Table of Contents

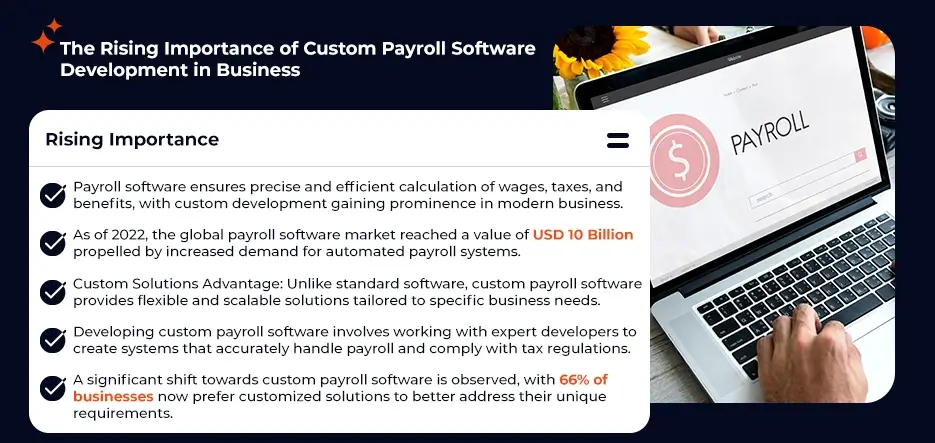

Payroll software is key to business success. It calculates wages, taxes, and benefits accurately and quickly. Custom payroll software development is important in the modern business world. It makes paying employees easier and follows tax laws and regulations.

A Grand View Research report shows that 2022, the global payroll software market was worth USD 10 Billion in 2022. This growth is due to more demand for automated payroll in various sectors. Also, the National Small Business Association (NSBA) says 30% of small businesses use over six hours each month on payroll, using a lot of time and resources. The American Payroll Association adds that automated payroll can cut costs by up to 80%.

Custom payroll software development creates specific solutions for business needs. It’s different from standard payroll software. Custom solutions are flexible and scalable, unlike general software. They fit perfectly with your current business, improving workflow and data management.

Custom solutions are important in payroll software development. This process involves working with expert payroll software developers. They understand company payroll systems well. They create software that calculates payroll correctly and meets tax laws and regulations for your business.

Recently, more businesses have wanted custom payroll software. FinancesOnline says 66% of businesses now prefer custom software. It meets specific business needs better than general software.

This trend towards custom software shows how payroll management is changing. Businesses want systems that automate payroll and adapt to business changes. This increase in demand shows the importance of skilled payroll software developers. They build systems that work well and are easy to use.

Understanding Custom Payroll Software

Custom payroll software development is about making a special payroll system for a business. It’s different from regular payroll software because it’s made just for one company’s needs.

This kind of software makes handling payroll easier and more accurate. It does things like figuring out wages, taxes, and other money taken out of paychecks. It also looks at things special to a company, like different kinds of pay, benefits, and following local tax rules.

Why It’s Better Than Regular Payroll Software

Custom enterprise software development is better than the usual kind for several reasons:

- Made Just for You: It fits your business perfectly. This is great for companies with tricky payroll or special rules to follow.

- Changes as You Grow: It can change and grow with your business, unlike regular software that might get outdated.

- Works Well With Other Systems: It can connect easily with other systems you use, like HR or accounting. This helps avoid mistakes when moving information around.

- Extra Safe and Legal: It keeps sensitive payroll information safe and ensures you follow the law, which is important.

As more payroll software development companies want software made just for them, payroll software developers become more important. They help make systems that work for each business. The benefits of ERP software development also show how custom solutions are key in today’s business world, where adapting and tailoring things to your needs is essential.

Mistake 1: Inadequate Needs Analysis

A detailed needs analysis is crucial for success in custom payroll software development. This step involves understanding a business’s requirements, workflows, and challenges. Payroll software for small businesses is even more vital. They often have unique needs that generic software can’t meet.

A thorough needs analysis covers many business areas. It looks at how employees are paid, tax duties, managing benefits, and following laws. It also checks the business’s tech setup to ensure the new software works well with current systems.

Top custom software development companies spend much time and resources on this. They know the better they understand a business’s needs, the more they can customize the software.

The Risks of Skipping This Step

Ignoring this crucial phase can lead to problems:

- Mismatch with Business Needs: The software might not fit right if you don’t fully understand a business’s payroll needs. It could be too complex or too simple.

