RPA or robotic process automation, is a software bot that manages monotonous tasks in finance. These bots replicate human movements, which allow them to execute efficient rule-based processes across different applications. RPA in financial services is mainly used for executing financial business processes with automation and ending with compliance reporting and customer onboarding functions.

Process automation enables employees to work on strategic goals while creating error-free operations and time-saving results. Market analysis confirms that robotic process automation in financial services will experience a 25.5% compound annual growth rate (CAGR). It expanded from $9.82 billion in 2024 to $12.32 billion in 2025. However, this blog discusses how the financial services sector transformation occurs through RPA technology. It will also explain its use cases, benefits, and challenges during implementation.

Table of Contents

Need for RPA in Financial Services?

Financial services involve large amounts of data and business processes, which are sometimes regularly repeated. Manual handling of these tasks can result in errors, delays, and higher operational costs.

Robotic Process Automation or RPA in financial services aids companies in automating different tasks. They mostly include –

- Data entry

- Loan processing

- Compliance reporting

- Fraud detection

This leads to lower errors, faster operations, and better customer satisfaction. Financial institutions gain more efficiency and transparency in their tasks. That is why RPA in financial services helps you comply with the newly enacted regulations.

The adoption of robotic process automation in financial services is necessary. It gives them a competitive edge, cuts costs, boosts productivity and allows them to make decisions more quickly.

Market Trend of RPA in Financial Services

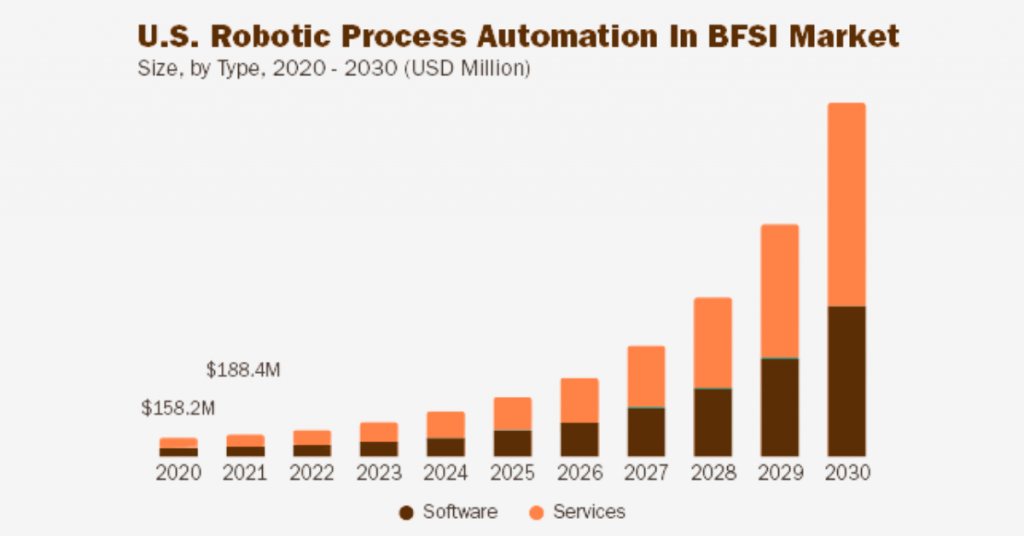

- Experts forecast that the RPA in financial services will reach USD 3.79 billion by 2024. This is because it experiences a predicted CAGR rate of 43.9% from 2025 to 2030.

- The market’s expansion depends on the growing business need for operation optimization and cost reduction. Various enterprise-size organizations within all industries utilize Robotic Process Automation (RPA) to automate basic repetitive rules they follow. It helps them boost workflow efficiency, minimize errors, and free up human resources for critical function fulfillment.

- Robotic process automation in financial services effectively manages operational challenges and compliance requirements. Hyper automation and cognitive RPA achieve cost reductions between 25% and 50%. The system both retrieves time and increases the precision of various operational procedures.

