Table of Contents

In today’s quick-moving world, managing money flexibly is key. This is why cash advance apps like Empower are valuable. They help people who need money right away. These apps are a big step forward for companies that create financial tech apps. They’re a refreshing change from the old way banks work.

One great thing about these apps is how easy they are to use. They’re made for everyone, making it simple to get financial help without all the usual bank complications. Cash advance apps open financial aid to more people, helping them manage their money better, even in tough times. A recent analysis by Overdraft Apps indicates that the cost for consumers using cash advance applications has increased over the last six months.

Empower and Why It Matters

Empower stands out because it does more than give you early access to your money. It also helps you track your spending, gives financial advice, and offers tips. This all-around approach allows users not just to get by but also to understand and improve their financial health.

Apps like Empower Cash Advance are leaders in the field, showing how financial tech can change how we handle our money. The people behind Empower, a fintech app development company, have used technology to create financial solutions that are more welcoming, simple, and available immediately.

The arrival of cash advance apps has changed how we deal with money urgencies and plan our finances. Empower is a prime example of the creativity of financial tech app companies, pointing to a future where financial health is possible for all.

What are Cash Advance Apps?

Cash Advance Apps like Empower have transformed personal finance handling, bringing ease, efficiency, and reach previously unimaginable. Let’s explore what cash advance apps are, their functionality, and the significant impact of fintech on personal finance evolution.

Cash advance applications, like Empower, are digital services that provide users with a portion of their next salary or deposit in advance. They link to your bank account, examine your earning and spending habits, and offer an advance based on your earnings. Unlike traditional lending, these apps usually don’t charge interest but might have a subscription cost or suggest a tip for their services.

The process is simple: sign up, connect your bank, and request an advance. Approval leads to funds being quickly sent to your account, often in a day. This swift access to cash is crucial for many, aiding in urgent expense coverage till the next payday arrives.

Fintech’s Surge and Its Influence on Personal Finance

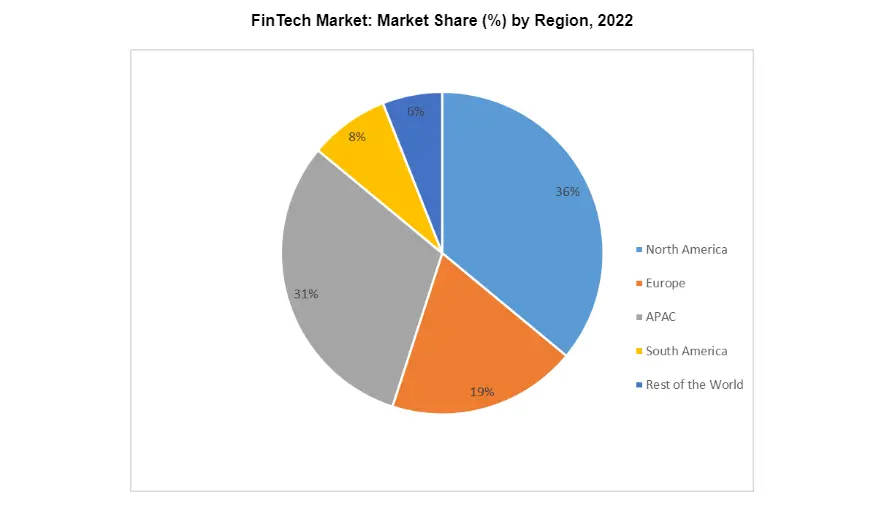

The fintech, or financial technology, boom has drastically altered financial service delivery and usage. Fintech app developers use top-notch technology to craft more approachable, user-friendly, and efficient solutions than traditional banking offerings. The push for digital-first service adaptation has led many to engage fintech app developers to innovate and fulfill these expectations.

Fintech has deeply impacted personal finance, with cash advance apps as a leading illustration. These platforms make financial services accessible, especially to those underserved by traditional banking. They offer a flexible, prompt, and less harsh short-term borrowing option, shaking up the conventional payday loan and overdraft fee landscape.