- Extra Costs and Delays: If the initial analysis isn’t thorough, you might face higher costs later. Making changes after development is expensive and time-consuming.

- Business Disruptions: The wrong software can slow down payroll, cause payment errors, and lead to tax issues.

- Unhappy Employees: A bad payroll system can frustrate employees. They won’t be happy if it’s hard to use or makes mistakes.

- Legal Problems: Every area has its payroll laws. Software that doesn’t consider these might break laws, leading to fines and legal trouble.

A deep needs analysis is key in custom payroll software development. It ensures the software works well and matches the business’s unique requirements. The best custom software development companies that focus on this step avoid extra costs, prevent business problems, and keep employees and the law happy. As businesses keep changing, detailed needs assessment in Business Software Development is more important than ever.

Take Control of your Payroll with our Tailored Software Solution

Mistake 2: Ignoring Compliance Requirements

In custom payroll software development, compliance is key. It’s not just a legal need; it’s essential for protecting the business and its employees. Compliance means the Enrollment Software follows legal and tax rules, which vary by region.

Knowing these rules is vital for a custom software development company in the USA or anywhere else. They include accurate tax deductions, reporting, labor laws, and data protection. In the US, software must meet the IRS, Fair Labor Standards Act, and state laws.

Free payroll software might save money but often can’t meet specific legal needs. Custom software can be made to fit these exact requirements.

The Dangers of Ignoring Compliance

Not following compliance rules in payroll software can lead to big problems:

- Financial Penalties: Not following the rules can mean large fines, especially harmful for small and medium businesses. Mistakes in taxes or payroll reporting can lead to audits and legal issues.

- Harm to Reputation: If you break compliance rules, it can become public and hurt your reputation. This can make you lose customers and trust from clients and investors.

- Work Disruptions: Software that doesn’t meet compliance can slow down payroll, make tax filing errors, and complicate employee benefits.

- Legal Problems: Not following employment and labor laws can lead to lawsuits or actions from regulators.

- Security Risks: Compliance also means keeping data safe. If you don’t, it can lead to data breaches, legal issues, and loss of trust.

Compliance in payroll software is critical in custom software development. Whether it’s free software or from a custom software development company in the USA, compliance must be a priority. The risks of ignoring it range from fines to damage to your reputation. Businesses must see compliant payroll solutions as a vital investment, not just a legal must-have. Good compliance keeps operations smooth, secures data, and maintains the company’s integrity, all crucial for long-term success.

Mistake 3: Underestimating Security Needs

Security in custom payroll software development is vital. Payroll systems store sensitive info like personal details, salaries, bank accounts, and tax records. This makes them targets for cyberattacks. The security challenges range from external threats to internal breaches.

When custom software development is outsourcing, security risks increase. It’s crucial to ensure the external team follows strict security rules and protects data shared between the business and developers.

Complying with data protection laws like the GDPR in the EU and state laws in the USA is also key. These laws demand strong data protection and privacy, especially for the best payroll software.

How to Improve Security

Enhancing security in payroll systems involves several steps:

- Robust Data Encryption: Encrypting sensitive employee data is crucial. It protects data, whether it’s stored or being sent.

- Regular Security Checks and Updates: Checking for security weaknesses and updating the software with new security patches is essential.

- Strong Login Processes: Using two-factor authentication (2FA) reduces the risk of unauthorized access.

- Controlled Data Access: Setting up access based on employee roles helps prevent internal data leaks.

- Employee Security Training: Teaching employees about security risks helps avoid issues like phishing.

- Safe Development Practices: If using outsourcing for software development, choose a partner known for secure coding and making secure software.

- Disaster Recovery Planning: A plan for data recovery and business continuity is critical in case of a security breach or data loss.

Ignoring security needs in payroll software can lead to major financial and reputational damage. Security is crucial when choosing custom payroll software development, the best payroll software, or outsourcing. Strong security measures and proactive approaches protect against cyber threats. It’s not just about data safety; it’s about keeping trust, following laws, and smooth business operations. In the debate of Custom Software vs. Off-the-Shelf Software, custom solutions often offer better-tailored security for a business’s specific needs.

Mistake 4: Neglecting User Experience

User experience (UX) is crucial in custom payroll software development. UX determines how easy and intuitive the software is for users. This is especially important for online payroll software, where ease of use is key. A good UX can make software popular, while a bad one can lead to resistance.

UX is more than just how the software looks. It includes how it feels, how efficiently it works, and how quickly it responds. In custom software development consulting, experts often emphasize UX. It affects user satisfaction, productivity, and software acceptance in an organization.