The Workflow of RPA in Finance

The workflow of RPA centers around identifying repetitive tasks based on strict rules. They include data entry in addition to invoice processing. Software bots execute repetitive tasks by applying set guidelines to multiple systems throughout their operations. Also, using RPA in financial services benefits from robotic bots. They swiftly collect and verify the information before modifying system records while creating organized reports.

Financial operations speed up through bots that run continuously without generating many errors. Employees handle exceptional cases and complex tasks as humans, but bots address every other situation between them. Also, RPA values will increase over time when businesses integrate AI and analytical capabilities to achieve higher efficiency.

Top Use Cases of RPA in Finance

The use of RPA in financial services has experienced major operational changes through the implementation of RPA. Employing automation for standard tasks produces essential benefits, including shortened work hours and diminished expenses.

RPA enhances both complaint level and customer service quality as well. However, the following list showcases RPA use cases in financial services and how it advances finance operations:

1. Invoice Processing & Accounts Payable

Bots from RPA technology automatically extract invoice information, after which they match the data against purchase orders to complete payments. The system decreases human mistakes while simultaneously accelerating the approval process. A better cash flow management system and faster payments represent essential benefits for companies.

Plus, the bots monitor discounts while preventing payment delays by avoiding charges. Through the automation process of RPA, the finance team obtains more time to concentrate on strategic financial activities. Now, RPA implements high-quality processing faster for all accounts payable functions. The is among the best RPA use cases in financial services to ensure that financial records remain updated while being prepared for audits.

2. Bank Reconciliations

Financial institutions need time for bank reconciliation manually because it remains a lengthy and critical task. But RPA technology enables the automation of the bank statement and internal record matching process. This way, urgent mismatch alerts appear from bots as they produce reconciliation reports.

The implementation of this process decreases human mistakes and shortens the closing procedure. Also, due to automation, cash flow transparency and control measurements have become better for organizations. Finance departments can execute bank reconciliations daily instead of doing them only once a month. Financial accuracy improves, and better cash management happens through RPA. Businesses receive improved and secure reconciliation procedures that deliver faster outcomes and enhanced reliability.

3. Financial Reporting & Compliance

Error reduction, financial report generation, and declaring compliance with standards are essential functions of RPA technology. The popular RPA use cases in financial services are quick financial reporting and compliance. It obtains data from numerous systems to generate precise real-time reports. Their resources validate adherence to regulatory requirements. Through automation, organizations minimize potential financial consequences.

Computer-generated reporting improves efficiency most significantly during audits or financial periods requiring closure processes. The team devotes its attention to analysis work because it no longer needs to handle data collection activities. The best part is that RPA helps organizations deliver reports on time without causing excessive workload to personnel.

4. Customer Onboarding and KYC

Organizations use Know Your Customer (KYC) processes and customer onboarding to verify vast amounts of information. Robotic process automation services accelerate business operations by automating document verification and data entry. Also, RPA technology enables companies to complete customer onboarding procedures within just a few hours instead of extended periods.

The bots maintain accurate data records and satisfy regulatory requirements. RPA leads to enhanced customer experience through quick verification, which establishes trust with customers. Financial organizations can grow their number of customers by maintaining operational cost stability. The onboarding process becomes faster and more secure because of RPA.

5. Fraud Detection & Risk Management

A financial service organization uses RPA as an enhanced tool to detect fraud while managing safety risks. The system uses bots to track transactions for behavioral anomalies. RPA in financial services use cases also includes instantly alerting teams of potential threats. The automation process allows faster responses to detected risks, which helps prevent economic losses.

RPA provides automated support for preparing official reports regarding fraudulent activities for regulators. It also accelerates data processing operations to offer better-quality risk assessments. Through this system, organizations gain compliance and operational protection from fraud.

6. Loan & Mortgage Processing

Besides the above-mentioned RPA in financial services use cases, the system also helps in loan and mortgage processing. Actually, the mortgage processing system demands personnel to execute manual procedures. For example, they collect documents through verification until receiving approval. But RPAs’ implementation of automation eliminates task durations and mistakes made by humans. Also, the bots retrieve application data for validation purposes and underline incomplete submissions.