23% of Americans have utilized Buy Now, Pay Later (BNPL) services or transferred money through social media platforms.

The FinTech industry is projected to grow to $851 billion by 2030, with a compound annual growth rate (CAGR) of 18.5% throughout the forecast period from 2023 to 2030.

These figures underline the escalating reliance on fintech solutions like cash advance apps and their beneficial influence on consumer financial health. They preview a future where financial services align more with the needs and expectations of a tech-savvy audience.

The ascent of fintech and its flagship offerings, such as cash advance apps, has overhauled personal finance management. Cash Advance Apps like Empower, expected to be among the best cash advance apps 2025, mark a shift towards more inclusive, responsive, and consumer-focused financial services. With ongoing industry evolution, the emphasis on innovation and consumer empowerment hints at a bright future for personal finance, where financial resource access is clear, transparent, and personalized.

In summary, grasping the essence of cash advance apps and their place in the wider fintech ecosystem is key for anyone aiming to demystify the intricacies of contemporary personal finance.

The Pros of Cash Advance Apps Like Empower

Immediate Financial Assistance

One of the top perks of cash advance apps like Empower is their fast response. If unexpected bills hit you, these apps can provide money swiftly. This quickness is a lifeline, avoiding late fees or helping you manage until your next paycheck. Traditional banks can’t match this speed, often taking much longer to approve loans.

Low to No Interest Features

A big worry when borrowing is the interest. Many cash advance apps offer a big advantage, with low or no interest. This starkly contrasts the high rates of credit cards and payday loans. For those needing short-term help, these apps are a breath of fresh air, ensuring you don’t fall into a debt trap.

Easy Application Process

Getting started with these apps is usually very easy. They require just a bit of your info and a few clicks on your smartphone. This simplicity reflects the goal of an on demand app development company to make financial help widely available. Unlike the complex process at traditional banks, these apps make it easy to get the help you need fast.

Budgeting and Financial Management Tools

Cash advance apps like Empower offer more than just quick cash. They come with these tools. These can show you where your money goes, help you set goals, and give you personal finance advice. This approach, championed by mobile app development companies in the USA and beyond, offers long-term solutions for financial wellness, not just short-term fixes.

Flexibility in Repayment

Another concern when borrowing is how you’ll pay back the money. Cash advance apps like Cleo shine here, too, with flexible payback plans. You can often choose to repay on your next payday or through installments. This flexibility is a big change from traditional loans, which have strict payback rules and can hurt your credit score if you’re not careful.

Cash advance apps are reshaping how we handle short-term financial needs. They offer rapid help, cost-effective borrowing, easy access, budgeting tools, and flexible repayment. Behind these platforms are on-demand app development companies, driving innovation and making financial services more accessible. Cash advance apps like Empower and Cleo are at the forefront, offering inclusive and innovative solutions.

The Cons of Cash Advance Apps Like Empower

Cash advance apps like Empower have grown popular, giving quick money when finances are tight.

Potential for Misuse and Overdependence

A big worry with cash advance apps is that it’s easy to start relying on them too much. If we’re not careful, we could end up in a cycle where we’re always behind, using these apps for everyday expenses. This could hide real issues like not budgeting well or spending more than we make. It’s important to keep an eye on this to stay financially healthy in the long run.

Fees and Subscription Costs

Even though cash advance apps often say they’re free or cheap, fees are usually involved. Some apps might charge a monthly fee, ask for a tip, or have charges for quick transfers. These fees can add up. Knowing about these fees is crucial to deciding if an instant cash advance app is right for you without spending too much.

Privacy Concerns

Keeping our personal and financial info safe is vital in today’s digital world. Cash advance apps must access our bank accounts and spending habits to work. Make sure you pick an app from a top mobile app development company in the US that’s clear about how they keep your data safe. Always read the privacy policy to be sure your information isn’t shared without your consent.