It’s important to remember that different users, like HR and accounting staff, use payroll systems. They each have unique needs. So, a one-size-fits-all approach usually doesn’t work in payroll software. Custom solutions are often better.

Tips to Improve User Interface

Improving the user interface (UI) is key to better UX. Here are some tips:

- Intuitive Design: Make the UI easy to understand and use, even for non-tech-savvy users. This includes a clear layout and easy-to-access features.

- Quick and Smooth: Users want fast software. Ensure quick load times and smooth transitions between different parts of the software.

- Customization: Allow users to change the software to meet their needs. Options like customizable dashboards and reports are helpful.

- Familiar Design: Use familiar design elements to make new users comfortable. Keep the design consistent throughout the software.

Ignoring UX in custom payroll software development can lead to poor adoption and user dissatisfaction. Focusing on an intuitive, responsive, and friendly interface can increase productivity and smooth adoption of online payroll software. Custom software development consulting should always stress the importance of UX. Avoiding Custom Software Requirements Gathering Mistakes, like not considering user needs, is essential for creating software that meets business goals.

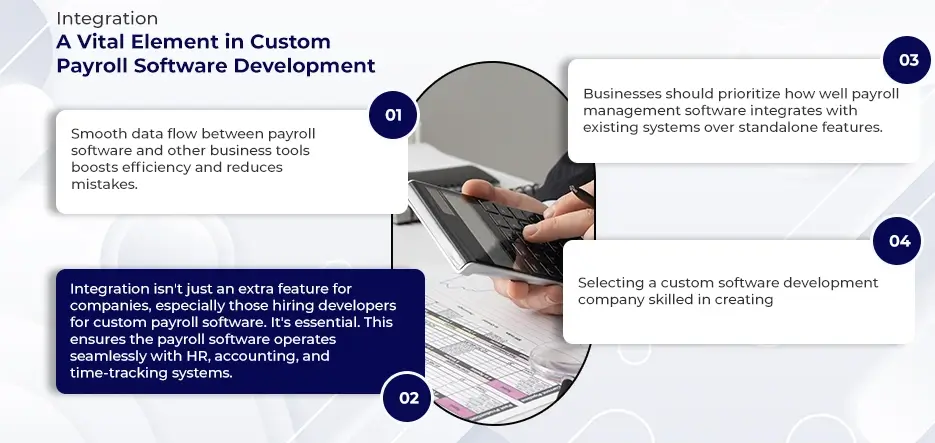

Mistake 5: Poor Integration Capabilities

Integration isn’t just a bonus in custom payroll software development—it’s essential. Payroll management software needs to work well with other systems in a business. This matters because it ensures data moves smoothly between departments, boosting efficiency and cutting errors. It also saves time and resources that you’d spend on manual data entry and fixing mistakes.

Businesses, especially those considering to hire a custom software development company, should focus on integration. The payroll software should connect and work well with other business systems like HR, accounting, and time-tracking tools. This helps manage employee data, financial records, and business operations together.

Common Challenges in Integration

Integrating software can be tough. Here are some common problems:

- Compatibility with Existing Systems: The new payroll software must work with the current systems without causing issues.

- Not Training Users: It’s not just about the software; it’s about people using it too. Employees need training to use the integrated system well.

- Security Risks During Integration: Combining different systems can create security gaps. It’s important to think about security when integrating to protect sensitive data.

- Scalability: The payroll software should grow with the business. If it can’t, it’ll become a problem, needing expensive upgrades or replacements.

Integration is key in custom payroll software development. Businesses should examine how payroll management software fits their existing systems, not just its features. Choosing a custom software development company skilled in creating integrated solutions is important. It improves efficiency, keeps data accurate, and helps businesses manage payroll complexities effectively.

Mistake 6: Inflexible Software Design

In custom payroll software development, scalability and adaptability are crucial. Scalability means the software can handle more work or expand its features. Adaptability is adjusting to new business needs, laws, and technology changes.

Custom software consulting companies stress these features, especially in payroll software. Businesses grow and change. A current payroll system might not be enough later when the industry has more employees, different legal needs, or bigger operations.

If payroll software can’t scale or adapt, it can slow business growth, cause legal issues, and lead to expensive replacements or upgrades. So, it’s important to design software thinking about future growth and changes.

Balancing Customization with Flexibility

It’s tricky to balance customization and flexibility in payroll software. Businesses need software that fits their specific needs and workflows, which is where customization is key. Custom software can match unique payroll structures, benefits, and reporting needs.