The automation processes also enhance the speed of loan approval procedures, directly benefiting customer satisfaction. The increased volume goes through financial institutions without needing additional staff members. RPA establishes regulatory compliance while generating complete audit trail records for documentation verification. It optimizes processing periods to create an accelerated and optimized operational flow.

7. Tax Reporting and Audits

Complex and rushed operations characterize organizing tax reporting and audit preparation. But, RPA is now here for efficient collection, validation and processing of tax data before filing. Bots enable organizations to achieve precise tax computations and ensure on-time filing of taxes. Their task includes document collection duties for audits and audit trail generation.

Also, such automation techniques decrease the chance of penalties or noncompliance issues. Finance departments can focus on developing tax strategies by using automated processes for their daily routine tasks. So, implementing robotic process automation in financial services allows companies to handle tax deadlines successfully while avoiding mistakes.

8. General Ledger and Journal Entries

The general ledger must be maintained while journal entries must be properly posted, although these tasks repeatedly occur. The use of RPA in financial services performs automated tasks for journal posting, data entry, and validation processes. Bots guarantee that journal postings arrive on time accurately while satisfying all accounting standards.

Automation decreases human errors, thus accelerating month-end and year-end closing procedures. Tool users obtain up-to-the-minute updates regarding their financial positions through this system. Finance teams achieve increased time for economic analysis and planning through the implementation of RPA.

Key Benefits of RPA in Financial Services

Applying RPA in financial services offers several benefits that propel business growth. It assists companies in being faster, smarter, and less costly. By automating their processes, financial institutions can control their market positioning, meet legal requirements, and serve their customers more professionally.

Besides all that, check out the bunch of advantages resulting from RPA in financial services below:

1. Increased Operational Efficiency

Tasks in the finance sector that involve repetitious work require vast amounts of time. So, one benefit that RPA offers is complete automation. The system enhances operational velocity while lowering human workforce responsibility. Running financial processes at higher speed and efficiency drives better organizational performance.

Also, the organization gains better productivity because staff members dedicate their efforts to strategic tasks. This automation further completes every process correctly without any errors. It generates improved productivity and better functioning daily operations.

2. Cost Savings & ROI

The automation of manual tasks allows RPA to eliminate the need for additional staff members. Robotic process automation in finance enables organizations to reduce operating expenses, which helps them achieve better ROI.

Also, the best part is that the reduced cost never affects their service quality. Implementing RPA helps organizations minimize their expenses that stem from mistakes and produce additional work and delays. Operations become leaner together with increased profitability at this point.

3. Improved Accuracy & Compliance

RPA bots are automated bots that never get tired, which humans can experience. So, this advanced technology offers financial institutions more accuracy in data, helping them stay compliant. The RPA in financial services offers predefined rules that support regulatory compliance when they operate their systems.

The automated processes also create open audit trails that reduce the complexity of regulatory reporting. RPA works as a tool for organizations to satisfy their strict compliance time requirements. The system also reduces the possibility for financial institutions to face monetary fines or penalties. This way, financial data becomes more trustworthy because of better accuracy.

4. Scalability & Flexibility

Business requirements determine how easily RPA services extend or shrink in number. During peak times, financial institutions can increase the number of bots in their operations. They can later decrease their usage. When they use RPA, they do not need to hire new employees or make significant IT implementations.

Robotic process automation in financial services allows businesses to remain adaptable and competitive. It demonstrates a natural ability to adjust seamlessly to changing business techniques and operating protocols. Also, RPA enables business expansion through streamlined operations, avoiding increasing complexity.

5. Enhanced Customer Experience

The automation of business processes enhances services dealing with new staff onboarding. Also, it offers swift loan processing and prompt query management. RPA provides rapid customer response times and improved service quality levels to end-users. This way, the staff team gains extra time to build better customer relationships because bots complete the back-end work.

Because of that, customer loyalty and trust increase when companies deliver fast and tailored service. Robotic process automation in finance also helps shorten waiting periods, enhancing overall operational smoothness. It helps improve customer satisfaction while retaining more customers.