Impact on Financial Habits

These apps can make it too easy to avoid dealing with money problems directly. Instead of fixing the root problem, like overspending or not saving enough, there’s a temptation just to use these free instant cash advance apps. This could stop us from learning important money skills like budgeting and saving.

Cash Advance Apps like Dave have changed how we handle our finances, offering convenience that banks can’t match. But it’s wise to be cautious. Be aware of the potential for misuse, hidden fees, privacy concerns, and how they might impact your financial habits.

Before using these apps regularly, consider them a last option, not your go-to solution. And do your homework. Look at different apps, especially those made by a reputable iOS app development agency known for caring about privacy and security. This way, you can make choices that fit your financial goals and values, ensuring these apps help rather than complicate your financial life.

Choosing the Right Cash Advance App

Picking the right cash advance app is key in a world where managing your money flexibly is a must. Many options exist, including cash advance apps like Empower and various instant cash advance apps.

Factors to Consider When Selecting an App

A few important things stand out when looking through all the cash advance apps. First, you want an app you can trust. Check out its reviews, how the Better Business Bureau rates it, and what current users say. You share important financial info with this app, so trust is huge.

Next, look at fees and interest rates. Even though many apps say they have low or no fees, that might not be the whole story. Some might have a monthly fee or charge you for quick money transfers. Knowing the fees is important so you’re not caught off guard.

The app developed by a custom app development agency should also be easy to use. You should be able to ask for money, check what you owe, and use any money management tools hassle-free. Plus, you should be able to do all this on any device, anywhere.

Finally, how fast the app gets you your money matters a lot. If you’re in a tight spot, waiting a long time for the funds to show up is the last thing you need.

Features to Compare

As you decide, there are some features to look closely at that will help you tell the best apps from the rest. One key feature is how much money you can get in advance. Depending on your need, you might want an app that can give you a lot at once. Apps differ a lot here.

Knowing how flexible they are about paying the money back is also important. The best apps let you adjust when you pay back based on when you get paid. This makes it easier to handle without stressing your budget.

Good customer support is another must-have. If something goes wrong or you have questions, reaching someone who can help is vital.

Finding the best buy now pay later apps means looking at what each offers and how it matches your needs. Whether you’re drawn to cash advance apps like Empower for their full range of money management tools or just need quick access to cash, your choice should fit your financial life. Considering the points we’ve covered, you can pick an app that’s right for you, aiming to meet your immediate money needs and support your overall financial health.

Regulatory Landscape for Cash Advance Apps

In a world buzzing with financial tech, cash advance apps that work with Cash App are growing fast. Cash Advance Apps like Empower have become go-to solutions for quick financial help. Yet, as they become more common, knowing their rules is crucial. This helps us see how safe these apps are and what future app-making might look like.

What Rules Are There?

The rules for cash advance services mix laws from the U.S. government and individual states. They aim to keep things fair for users and let new ideas flourish. The Consumer Financial Protection Bureau (CFPB) is a big player at the federal level. It watches over financial services, ensuring they’re open about costs and fair to users.

State rules can differ greatly. Some states are strict about fees and the amount of interest that can be charged, while others are more relaxed. These differences affect which apps you can use and how they work. For creators and an Android app development agency, knowing and following these rules is key to operating smoothly everywhere.

How Do These Rules Affect Apps and Their Users?

Rules shape how cash advance apps like Empower feel and work for us. They push apps to be clear about fees, how much interest you’ll pay, and when you need to pay back. This honesty is important for trust and making smart money choices.

Also, these rules can limit what the app can do—like how much money it can lend you and the conditions. This is to stop unfair lending that could hurt users. For the teams behind the best cash advance apps of 2025, working within these rules while still being innovative is a fine line to walk. They might link up with services like Cash App or device smart ways to lend money safely without a traditional credit check.

