Table of Contents

Buy Now Pay Later apps make shopping more flexible. You can immediately purchase and pay for items over time, often with no interest. This makes things more affordable and helps shoppers manage their money better. For businesses, BNPL apps mean larger orders and happier customers.

Successful example for Buy Now Pay Later apps like Klarna. They’ve made payments more accessible for millions of customers. Their app is secure, easy to use, and offers various payment plans. If you’re an on demand app development company looking to build a BNPL solution, Klarna sets a high standard. Their success proves that people want simple, customer-focused financial tools.

Why Buy Now Pay Later Apps Matter

Buy Now Pay Later apps are a big deal for today’s economy. Here’s why they matter for shoppers and businesses:

- Shoppers: BNPL makes buying easier and less stressful.

- Businesses: BNPL encourages spending, leading to bigger orders and more loyal customers.

- The Economy: BNPL apps boost spending, especially in online shopping and retail, which helps the overall economy.

Businesses that offer BNPL options often see 20-30% larger orders. This highlights the power of flexible payments.

In Summary, Buy Now Pay Later apps like Klarna are changing how we pay for things. They offer more choice and control.

What are BNPL Apps?

They’re changing the finance industry. By making financial services accessible, they promote financial inclusion. Buy Now Pay Later apps also pressure banks and credit card companies to offer better, more innovative services.

From the enterprise mobile application development standpoint, BNPL apps are part of a greater trend: integrating financial solutions into our everyday digital experiences.

The popularity of Buy Now Pay Later apps has also sparked interest in related technologies like P2P money transfer apps.

The Market Landscape for Buy Now Pay Later Apps in 2025

Current BNPL Market Trends

Today’s BNPL trends show how people’s attitudes towards money are shifting. There’s a major move towards digital payment methods, and Buy Now Pay Later apps are leading the way. In 2025, EMARKETER projects that 93.3 million consumers in the US will utilize Buy Now, Pay Later (BNPL) services. The number of users is expected to grow yearly until 2027, but the growth rate will slow down because of rising competition.

The market is also expanding. Buy now, pay later apps in the USA and worldwide are moving beyond online shopping and entering industries like healthcare, travel, and education.

Lastly, mobile-first solutions are becoming crucial. iOS app development companies and Android teams ensure that Buy Now Pay Later apps work seamlessly on phones. This focus on mobile access and convenience is driving growth and adoption.

Key Players Like Klarna: Their Advantage

Klarna and other top BNPL companies are setting industry standards. Their app offers quick approval, flexible plans, and clear fees. This service will shape the Best Buy Now Pay Later Apps of 2025.

Top companies also invest heavily in technology to protect user data and prevent fraud. This is crucial, given the financial nature of their apps. Their success depends on building trust with users.

Key players further stand out through partnerships with retailers and strong marketing. This ensures they stay at the top of people’s minds when considering BNPL options. Staying adaptable and innovative helps them stay competitive.

What’s Next for BNPL Apps

The BNPL market will continue to grow and change. One likely trend is that BNPL services will be further integrated into our financial lives. This might mean features like budgeting tools, financial advice, and loyalty programs. Users want more than just payment plans; they want complete financial services.

BNPL offerings will also likely become more diverse, with options tailored for specific groups or industries (even business-to-business transactions). This means we’ll see specialized BNPL solutions that address unique market needs.

Technology remains central. Fintech app development companies will explore using AI and machine learning to improve personalization and risk assessment. This focus on technology will both enhance the user experience and improve the long-term sustainability of BNPL services.

Why Develop a Buy Now Pay Later App in 2025?

Market Demand and Changing Consumer Preferences

Buy Now Pay Later apps perfectly meet these needs. They let people spread the cost of purchases over time without the fees of traditional credit.

With online shopping booming, consumers seek convenient and budget-friendly financial tools. A BNPL app gives them exactly this, targeting a large audience seeking alternatives to loans and credit cards. It’s about more than just buying things; it’s about fitting into modern financial habits.

Financial and Business Benefits

From a business standpoint, launching a BNPL app in 2025 brings major benefits. Apps like Klarna have shown that BNPL boosts average order values and sales conversion rates. This makes sense – people are more likely to buy when they have flexible payment options.