6. 24/7 Process Execution

Automation through RPA bots operates tirelessly throughout every hour of the day because it lacks human restrictions. They conduct their programming tasks during unscheduled working hours. Thanks to this measure, this continuous operational flow is supported.

Important procedures such as transaction monitoring and compliance checks in financial institutions execute in real-time. Therefore, all processes continuously create shorter waiting periods for completed tasks. This continuous process execution through RPA allows businesses to provide effective service to customers in various time regions.

Challenges of Implementing RPA in Finance

While RPA use cases in financial services offer many benefits, they also come with challenges. So, financial institutions should understand the case and be able to plan accordingly to get the best results from RPA.

Being aware of these hurdles is key to better implementation and long-term success. However, the following are the significant challenges in implementing RPA to be aware of:

> Integration with Legacy Systems

Many banks and financial firms still rely on old, legacy systems. So, for them, integrating RPA in financial services may prove expensive and complicated. Also, their older system may not always integrate with RPA. Therefore, the integration process demands major modifications and possible system replacement to guarantee automated workflows function correctly.

> Data Privacy and Security Concerns

Financial institutions operate under strict regulations. However, operating data with bots creates privacy threats and security vulnerabilities for the system. In fact, there are a few RPA examples in financial services that faced severe legal repercussions and damaged reputations. So, in this case, they need to protect their data through encryption protocols and ongoing surveillance systems. These steps will serve as mandatory steps to avoid potential security threats.

> Initial Setup and Change Management

Setting up RPA requires time, labor, and capital. Therefore, many companies prefer to avoid changes because they fear losing their revenues. This type of change management that is not adequately prepared can create obstacles to a project, eventually delaying it or making it go off track. If the business does not provide regular training and communication, it will not be able to raise team performance, sustainability, and project growth.

> Lack of Skilled Talent

RPA consists of the need for a person with technical and business qualifications. But, most organizations are unable to recruit personnel with mixed skills. Once the RPA project is at the stage where it requires new developers, it can cause the entire project to run slowly. There is no way but to train your team and engage specialists effectively in the organization. So, acquiring a well-experienced RPA team is much needed which many companies cannot afford.

> Process Standardization Issues

Documentation is the key to successful automation when processes are well-organized and standardized. Many financial processes differ among teams and departments. RPA in financial services operates without problems, provided the process parameters are clearly defined. This enables RPA to deliver the anticipated efficiency and accuracy.

Best Practices for RPA Implementation

RPA implementation can be successful if you do a thoughtful planning and make solid strategies. The use of RPA best practices in financial services ensure that the deployment is simple and maximizes the outcomes.

With a sensitive and systematic process, companies of any size can make their way through the challenges and maximize the true potential of the RPA. So, here are some of the best practices below:

Process Assessment and Selection

Proper process selection represents the first move for automation implementation. The first step is identifying procedures that involve repeated rules-following activities. It needs minimal human supervision, making it one of the RPA best practices in financial services.

However, you need to understand the complexity level, the frequency of operations, and the anticipated return on investment. Its automated procedures further yield performance improvements and generate maximum value.

Pilot Program and Gradual Scaling

One of the popular RPA best practices in financial services is the RPA program and gradual scaling. Remember, the project should serve to evaluate its operational success. Also, the trial should concentrate on a manageable, small process.

The system needs continuous monitoring and resolution of identified problems while improving the automation strategy. So, expand automated processes across different departments after running successful pilot tests where you will ensure stable transitions and prevent disruptive scale-up.

Stakeholder Involvement and Training

Relevant stakeholders should participate in RPA planning at the beginning of implementation. So, achieve their backing through informed presentations of RPA advantages and objectives.

Employee training must occur to teach people about their shifting job responsibilities. The success of RPA implementation and its long-term advantages stem from involved teams that embrace this technology.

Monitoring and Continuous Improvement

The performance of RPA systems needs periodic review, and therefore, it is among the robotic process automation best practices in financial services. It should be there to spot trouble spots and improve operational areas.