However, too much customization can make software rigid. Software that’s perfect now can become a problem when it needs to change. Flexible software, designed modularly, allows for adding or changing features without disrupting everything.

Custom software consulting companies usually recommend focusing on customization for now and flexibility for later. This makes sure the software stays useful as the business grows and changes.

When starting custom payroll software development, avoid making too rigid software. Aim for a mix of customization and flexibility. This means the software meets current needs and can adapt to future changes. Consulting with skilled custom software consulting companies can help find this balance, leading to a better, more sustainable payroll system.

Mistake 7: Overlooking Testing and Quality Assurance

Testing in custom payroll software development is crucial. It’s not just a phase but a key part of ensuring the software works right. Testing checks for defects and confirms the software does what it should. This is vital in payroll software, where accuracy and legal compliance are necessary.

Testing is essential for custom software development services in USA and elsewhere. It includes various checks to ensure everything in the payroll system, like tax calculations and data security, is error-free. Testing finds bugs or problems that might have been missed during development.

The need for thorough testing in payroll software is huge. Payroll mistakes can cause big financial and legal issues for companies and employees. Good testing ensures the software is reliable, accurate, and meets all legal standards.

Best Practices in Quality Assurance

Quality assurance (QA) in software development ensures the software meets quality standards. Here’s how to do QA right for custom payroll software:

- Detailed Test Planning: Have a clear plan outlining what to test, how to test, and success criteria.

- Continuous Testing: Test throughout development to find and fix issues early.

- User Acceptance Testing (UAT): Include end-users in testing to ensure the software meets their needs and is easy to use.

- Security and Compliance Testing: With sensitive payroll data, security testing is vital. Compliance testing makes sure the software follows all relevant laws.

Ignoring testing and QA in custom payroll software development can have serious effects. Well-tested and quality-assured software ensures accuracy, compliance, user satisfaction, and trust. Custom software development services in the USA and beyond should focus on these areas to create effective and reliable payroll solutions.

Mistake 8: Inefficient Project Management

Effective project management is vital for successful custom payroll software development. It’s more than just handling tasks and deadlines. It’s about aligning every part of the development process with the project’s goals and business aims.

Bad project management can slow down the development of custom payroll software. It can cause missed deadlines, overspending, and a final product that doesn’t meet the client’s needs. Good project management, though, keeps the project on track, within budget, and finished on time. This directly affects the Custom Software Development Cost.

Tips for Good Project Management

Here are some important tips for managing custom payroll software projects well:

- Clear Goals and Planning: Start with clear project goals. Plan well, set realistic timelines, determine resources, and define the project’s scope.

- Agile Methods: Using agile project management can work well. Agile focuses on flexible, step-by-step development.

- Managing Risks: Spot potential risks early and plan how to deal with them. This prevents unexpected problems.

- Quality Assurance: Make sure quality checks are part of your plan. Regular testing and reviews make sure the software is up to standard and reduce big problems later.

Efficient project management is essential in custom payroll software development. It affects the project’s success and the custom software development cost. Focusing on clear planning, good communication, agile methods, risk management, and quality assurance can greatly increase the chance of a successful project. This approach leads to software that meets the client’s needs and makes the development process more efficient and profitable.

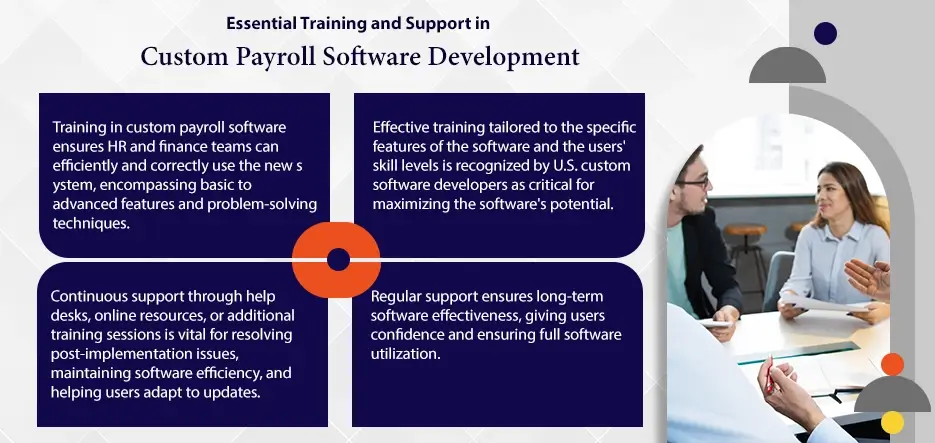

Mistake 9: Insufficient Training and Support

In custom payroll software development, training and support are essential. They make sure the software is used well and efficiently. Training gives HR and finance teams the skills and knowledge to use the new payroll system properly.