Competitive Advantages in the Fintech Space

Entering the BNPL market will give you a strong competitive edge. If you’re an enterprise mobile app development company wanting to make waves in fintech, a BNPL app positions you at the forefront.

Buy Now Pay Later apps have a unique selling point in the crowded fintech industry. They directly solve consumers’ needs for flexible credit options and financial tools. You can carve out a strong niche that appeals to many people. This is especially true with consumers increasingly searching for the best cash advance apps in 2025. This trend shows people want tools that help them manage their money.

Finally, developing a BNPL service lets you leverage data analysis and AI for personalized financial options. This technology helps tailor payment plans to each user, leading to better experiences and outcomes.

For businesses and enterprise mobile app development companies that want to stand out in fintech, BNPL services are an amazing opportunity. With the right approach, these apps can meet today’s needs and pave the way for future financial solutions that put flexibility, inclusion, and user experience first.

Key Features of Successful Buy Now Pay Later Apps

User-Friendly Interface: The Key to Adoption

A BNPL app’s first impression is its interface. A user-friendly design is vital for easy navigation. This means a clear layout, simple instructions, and a smooth setup process for new users. Apps like Klarna excel here – their minimalist design aids the user experience without losing features.

Android app development companies building BNPL apps must ensure the design works well on various screens and devices. Features like one-tap payments, clear payment schedules, and order tracking make the app more appealing.

Security Features: Building User Trust

Trust is essential for any financial service, especially Buy Now Pay Later apps. Strong security is a must to protect user data and transactions. This includes full encryption, two-factor authentication, and frequent security checks.

Successful payment apps like Klarna also focus on transparency. They clearly explain how they use and store user data. This openness builds trust and encourages long-term use.

Flexible Payment Options: Meeting Diverse Needs

Top Buy Now Pay Later apps offer several payment plans. These plans should cater to different budgets. Options like early repayment, installment choice, or even pausing payments when needed add value.

The Best Buy Now Pay Later apps also allow financing for various purchases. This versatility makes them more useful to a wider audience.

Integration Capabilities: Expanding the App’s Use

Successful Buy Now Pay Later apps integrate seamlessly with stores’ payment systems, e-commerce sites, and potentially other financial apps. This ease of integration makes the BNPL service more attractive to merchants.

Linking with banking and money apps like Dave creates a more complete user experience. This allows users to manage multiple aspects of their finances in one place.

Successful Buy Now Pay Later app development needs a strong focus on user experience, security, flexibility, and integration. By nailing these key areas, BNPL services fill a real consumer need. They are a valuable alternative to traditional credit, showing the power of fintech to make financial services more accessible.

Step-by-Step Guide to Developing a BNPL App

Planning and Research

Understanding Your Target Audience

The first step in building a great BNPL app is knowing your target audience inside and out. What are their spending habits? How do they prefer to shop, and what financial challenges do they face? Are they looking for flexible payments or a way to avoid credit card debt? Tailoring your app’s features to these specific needs will significantly boost its appeal.

A custom mobile app development company often gathers this vital information through surveys, focus groups, and market research. This initial research is the foundation for a BNPL app that truly connects with users and solves their financial pain points.

Analyzing Competitors like Klarna

Competitor analysis is crucial in the BNPL market, where apps like Klarna set the bar high. Study what apps like Klarna do well and how they could improve. This analysis can help you find ways to stand out by offering more flexible payment options, lower fees, or support for a wider range of stores.

Pay attention to their app design, the user’s journey through the app, and the technologies used. Studying these aspects can teach you about best practices and what’s new in the industry.

Design and User Experience

Creating an Intuitive App Design

Design is critical for a BNPL app. The goal is a simple, attractive interface that’s easy to navigate for any user, regardless of their tech skills.

Partner with a custom mobile app development company experienced in UX/UI design. This will ensure your app looks great and functions smoothly. Incorporating feedback from user testing early in the design process further refines your app’s layout and features.