Data insights also help maximize the effectiveness of bots and operation systems through optimization processes. Automation workflows should experience continuous optimization because business requirements transform over time. Regularly observing RPA systems also leads to better operational performance while extending their advantageous results.

How to Choose the Right RPA Tool for Finance Teams

Choosing the perfect RPA tool is a pivotal part of the finance department’s journey toward successful automation. Financial specialists should take into account several factors to be sure that the tool fits their exact needs. The following is what you should be on the lookout for:

Ease of Integration

Go for the tool that is easily integrated with your existing financial systems. There are RPA examples in financial services that show how a hassle-free integration process ensures quicker deployment.

Scalability

Select a tool that is compatible with the demands of your business growth. A tool that can be scaled is one that you can add more bots to or automate more processes without affecting the current infrastructure.

Security Features

When dealing with financial data of a confidential nature, the safety factor comes on top. A good option in tools of RPA in financial services will, therefore, be the solution that is properly encrypted, regulated, and offers strict user access controls.

User-Friendly Interface

The smart choice would be an RPA platform that is easy to learn, and that allows automation without extensive programming. RPA examples in financial services show that a convenient and uncomplicated interface essentially empowers finance teams to handle and modify bots with no effort.

Future of Robotic Process Automation in Financial Services

RPA has a vivid and transformative outlook toward financial services operations. AI, ML, and cloud computing will reshape how automation affects finance. However, here’s what the future holds:

Hyper-automation and AI Integration

Hyperautomation actually combines AI and ML data analytics for complete process automation. So, in future, financial professionals will be able to carry out even complex tasks, based on with almost no human intervention. This wave in RPA in financial services use cases will lead to more intelligent operations. It will provide finance services which will be faster and accurate.

RPA + ML for Predictive Insights

By merging RPA and machine learning, banks can forecast market risks and variations more accurately. The bots will not only perform the work but also provide new business insights. The move will also facilitate a quicker and more accurate decision-making process for organizations.

RPA as a Service (RPAaaS) Models

RPA as a Service permits businesses to utilize RPA tools via the cloud, reducing initial costs. With robotic process automation in financial services, financial institutions can easily expand their automation facilities without substantial IT investments. This model provides big and small enterprises with faster implementation, flexibility, and better results.

Trends to Watch in 2025 and Beyond

From 2025 onwards, there will be more extensive RPA use cases in financial services. There will be more low-code platforms, and cloud-native RPA tools. Also, the emergence of regulatory technology (RegTech) will also provide the opportunity for the organization to stay compliant through automation. These advancements will make financial services faster, more transparent, and highly personalized.

Why Choose A3Logics for RPA in Finance?

Finances require the right RPA provider to achieve security and efficient system automation. A3Logics delivers its clients a combination of sector-specific expertise, advanced technological capability and demonstrated performance results. They stand as the preferred provider of robotic process automation consulting services due to the following reasons:

1. Expertise in Financial Process Automation

A3Logics possesses extensive knowledge in financial operation automation, including invoicing, reconciliation, and reporting functions. Their expert team’s comprehensive understanding drives smooth and accurate deployments.

2. End-To-End RPA Solutions Tailored to Banking and Finance

The company offers tailored RPA solutions that align with the requirements of banking institutions and financial organizations. They make the right solutions that address business needs and their corresponding sector requirements.

3. Proven Success Stories and Case Studies

The financial sector positions A3Logics as a company that consistently achieves successful RPA deployment projects for its clients. They demonstrate success through tangible evidence that shows operational cost reductions and process efficiency gains.

4. Compliance-Driven Approach

Financial services demand strict regulatory compliance, so they establish this priority in every project. The RPA in financial services developed by A3Logics follows international financial standards and upholds organization-wide security protocols for data protection.

Conclusion: RPA in financial services

RPA automates repetitive tasks, thus enhancing efficiency and reducing expenses in financial services. The major fields of automation are invoice processing, KYC, reporting, and fraud detection. Despite difficulties in security and the need for interconnection, ensuring success via RPA best practices in financial services is possible. So, get customized RPA solutions from A3Logics and witness growth quickly.