Table of Contents

Are you wondering how businesses manage to exchange financial data in such a seamless and effective way? It all lies in Electronic Data Interchange (EDI). We are here to help you understand how EDI in finance is a masterstroke for ages. EDI has been in use for a long time, changing the ways that businesses exchange data. It plays an significant role in the financial sector especially, where the rapidity and precision of data exchange could be a major difference.

As said by Warren Buffett,” Transformation is the fundamental reality of businesses today“, we’ll look at the ways how EDI can transform finance processes. The article will also explore the benefits of implementing EDI in Finance and how it’s ever more essential for organizations to be competitive in today’s technologically advanced economy.

What is Electronic Data Interchange (EDI)?

Electronic Data Interchange (EDI) is the exchange of computer-to-computer trade documents between partners. It’s a method that helps businesses simplify their processes and reduce the requirement for paper-based procedures. These solutions are used extensively in a variety of industries, such as the retail and manufacturing industries, health care as well as Finance.

EDI in Finance is used to transfer financial documents like invoices, purchase orders, and other payment data between organizations as well as their trading partner. This allows speedier and better accuracy in the process of financial transactions, decreasing errors while increasing efficiency.

EDI solutions generally require using standard formats like EDIFACT as well as ANSI X12, which ensure that documents sent between trade partners are efficiently processed and understood by each of the partners. The implementation of EDI is possible by a variety of methods, for example, directly connecting companies and their computer systems or via the use of a third-party service supplier.

All in all, EDI offers numerous benefits for businesses. These include greater efficiency, less cost as well as improved accuracy, and speedier processing time. This is why it has become a more well-known tool used by companies looking to streamline their processes and increase their profit margins.

Take The Modern Approach For Faster Processing of Financial Transactions

Understanding the Role of EDI in Finance

EDI, also known as Electronic Data Interchange, is the exchange of electronic documents like invoices, purchase orders, as well as shipping and delivery notices between businesses. For Finance, EDI enables businesses to simplify their finance operations through the automation of exchanges of financial documents among trading partners. It eliminates the requirement to manually enter data and minimizes mistakes, which results in improved efficiency as well as reductions in costs.

Benefits

EDI in Finance offers a variety of benefits, such as

- improved precision,

- faster processing times and improved cash flow, and

- improved customer satisfaction

- Automating financial transactions

Tools and Standards

A variety of EDI solution providers provide tools and solutions to help firms use EDI for financial transactions. The providers provide a wide range of services, which include cloud-based EDI platforms, EDI translation software, as well as controlled EDI services.

EDI standards are rules and protocols which govern the exchange of data electronically among trading parties. For Finance, the two most frequently utilized EDI standards are the X12 standard and EDIFACT. X12 is a specification developed by the American National Standards Institute (ANSI) and widely utilized across the United States. EDIFACT is a normative standard created in the United Nations and is more frequently utilized across Europe and the rest of the globe.

EDI integration

Integration of EDI into ERP (Enterprise Resource Planning) systems is crucial for companies that wish to streamline their finances. ERP systems are built to handle every aspect of business activities, which includes the management of inventory, Finance, and the management of customers. Through the integration of EDI into ERP software, companies can streamline the exchange of financial records and simplify financial processes.

EDI security in Finance

The security of EDI transactions is an essential factor in Finance because financial document exchange is susceptible to cyber-attacks. In order to protect EDI transactions, organizations need to adopt encryption, authentication, and access control procedures. Also, they must cooperate together with EDI service providers with strong security protocols.