Ensuring a Seamless User Journey

A frictionless user journey is key to keeping users engaged. Everything should be easy and intuitive, from app download to their first purchase and beyond. This includes a simple onboarding process, accessible customer support, and clear communication about payment plans and terms.

Consider adding features beyond basic payments, such as personalized shopping ideas or spending trackers. Cleo Money App offers financial insights; similar features can enrich the BNPL experience.

Development and Testing

Test everything from payment processing and data encryption to how the interface performs under load.

Beta tester feedback is invaluable in catching any bugs missed in earlier testing. Continual testing and updates, even after launch, keep the app secure and in step with user needs and technology trends.

Building an app like Klarna takes a smart mix of research, user-centered design, and technical expertise. By knowing your audience, studying your competitors, focusing on design and user experience, and being rigorous in development and testing, you can create a BNPL app that meets today’s needs and sets a new standard in fintech.

Marketing Your BNPL App

Identifying Your Unique Selling Proposition (USP)

The first step is determining what makes your BNPL app stand out. Does your app offer something special – an innovative feature, the best customer support, or more flexible payment plans than others?

For example, if you offer rewards for on-time payments, highlight that! This can attract users who want more than just a payment solution. Your goal is to show why your app is the best choice. Top mobile app development companies in the USA often research the competition to help pinpoint your app’s unique strengths.

Effective Marketing Strategies for Fintech Apps

Content marketing can be especially effective. You build trust by creating informative articles and videos explaining how BNPL works and the benefits of using your specific app. Testimonials and case studies further boost your credibility.

Partner with e-commerce platforms or retailers. This increases exposure and introduces your BNPL as a direct payment option when it’s most relevant to shoppers.

As online shopping booms, a slew of new financial companies have sprung up that allow consumers to pay for items in interest-free installments, threatening the dominance of credit cards for e-commerce transactions. – Alexander Besant

Building a Loyal User Base Through Engagement

User engagement shouldn’t end when they download your app. Ongoing engagement builds loyalty. This includes personalized messaging, top-notch customer support, and regular updates that improve the user experience.

Loyalty programs and referral incentives help, too. Apps like Cash App use them to grow their user base.

Actively seek and respond to user feedback. This shows you value your users’ opinions and builds a sense of community. Custom app development services can help you add feedback features directly into your app.

To keep users engaged and interested, share new features, personal finance tips, or even industry news in emails, push notifications, or social media.

Marketing your BNPL app requires a strategy that highlights your USP, uses a mix of fintech-specific digital marketing tactics, and focuses on building lasting user relationships. Using custom app development services to offer a great user experience and put customers first, you can set your BNPL app apart in the competitive fintech market. The goal isn’t just to attract users and create advocates who see your app as an essential financial tool. This strategy helps ensure sustained growth and success for your BNPL app.

Enhancing User Trust and Transparency

Strategies for Building Trust with First-Time Users

Winning over first-time users is key to the success of any Money making apps. Create a seamless and secure onboarding process. Make signing up simple, but explain the security features clearly. Show how data is encrypted and protected to address privacy concerns.

Next, feature user testimonials and reviews prominently in your app or website.

Reviews from happy customers can greatly influence new users. Consider getting certifications from industry groups and display those to further emphasize your app’s security and reliability.