Rules also play a big role in whether new or current apps can grow. Staying up-to-date with the law is both a challenge and a chance to find new ways to help users. For those developing apps, especially on Android, being quick to adjust and savvy about rules is crucial.

The rule book for cash advance apps like Empower is always being written. It’s a balance between keeping users safe and letting new ideas bloom. For app makers and fintech companies, understanding and following these rules is not just about avoiding trouble—it’s also about creating safe, clear, and user-friendly apps. For us users, these apps can be a trusted way to manage our money in tight spots. Watching how fintech grows with these rules will be interesting in the years ahead.

Comparison with Traditional Banking Solutions

Today, managing money is seeing a big shift with cash advance apps like Empower. These apps are changing how we get money when we need it quickly, offering a fresh alternative to the old ways of banking. Let’s explain how these banking app development options stack up against traditional bank loans and why old-school banks are still important.

The Big Differences

- Access and Speed: Cash advance apps shine with easy access and quick help. They skip the long wait and tough paperwork you find at banks. Instead, they give you what you need quickly, often right when you ask.

- Credit Checks: Unlike banks, which monitor your credit score closely, many cash advance apps don’t. This opens doors for more people, especially if your credit score isn’t top-notch.

- Costs: Legit cash advance apps often avoid the high interest of bank loans. Some might have fees, but they’re usually not as steep as those for a traditional loan.

- Paying It Back: These apps aim to simplify repayment, lining it up with your next paycheck. This is a big change from bank loans that can stretch over the years.

Why Traditional Banks Still Matter

Despite the buzz around fintech, traditional banks hold their ground for several reasons:

- Safety and Trust: Banks have built a solid reputation over the years. Many people find comfort in dealing with established names, especially for big financial moves or long-term planning.

- More Than Just Loans: Banks cover all bases, offering everything from advice on investing to help with retirement plans. They’re a one-stop shop for a wide array of financial needs.

- Staying Current: Banks aren’t just sitting back. They’re bringing new ideas, Apps like Zelle for instant payments, mixing tried-and-true banking with today’s tech.

- Joining Forces with Fintech: Banks and a custom mobile app development company are teaming up. This means banks can introduce innovative tools and apps into their lineup, combining their reliability with the convenience of new tech.

The world of finance is evolving, with cash advance apps and banks finding their unique spots. Cash advance Apps like Empower offer a fast, easy option for short-term needs, while banks provide a broad, secure base for all financial matters. Looking ahead, it’s all about choices—finding the right mix of modern convenience and traditional security to fit your financial life.

Future of Financial Assistance Apps

The world of cash advance apps like Empower is changing fast. Apps that give you cash advances are becoming more than quick fixes when you’re short on money. They’re growing into tools to help you manage your money better, keep it safe, and make dealing with money easier.

What’s Coming Next for These Apps?

- Smarter Apps with AI: Imagine apps that know just what you need. They’re getting smarter, using AI to offer custom cash advances and repayment plans that fit your spending and saving habits.

- Blockchain for Safety: Keeping your money safe is a big deal. Future apps might use blockchain, behind Bitcoin, to ensure every transaction is secure. This means less chance of fraud and more peace of mind for you.

- Working with Rules: As these apps grow, custom mobile app development services work more closely with laws and rules to ensure everything’s fair and safe. This means finding smart ways to keep innovating while ensuring you’re protected.

Emerging Technologies and Their Potential Impact

- Voice Technology and Chatbots: Future apps might let you use your voice to manage your money. Need a cash advance or want to check your balance? Just ask out loud.

- Wearable Technology Integration: Imagine getting updates about your loan or reminders to pay back right on your smartwatch. This could make keeping track of your money super convenient.

- Cryptocurrency Advances: Some apps might start offering advances in cryptocurrencies like Bitcoin. This could be a game-changer for people who prefer using digital currencies.

- Cross-Platform Services: Look out for cash advance apps like PayPal. This could make moving your money around much easier enhancing user convenience and expanding the utility of the payday cash advance app.