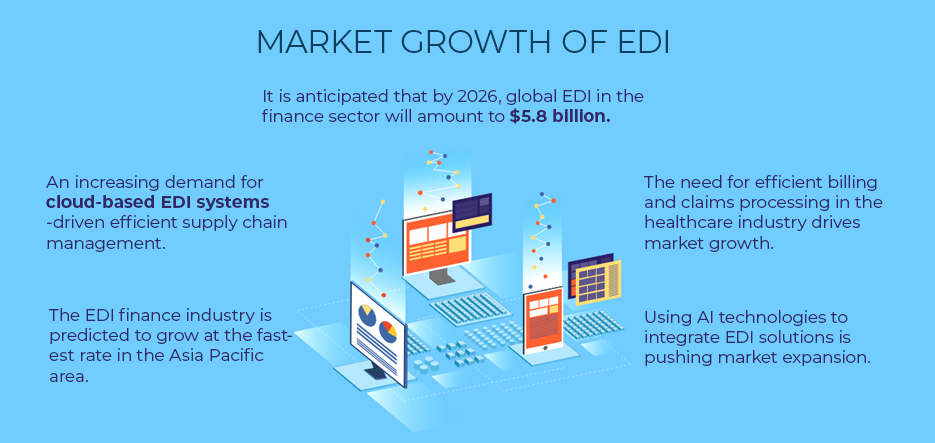

The use of EDI in Finance is likely to keep growing in popularity as firms want to improve their finance operations and cut costs. Cloud-based EDI platforms and the incorporation of EDI alongside other technology like blockchain and AI will further improve the effectiveness and efficiency of EDI within Finance. Since businesses are continuing to adopt the digital revolution, EDI is likely to grow to become a crucial part of their financial processes.

Benefits of EDI in Finance

Let’s look at the advantages of EDI in Finance and talk about what EDI services can aid firms in using this technology.

Improved Efficiency

One of the main advantages of EDI is the fact that it increases efficiency. In automatizing the transmission of information, organizations are able to reduce the duration and time necessary to handle transactions. Businesses can complete more transactions in less time. This can improve efficiency and decrease costs.

Reduced Errors

EDI can eliminate the need for data entry by hand that is susceptible to error. With the help of automation, it can cut down on the possibility of mistakes and make sure that data is precise. This could enhance the accuracy of information and decrease the chance of costly errors.

Faster Processing Times

EDI can allow businesses to handle transactions instantly and can accelerate the process times. Businesses can respond faster to the needs of customers and handle transactions faster. This will enhance customer satisfaction as well as increase the amount of revenue.

Increased Visibility

EDI can provide businesses with more transparency in their activities. With the automated exchange of data, organizations are able to monitor the progress of transactions at a real-time rate. This will help improve business decision-making and give businesses better insight into their processes.

Reduced Costs

EDI helps businesses lower costs by removing the requirement for manual data entry and decreasing the chance of making mistakes. This will help in reducing the time and energy required to complete transactions. This could help reduce costs and improve profitability.

EDI providers are able to help companies adopt this technology with different services such as software, support, and even training. The service providers are able to assist companies in selecting the appropriate software and then setting up the system in accordance with their needs. They will also be able to provide continuous assistance and education to make sure that organizations reap the advantages of EDI.

Therefore, EDI is a technology that has revolutionized how businesses function within the financial industry. It has numerous advantages, such as enhanced efficiency, fewer mistakes, quicker processing times, enhanced visibility, and lower costs. EDI providers will help companies to adopt the technology by providing assistance, software, and even education. When they embrace EDI, businesses can boost their efficiency, improve efficiency, and cut expenses, which will help in boosting profitability and drive growth.

Transforming Financial Processes by Streamlining EDI

Let’s look at the ways in which EDI will help to streamline your finance processes and what EDI consultancy services can assist firms in adopting EDI.

Automate Invoice Processing

The most tedious financial task is the processing of invoices. Through EDI, invoices can be delivered and accepted electronically, removing the necessity for manually entering data. This lowers the possibility of mistakes and speeds up the entire process of payment. EDI is also able to automate the process of comparing invoices and purchase orders to ensure that the transactions are completed accurately and timely.

Reduce Costs

EDI will significantly cut down on the costs of transactions with financial institutions. By removing paper-based transactions, businesses can cut costs on printing, postage, and storage. EDI can also cut down on the requirement for data entry by hand, which reduces costs for labor and increases the likelihood of mistakes. Furthermore, EDI can reduce the possibility of late payments as well as penalties. This could make companies more money over the long term.

Improve Accuracy

Manual data entry can be prone to mistakes and can cause financial loss and damage the image of a company. EDI can eliminate the requirement to manually enter data which reduces the chance of error and improves precision. It gives real-time insights into financial transactions, which allows firms to spot and address difficulties quickly.