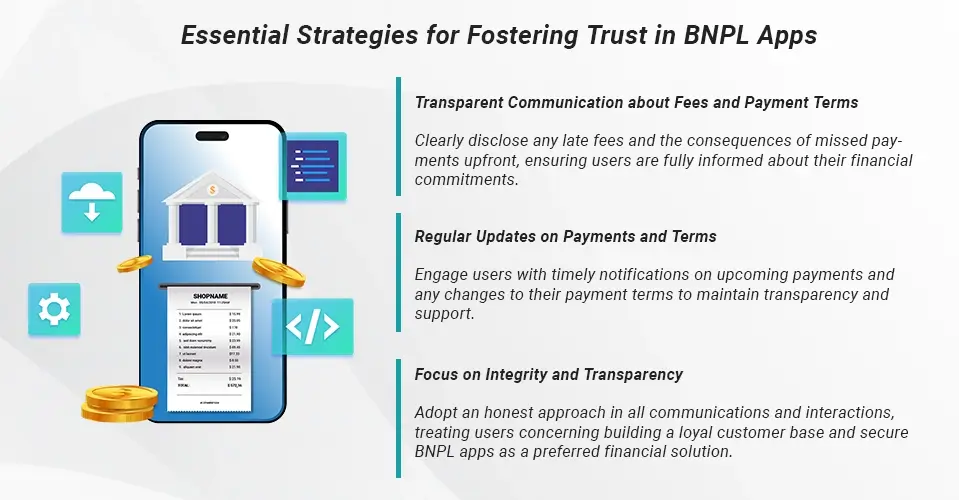

Importance of Transparent Communication about Fees and Payment Terms

Clearly outline the consequences of late payments. While BNPL services often focus on no interest and flexible terms, users need to know about late fees or the impact on their credit score for missed payments. This information upfront helps users make smart choices, fostering trust in your app.

Regularly update users via email or in-app notifications about upcoming payments and changes to terms. This enhances transparency and makes users feel supported throughout their experience.

As Buy Now Pay Later apps continue to reshape fintech, focusing on user trust and transparency is critical. Implement strategies that make onboarding secure, highlight positive user experiences, and communicate fees and payment terms. This way, apps can build a loyal customer base. This approach aligns with fintech best practices while setting the stage for long-term success. Treat users with honesty and integrity, and BNPL apps will remain a top financial choice for consumers.

Partnerships for Expanding BNPL Services

Collaborations with Retailers and Financial Institutions

The game’s name is partnerships. Why? Because they make BNPL better for everyone involved: the app, the stores, and most importantly, the customers. Here’s the breakdown:

If you integrate BNPL into a store’s checkout, shoppers are likely to click ‘buy now.’ That’s a win for the store, which means they’re happy to partner up and maybe even offer special deals for BNPL users. It’s a snowball effect—the more stores you’re in, the more customers you get, and the more attractive you are to even bigger stores.

Partnerships with financial institutions help manage the operations of BNPL services. They can provide funding, tools to assess risk, and expertise to comply with regulations. In return, financial institutions get exposure to new customers and become part of the innovative fintech space. This drives new revenue and diversifies their offerings.

Enhancing the BNPL Ecosystem Through Strategic Partnerships

Strategic partnerships fuel innovation, ensure Buy Now Pay Later apps follow regulations, and make them more accessible. BNPL apps can use the latest security, data analysis, and user experience tools by partnering with technology providers, keeping their platforms secure and cutting-edge.

Collaborations with regulatory bodies help BNPL providers understand the complex web of financial rules. This ensures their services are compliant and trustworthy, essential for maintaining consumer confidence.

Partnerships can help BNPL services expand beyond traditional retail into healthcare, education, and travel sectors. Here, flexible payment options make essential services more affordable. This expansion benefits consumers and the BNPL sector, fueling innovation and growth.

Overcoming Challenges in Buy Now Pay Later App Development

Let’s be real: building a BNPL app is a serious undertaking. Regulations that could trip you up, hackers that want your data, the risk of losing money…it’s enough to give anyone pause. But that’s why the rewards are so great, right? Here’s how to tackle the toughest bits head-on:

Fintech means rules, and they change fast. You absolutely cannot ignore this side. It’s not glamorous, but it can be the difference between launching your app and getting shut down.

Smart Strategies

- Hire the Right People: A lawyer who gets fintech is worth their weight in gold.

- Don’t be afraid to ask: Regulators usually want to help you do things right, reach out!

- Think Scalability: Can your app adapt quickly if a rule changes? Build that in from the start.

Buy Now Pay Later apps hold the data that makes hackers drool. Security isn’t “nice to have”; it’s how you stay in business.

Things You Can’t Skimp On

- Encryption, Encryption, Encryption!: If data is stolen and unusable, that’s less of a disaster.

- Make Logins a Pain: Sorry, users, but 2FA is a must. Biometrics are even better.

- Never Stop Testing: You don’t find vulnerabilities hackers do if you don’t look for them.