The future looks bright for cash advance apps like Empower, with new tech and ideas for making managing your money easier and safer. These changes aren’t just about getting cash fast—they’re about making a real difference in your financial health. For anyone creating these apps, staying ahead of these trends will be key to making apps that help people.

Conclusion

In the rush of today’s life, having tools that match our fast-paced financial needs is crucial. Cash advance apps like Empower have become essential for quick monetary help without stress. But, like all financial tools, they have their ups and downs, which are worth weighing carefully.

The Ups and Downs

The perks of these apps are clear. They jump in to save the day when money gets tight unexpectedly, offering a much-needed bridge without the hefty costs tied to usual credit options. Their simple use means support is just a few taps away, breaking down access barriers. These apps don’t just lend money; they often come with budgeting tools to help users better grip their finances, encouraging smarter financial choices. Their flexible payback approaches let users manage their cash advances in stride with their financial rhythm.

Yet, it’s not all smooth sailing. The ease of accessing cash can tempt users into a loop of dependency, especially if it’s for daily expenses, which can spiral into a tricky financial cycle. While the apps might boast low fees, they’re not always zero—these costs can pile up, particularly for those who lean on these services often. Privacy is another big watch-out; how these apps handle and safeguard personal info needs careful eyeing. Moreover, there’s a worry these apps could nudge users toward shaky financial planning by offering an easy fix to deeper money issues.

Smart Use of Cash Advance Apps

Using them wisely is the trick to making the most of cash advance apps. These platforms are best as backups, not a go-to for constant financial hiccups. Knowing your financial landscape well and saving these apps for emergencies is key.

Doing your homework before picking an app is also vital. Look into any fees, read up on their privacy commitments, and sift through user feedback. Choosing apps that value transparency and user safety is a must. Tapping into these apps’ budgeting features can help carve out a healthier money path, nudging users towards better saving and spending habits.

As we look ahead, cash advance apps’ place in personal finance only seems to be getting bigger, thanks to ongoing fintech innovations. This opens up great chances for users to handle financial surprises more smoothly. Yet, this convenience comes with the call to use these services sensibly, aiming to boost one’s monetary wellness.

For anyone eyeing a Payday Advance Apps, the advice is straightforward: tread carefully, keep smart money management focused, and use this opportunity to stride towards a stable financial future. If immediate financial help is what you’re after, remember that these apps can be a quick fix, but solid financial footing and independence should be the end game.

Ready to steer your financial path forward? Begin with A3Logics by exploring your options and making choices that lay the groundwork for a financially secure tomorrow.

FAQs

What exactly are these cash advance apps like Empower?

Cash advance apps are like your financial buddies on your phone. They let you borrow a bit of cash before your paycheck arrives. Unlike the old-school loan process, these apps quickly lend a hand, with fewer hoops to jump through, making them perfect for urgent money needs.

Will they tattle on me to credit agencies?

Mostly, no. Using these apps is like a quiet deal between friends; it doesn’t get shouted out to everyone. However, be smart about it. If you’re not careful and your bank account gets too low to cover the repayment, it could indirectly affect your financial reputation.

How quickly can I get help?

Super quick! Many apps offer help almost instantly, like a friend always there when you need them. This speed can be a game-changer for sudden expenses.

Are there any downsides?

Yes, and it’s important to be aware. Relying too much on these apps can lead you into a cycle of needing them for regular expenses, which isn’t ideal. They’re great for the occasional rescue but shouldn’t become a monthly habit.

Picking the best app – how do I do it?

Choosing the right app is like finding a good friend. Look for one that is well-spoken of by others, transparent about any help they expect in return (like fees), and genuinely interested in your financial well-being, offering tools to manage your money better.

![How to Create Your Own AI Crypto Trading Bot? [Step-by-Step Guide]](https://www.a3logics.com/wp-content/uploads/2025/03/How-to-Create-Your-Own-AI-Crypto-Trading-Bot.jpg)