments. With over 50 million downloads, the bank’s mobile app has grown to become one of the most well-liked in the nation. The app makes banking more convenient and accessible by enabling users to manage their accounts, deposit checks, and make payments from their mobile devices.

Another example of a US bank that has embraced digital transformation is Bank of America. The bank has invested in a range of digital solutions, such as chatbots and voice assistants, to improve customer engagement and provide more personalized experiences. Bank of America has also launched a number of mobile apps, such as Merrill Edge and Erica, to help customers manage their finances more effectively.

Benefits of Staying Competitive and Relevant

By staying ahead of the competition, banks and financial organizations can attract and retain customers, increase revenue, and improve their bottom line. They can also gain a better understanding of their customer’s needs and preferences, which can help them develop more targeted and effective marketing campaigns. By adopting new technologies and modernizing their operations, banks can improve their ability to detect and prevent fraudulent activities, as well as ensure that they are complying with regulations and guidelines. Furthermore, staying competitive and relevant can help banks and financial organizations to attract and retain top talent. In today’s digital age, many employees are looking for employers that are innovative, progressive, and forward-thinking by embracing digital transformation and investing in new technologies, banks, and finance.

Regulatory Compliance and Risk Management

As banks and financial institutions continue to adopt digital transformation, regulatory compliance, and risk management have become increasingly critical areas for these institutions to focus on. Digital transformation can help financial institutions to comply with regulations while simultaneously managing risk more effectively. This section will explore how digital transformation is enabling financial institutions to manage risk and comply with regulations, with examples from US banks and financial organizations.

How does Digital Transformation help with Regulatory Compliance and Risk Management?

Digital transformation enables financial institutions to automate compliance activities, reducing the time, cost, and resources required to comply with regulations. Automation can help with activities such as monitoring transactions for fraud, verifying the identities of customers, and tracking suspicious activities. Digital transformation enables financial institutions to monitor transactions in real time, identifying potential risks or compliance issues before they become problems. This can be done through the use of real-time alerts and notifications, which can be customized to meet specific requirements.

Examples

Wells Fargo has implemented a digital transformation program to improve its regulatory compliance and risk management capabilities. The bank has implemented a number of tools and technologies to automate compliance activities, including transaction monitoring and identity verification. It has also invested in data analytics and artificial intelligence to improve its ability to detect and prevent fraud. Additionally, the bank has implemented advanced cybersecurity measures to protect against cyber threats.

Capital One has implemented a digital transformation program to improve its regulatory compliance and risk management capabilities. The bank has invested in data analytics and artificial intelligence to improve its ability to detect and prevent fraud. It has also implemented a real-time monitoring system that can identify potential compliance issues before they become problems. Additionally, the bank has implemented advanced cybersecurity measures to protect against cyber threats.

Benefits of Regulatory Compliance and Risk Management

- Improved Compliance: Digital transformation enables financial institutions to comply with regulations more effectively, reducing the risk of regulatory fines and penalties. Automated compliance activities can reduce the time and resources required to comply with regulations, allowing financial institutions to focus on other key areas.

- Enhanced Risk Management: Digital transformation enables financial institutions to manage risk more effectively, reducing the risk of financial loss or reputational damage. Real-time monitoring and alerts can help financial institutions to identify potential risks or compliance issues before they become problems.

Conclusion

For banks and other financial institutions in the US, digital transformation has become essential. By partnering with a reputable React Native App Development Company, banks, and financial organizations can develop custom mobile applications that meet the unique needs of their customers and employees, enhance their data management and decision-making capabilities, and streamline their operations to reduce costs and improve efficiency.

The potential benefits of digital transformation for banks and financial organizations are numerous, including improved customer experience, increased profitability, reduced risk and regulatory compliance, and better insights and decision-making capabilities. As the industry continues to evolve, it is essential for these organizations to stay ahead of the curve and embrace digital transformation to remain competitive.

In the future, we expect to see continued innovation and advancements in digital transformation technologies, particularly in the areas of artificial intelligence, machine learning, and data analytics. Banks and financial organizations that embrace these technologies and partner with fintech software developers will be well-positioned to thrive in the years ahead. So, it is high time to hire fintech software developers through A3logics and embrace digital transformation to stay ahead of the competition and remain relevant in the ever-changing banking and financial industry.

FAQ’s

Q: What is digital transformation?

A: The term “digital transformation” refers to the process of integrating digital technology into all facets of an organization’s operations, which has a profound impact on how the organization functions and provides value to its customers.

Q: Why is digital transformation important for banks and financial organizations?

A: Digital transformation is crucial for banks and financial organizations to stay competitive and relevant in today’s digital age. By leveraging digital technology, these organizations can improve efficiency, enhance customer experience, and make better data-driven decisions, among other benefits.

Q: What specific instances of the finance sector’s digital transformation come to mind?

A: Examples of digital transformation in the banking industry include mobile banking apps, online account management portals, and automated loan underwriting processes.

Q: What advantages can banks and other financial institutions anticipate from digitalization?

A: Benefits of digital transformation for banks and financial organizations include increased efficiency, cost reduction, enhanced customer experience, improved data-driven decision-making, and staying competitive and relevant.

Q: How can a digital transformation agency help banks and financial organizations with their digital transformation efforts?

A: A digital transformation agency can provide expertise and support throughout the digital transformation process, including identifying opportunities for improvement, developing and implementing digital solutions, and managing change within the organization.

Q: What are the prospects for the banking sector’s digital transformation in the future?

A: The pace of digital transformation in the banking industry is expected to accelerate in the coming years, driven by advancements in technology and increasing customer demand for digital solutions. The adoption of digital transformation by banks and other financial institutions will probably give them a competitive edge over those that do not.