Custom software development companies in the USA know that even great payroll software won’t reach its full potential if users aren’t trained well. Effective training should match the software’s specific features and the users’ skill levels. It should cover basic operations, advanced features, and how to solve problems.

The Need for Ongoing Support

Beyond initial training, continuous support is key for handling issues after the software is in place. Support can be help desks, online resources, or more training sessions. It keeps users skilled in using the software and helps them adjust to updates or changes.

Ongoing support also maintains the software’s efficiency and effectiveness over time. It gives users a safety net, helping them use the software confidently and fully.

Good training and ongoing support are vital for the success and longevity of custom payroll software. They make sure the software is used effectively, maximizing investment return. Custom software development companies focusing on training and support in the USA will likely have successful projects and happy clients. By investing in thorough training and strong support systems, businesses can make sure their payroll software is an asset, not a problem.

Mistake 10: Not Planning for Future Updates

A big mistake in custom payroll software development is not planning for future updates. Future-proofing means ensuring the software stays useful and efficient as business needs, technology, and laws change. This is important for enterprise software development companies in the USA, where tech and regulations change often.

If custom payroll software isn’t built to be scalable and adaptable, it can quickly become outdated. This leads to higher costs over time, as businesses have to buy new software earlier than expected. It also risks operational problems and compliance issues.

Strategies for Updates and Maintenance

To make sure custom payroll software can be updated and maintained, consider these strategies:

- Modular Design: Using a modular design makes updates and changes easier. Each software part is separate, so you can update one part without affecting the whole system.

- Regular Maintenance: Set up a schedule for regular check-ups and updates. This helps find and fix problems early and keeps the software running well.

- User Feedback: Having a way to get and use feedback from users is important. This feedback can guide future updates to ensure the software meets user needs.

- Ongoing Developer Partnership: Keep working with the software developers. For businesses, staying in touch with enterprise software development companies means the software gets regular expert updates and care.

Planning for future updates and maintenance is key in custom payroll software development. Strategies like modular design, scalability, regular maintenance, and keeping up with laws help keep payroll software effective and compliant over time. For enterprise software development companies, offering ongoing support and partnership is valuable. It helps clients get the most out of their software and adapt to changing business needs.

Conclusion

Good planning is key in custom payroll software development. It guides every step, ensuring all critical parts are considered. This includes understanding unique business needs, staying current with compliance, focusing on security, user experience, smooth integration, designing for adaptability, thorough testing and QA, efficient project management, comprehensive training and support, and planning for future updates.

As businesses evolve, the demand for efficient, compliant, secure, and user-friendly custom payroll software grows. Partnering with experienced professionals can be hugely beneficial. Contact A3Logics if you want to enhance your payroll management with custom software. Start your journey to a more efficient, compliant, user-friendly payroll system today.

Transform Your Software Vision into Reality – Book a 30-Minute Free Consultation!

FAQs

What is Custom Payroll Software Development?

Custom payroll software development creates specialized software for specific business payroll needs. It’s different from standard payroll solutions. Custom software meets a business’s unique payroll process needs. It handles special payment structures, works with existing business systems, and follows specific laws.

Why is Compliance Important in Payroll Software?

Compliance with payroll software is vital. It involves following tax laws, employment rules, and financial reporting standards. Not following these can lead to legal problems, including fines and harm to the company’s reputation. Proper compliance ensures correct tax filing, fair employee pay, and adherence to labor laws, protecting the business from legal issues and keeping its credibility.

How Can You Lower Security Risks in Payroll Systems?

To reduce security risks in payroll systems, do these things:

- Use strong encryption for stored and moving data.

- Update the software regularly to fix security weaknesses.

- Have security checks to find and fix risks.

- Control who can access data.

What Makes Payroll Software User-Friendly?

User-friendly payroll software is easy to use and makes payroll tasks simpler. It should have a clear interface, a logical workflow, easy instructions, and quick access to important features. Offering customization for different users and good customer support also helps.

What are Common Payroll Software Integration Challenges?

Common challenges in integrating payroll software include:

- Compatibility issues with other systems.

- Data syncing errors cause payroll mistakes.

- Complexities in fitting the new software with current business processes.

- Security risks during data transfer and integration.