BNPL is lending money, and some people won’t pay you back. That’s the risk. Mitigating it is how you turn a profit.

- Don’t Guess About Credit: Build a smart system for approving loans, or partner with someone who does.

- Spot the Scammers: Fraud detection tech constantly improves; invest in the best.

- Don’t Put All Your Eggs in One Basket: BNPL is great, but what else can your app do? Diversify!

The Future of Buy Now Pay Later Apps Apps

BNPL has come a long way, but the exciting stuff is beginning! Think smarter apps, easier ways to pay, and move beyond buying the latest sneakers. The key to it all? Artificial Intelligence Development (AI) and Machine Learning (ML). Let’s talk about what’s coming, the amazing things AI can do for BNPL, and how to get ahead of the curve.

What’s on the Way

- Payment Plans Just for You: Imagine the app figuring out the ideal payment plan based on what you buy and how you budget. That’s the power of AI!

- BNPL for Life’s Big Stuff: Paying for a medical procedure in installments? Spreading out the cost of that dream trip? This is where BNPL gets truly useful.

- Built Right into Your Bank: What if you could get BNPL straight from your banking app? No more juggling multiple accounts. That kind of convenience is a game-changer.

How AI & ML Will Take BNPL to the Next Level

This is where it gets cool. AI and ML aren’t just buzzwords. They can:

- Help Providers Lend Smarter: Analyzing data means making better decisions about who gets approved and safer loans overall.

- Protect Against Fraud: AI is always learning, so it can spot suspicious stuff faster than a person ever could. That builds trust.

- Supercharge Customer Service: Chatbots that solve your problem? Yes, please!

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your App Journey Today!

Conclusion

Buy Now Pay Later apps are shaking up the world of finance! They’re bringing in folks who never saw themselves as ‘fintech people,’ and that’s huge. It forces everyone—even those stuffy banks—to better serve customers. That kind of change excites me about what tech can do.

This isn’t just about buying jeans in installments. BNPL apps are making the whole financial world take notice. Tech that helps people? That makes the playing field fairer? That’s an innovation we should all be cheering for. And it doesn’t stop there – they’re pushing old-school banks to improve, creating better options for everyone.

Flexible finance, works for people, and doesn’t leave anyone behind – that’s the goal, right? BNPL is leading the way. Whether you’re a big player or just starting, this is your chance to make a difference. It’s more than making money; it’s about making lives easier.

Imagine someone using BNPL to afford that medical treatment they desperately need. That’s the power of this stuff. So, if you’re ready to build something amazing with A3Logics, dig into BNPL. This isn’t just about coding an app but shaping how the world handles money. What are you waiting for?

FAQs

How Do These Apps Make Money?

Mostly in two ways:

- Merchants Fees: Stores pay the BNPL a bit each time you use their service. This makes sense for them since it can encourage more sales.

- Late Fees: Some (not all!) BNPL apps may charge you if you miss payments. This is where it’s crucial to read the fine print.

Are BNPL Apps Safe?

They can be, but you have to be smart. Spending more than you meant to is tempting since you don’t pay upfront. Late payments can ding your credit, too. Use them responsibly and only if you know you can handle those later payments.

So, Can I Just Build My BNPL App?

Not so fast! Building a good one takes serious know-how. You need tech skills to understand finance rules AND to know what makes users tick. There’s no official certification, but experience in app development and finance and knowing your customer base are key. This is where working with a top app development team can make all the difference.

What Makes a Buy Now Pay Later App Great?

Think from the user’s perspective:

- Easy to use: Can your grandma figure it out?

- Top security: People won’t trust it if their info isn’t safe.

- Flexible payments: Options let people pay in a way that works for them.

- Seamless checkout: Don’t make buying at stores (online or brick-and-mortar) harder!

- Bonus features: Tracking budgets, support chat, etc., can make your app stand out.

How Do I Stay Ahead of the Game?

The BNPL world changes fast! To win, you must

- Keep innovating: What else can your app help people with?

- Play by the rules: Financial regulations exist for a reason.

- Partner Up: Working with lots of stores = more users for you.

- Use the latest tech: Customers want slick, cool, and secure.