Enhance Security

EDI employs encryption for transactions in financial transactions. This ensures that information sensitive to you is secure. This is crucial for transactions that involve important information like the bank account number and information about payment transactions. EDI can also provide the audit trail of transactions in the financial sector, which could assist companies in complying with legal requirements.

Increase Efficiency

EDI could significantly boost the effectiveness of financial processes. Through automation of tasks like the processing of invoices and reconciling payments, firms can reduce personnel time so that they can concentrate on different tasks. EDI can also provide real-time insight into financial transactions. This allows firms to spot and address difficulties quickly.

EDI consultation services can assist firms in implementing EDI through expert advice and assistance throughout the procedure. They are able to assist companies in selecting the best EDI solution to meet their requirements and connect EDI to their existing system, and instruct personnel on how to utilize EDI efficiently.

Thus, EDI is a powerful technology that helps businesses improve their financial procedures, decrease costs, enhance efficiency, improve security, and improve efficiency. EDI consultancy services can assist firms in adopting EDI efficiently, making sure they reap the maximum benefits of this technology.

Avoid Penalty and legal Issues By Our Reliable EDI Solutions

Examples of EDI in Finance

We will look at some instances of EDI in Finance as well as the most reputable EDI service providers in the USA.

Electronic Invoicing

One of the most well-known ways to use EDI in Finance involves electronic invoicing. Instead of mailing bills in paper via the post, businesses can issue electronic invoices to clients in a format that is structured. This reduces the time spent and chances of mistakes because the data will be automatically entered into the system used by the recipient.

Payment Processing

E-Commerce can also be used for processing payments. The company can transmit electronic instructions for payment to banks. These will then be processed in a way that is automated. This minimizes the chance of mistakes and fraudulent activities because the payment information is inserted directly into the bank’s system. A few EDI provider options, such as B2BGateway, provide payment processing services that integrate with accounting software such as QuickBooks as well as Xero.

Purchase Orders

A different common application of EDI within Finance can be purchase orders. Businesses can electronically send purchase orders to suppliers. The orders are then immediately entered into the supplier’s software. The process is streamlined and decreases the possibility of mistakes since the order data is entered in a way that’s automated. The EDI providers, such as DiCentral and Cleo, have purchase order options that integrate with the most popular ERP software, including SAP or Oracle.

Inventory Management

It can also be employed to manage inventory. The company can transmit electronically updated inventory information to its suppliers. The updates will then be seamlessly integrated into the supplier’s database. This helps suppliers manage their inventory more efficiently and decreases the possibility of shortages.

Tax Reporting

Additionally, EDI can be used to file tax returns. The companies can submit electronic tax returns to the IRS that are later automated. This minimizes the chance of mistakes and makes sure that tax returns are processed swiftly.

Therefore, EDI has become an indispensable tool in the financial sector, which allows companies to improve their financial operations and cut down on mistakes. Utilizing EDI for electronic invoices as well as purchasing orders, payment processing, managing inventory, as well as tax reports, businesses will save time and cash as well as improve their financial efficiency.

Challenges and Limitations of EDI in Finance

Electronic Data Interchange (EDI) has revolutionized the way that businesses manage transactions and has evolved into an indispensable instrument in the world of finance. The exchange of electronic documents has enabled transactions to be speedier, more efficient as well as cost-effective. Yet, despite all its advantages, EDI has a fair number of issues and limitations that must be dealt with. In this article, we’ll look at the biggest challenges and drawbacks of EDI in Finance.

Integration with Legacy Systems

One of the major challenges in the implementation of EDI is the integration of legacy systems. Numerous companies have invested a lot in their current systems and might not want to switch over to EDI. It can lead to an absence of interoperability as well as difficulties when sharing data with companies that use various platforms. Businesses may have to purchase the latest software or hardware in order for seamless interoperability.

Complexity

The EDI process can be an extremely complex procedure that requires specialist know-how and expertise. Some companies will require hiring experts or contracting the process to EDI service suppliers. This could result in higher expenses and could require additional education for employees.

Security

EDI allows the exchange of sensitive financial information, which makes security an important concern. Businesses must ensure they have an EDI system that is secure and conforms to industry standards and laws. This could involve the implementation of the use of encryption, firewalls, and various other security precautions.

Cost

Although EDI may be cost-effective in the long-term, setting up the system could cost a lot. It is possible for companies to spend money on hardware, software, as well as education, and provide ongoing maintenance and assistance. The EDI providers may be charged fees for their services.

Also Read: EDI cost evaluation

Limited Accessibility

Many companies do not have EDI, which can restrict access to some partners. Some companies may require different systems to cater to customers who don’t use EDI.

Limited Functionality

EDI is used primarily to exchange important business documents. Although certain EDI platforms have more functions, they won’t be able to handle every type of transaction. In fact, it might not connect with every system also.

Reliance on Third-Party Providers

Most companies use third-party providers to provide EDI services. This can cause a loss of control over the entire process. The company may be forced to depend on their supplier for maintenance, support as well as upgrades. These may limit their ability to change.

Despite the challenges and shortcomings, EDI remains a valuable instrument in the financial industry. It is possible for companies to overcome these issues with the proper technology. Working with reliable EDI service providers ensures that they are in compliance with the industry’s standards. By leveraging the advantages of EDI as well as addressing its shortcomings, organizations can simplify their financial operations. It can help them increase their profit margins.

Future of EDI in Finance

Electronic data exchange (EDI) is an important game changer for finance departments across the globe. In automatizing the exchange of documents for business, EDI has eliminated the requirement for paper-based transactions. It also decreased errors and speeded up the processes. But what do the next few years have in store for EDI in the field of Finance? Here are seven important emerging trends worth keeping an eye on.

Increased Adoption

In the coming years, more companies will realize the advantages of EDI as a solution. We could expect to see a rise especially in the field of Finance. Businesses that are smaller, particularly, are expected to adopt EDI as a means to stay ahead. Not only this, EDI in Finance can help them streamline their business processes.

Integration of AI

Artificial Intelligence (AI) is utilized in Finance to streamline operations like data entry as well as reconciliation. As time goes on, we will likely witness EDI coupled with AI. This can improve the efficiency of processes and increase accuracy.

Blockchain Integration

Blockchain technology is poised to transform the way that the financial transaction process is conducted. With an centralized ledger, blockchain will provide better assurance, security, and effectiveness. It is possible to integrate EDI into blockchain technology, creating an improved and secure method for transactions in financial institutions.

Cloud-based Solutions

Cloud-based services are becoming more well-known in the finance sector due to their adaptability and flexibility. EDI is not an exception. We could expect to be seeing increasing use of cloud-based EDI solutions coming in the near future.

Also read: On Premise vs. Cloud Based EDI

Mobile Access

Since more and more employees work at home or travel on the go, access to EDI devices will be increasingly essential. We can expect to find increasing EDI solutions for use on mobile devices.

Greater Standardization

EDI has helped simplify many financial processes. However, there’s an opportunity to improve. Greater standardization of processes can make it simpler for businesses to share data and perform transactions among themselves.

More Analytics and Reporting

As EDI technology improves and is sophisticated, they’ll have the ability to offer greater reports and analytics. These will enable finance departments to have greater insight into their business operations and take more educated decision-making.

Therefore, the future for EDI in Finance looks bright. As technology advances and improves, we will be seeing increasing automation, integration, and standardization within the realm of EDI. If you embrace these developments, financial departments will be on top of their game and continuously optimize their work.

Ensure More Secure Transactions By Implementing EDI in Finance

Wrapping It Up

To sum up, EDI in Finance has changed the way companies conduct transactions and exchange data. Utilizing EDI is more efficient in the process, lowers errors, and reduces time and cost. With the pace of digitalization continuing to expand, EDI will become even more crucial in Finance.

In order to capitalize on the trend, companies should think about the possibility of implementing EDI for their financial operations. Additionally, they should spend money on training staff members on how to utilize EDI efficiently and safely. In addition, businesses should stay current with the most recent EDI technology and standards to remain ahead of rivals.

The next phase of EDI in finance appears promising. Thanks to the advent of blockchain technology, EDI could be even more transparent and secure. Furthermore, the latest EDI specifications are currently being created to meet the requirements of various industries and areas. If businesses continue to implement EDI and other EDI standards, we are likely to see an increase in innovation and expansion in this area.

Frequently Asked Questions (FAQs)