The world is witnessing how the financial market is transforming thanks to machine learning. Today, machine learning for trading brings in the power of easy analysis of data-driven algorithms. So, you will be able to easily analyze a vast amount of data and execute trades with a lot of accuracy and speed.

So, it is basically a technical upgrade that makes it easy for the investors to make their decisions a lot more comfortably. If you are thinking how machine learning for trading is a great opportunity for businesses. Below we discuss all the aspects related to machine learning for trading to proceed ahead with clarity.

Table of Contents

What is Machine Learning in Trading?

Machine learning in trading is the application of sophisticated algorithms that learn from historical and real-time market data to provide forecasts, automate trading decisions. The primary methods of machine learning in trading are:

- Trained on labeled past data, these models forecast results like asset returns or price direction. Commonly utilized algorithms include support vector machines, random forests, and decision trees.

- Useful for spotting market regimes or atypical trading activity, these algorithms find clusters or anomalies in unlabelled data.

- Algorithms here learn ideal trading strategies by means of trial and error, hence getting feedback in the shape of incentives or penalties.

Stock trading using machine learning goes beyond price prediction. It covers trade execution, risk management, portfolio optimization, and even the examination of alternate data sources such as social media sentiment. Machine learning in trading’s versatility and scalability let it react to fast changing market conditions, thereby making it a must-have tool for institutional as well as retail investors.

Market Analysis of Machine Learning in Trading

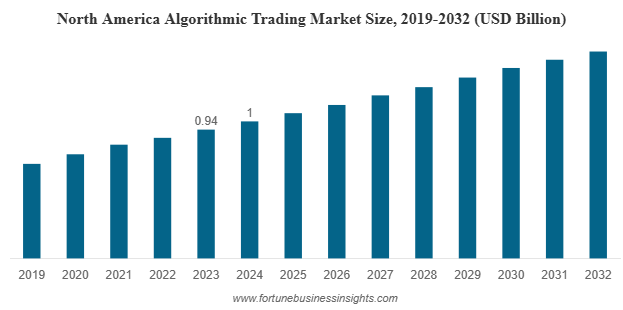

Advancements in data availability, processing capacity, and the need for automation are driving the financial sector to embrace machine learning for trading more quickly. Some important machine learning statistics highlight the rapid adoption and growing impact of these technologies across the trading landscape.

- Growing at a double-digit CAGR, the worldwide algorithmic trading market is projected to exceed $42.5 billion by 2033.

- Now, algorithmic and machine learning-driven systems conduct more than 70% of daily trading volume in US equities.

- With some reaching annualized returns of 60% over several decades, hedge funds employing machine learning for stock trading have surpassed many conventional funds.

- Over the last five years, the usage of alternative data in trading-such as social media sentiment, satellite imaging, and online traffic-has surged by more than 400%, driving fresh machine learning applications in trade.

- Depending on the time horizon and data quality, machine learning models in trading can forecast accuracy between 55% and 88%, which could result in notable trading gains when coupled with strong risk management.

These patterns underline the increasing dependence on machine learning in trading, not only among big institutions but also among retail investors using AI-powered platforms. The market is also witnessing more cooperation with artificial intelligence consulting services and AI development services to create, implement, and improve bespoke trading solutions.

Key Applications of Machine Learning in Trading

The following are the most profound applications of machine learning in trading:

1. Algorithmic Trading and High-Frequency Trading

By processing enormous volumes of market data in real time, machine learning for trading drives algorithmic and high-frequency trading. Executing transactions in milliseconds, these algorithms find transient patterns, price discrepancies, and arbitrage opportunities. High-frequency trading uses ML models to examine order book dynamics and liquidity, therefore increasing earnings from small price changes by making split-second judgments. Their capacity to change with changing market conditions and learn from past data helps traders to outperform manual tactics by guaranteeing methodical and emotion-free execution across worldwide markets.

2. Predictive Analytics for Market Trends

Trading with machine learning forecasts future market patterns and asset price changes using predictive analytics. These models find trends preceding notable changes by means of historical pricing, technical indicators, and macroeconomic data. Traders use these insights to forecast market direction, maximize entry and exit opportunities, and proactively modify portfolios. By offering probabilistic projections of future scenarios, predictive analytics improves decision-making and enables investors to keep ahead of market cycles and reduce exposure to negative events.

3. Sentiment Analysis for Market Insights

Sentiment research draws market sentiment from news stories, financial reports, and social media using natural language processing and machine learning. ML models measure investor mood and its probable effect on asset values by means of quantification of the tone and context of public discourse. This tool is vital for spotting early signs of optimism or fear, hence enabling traders to forecast short-term volatility and modify their plans accordingly. By adding a useful extra data layer to conventional quantitative models, sentiment analysis enhances general trading performance.

4. Portfolio Optimization with ML

Based on large historical datasets and real-time market data, machine learning for trading maximizes portfolio allocation by balancing risk and reward. To suggest the perfect combination of investments, ML models constantly evaluate asset correlations, volatility, and performance. They adjust to evolving market conditions, automatically rebalancing portfolios to fit investor objectives and risk appetite. Maximizing returns while avoiding exposure to market declines, this dynamic strategy guarantees that portfolios stay resilient and efficient.

5. Automated Trading Bots

ML-driven trading bots run transactions according to pre-defined rules or adaptive techniques. These bots track market circumstances, run data analysis, and place orders around the clock without human involvement. They minimize emotional bias, boost efficiency, and take advantage of transient possibilities by learning from prior trades and adapting to new information. Offering scalability and consistency in plan execution, automated trading bots are commonly employed for both retail and institutional trading.

6. Stock Price Prediction

Machine learning for stock trading leverages advanced algorithms like support vector machines and neural networks to predict future stock prices. These models analyze historical price patterns, trading volumes, and alternative data sources to generate forecasts. While not foolproof, ML-based predictions often outperform traditional methods, providing traders with actionable signals for buying or selling. The continuous learning capability allows these models to adapt to new market regimes and improve accuracy over time.

7. Quantitative Trading Strategies

Quantitative trading strategies control portfolio risk, optimize trade execution, and find statistical arbitrage possibilities using machine learning. ML models examine vast data sets to find inefficiencies, correlations, and pricing anomalies throughout markets. Automating complicated mathematical models helps traders to execute methodical plans that produce steady profits and reduce human error. These extremely scalable techniques may be thoroughly backtested to guarantee resilience.

8. Neural Networks for Trading Patterns

Including convolutional and recurrent architectures, deep learning neural networks are particularly good at identifying complex trading patterns and temporal correlations in financial data. These models can find non-linear connections, regime changes, and subtle signals that conventional models overlook. Particularly good at handling unstructured data like price charts and time series, neural networks help to produce more precise forecasts and sophisticated trading signal generation.

9. Reinforcement Learning in Trading

By engaging with the market environment and getting feedback in the form of rewards or penalties, reinforcement learning algorithms learn best trading practices. These models actively adjust to fluctuating market conditions, constantly fine-tuning their tactics to maximize long-term profits. Dynamic portfolio management, automated trading, and execution optimization in complicated, unpredictable settings all benefit greatly from reinforcement learning.

10. Macroeconomic Indicators Analysis

To evaluate their influence on asset prices and market movements, machine learning models examine macroeconomic indicators including GDP, inflation, interest rates, and employment statistics. ML enables traders to expect general market movements and modify tactics in reaction to economic changes by including these factors into trading models. This program improves tactical trading choices as well as strategic asset allocation.

11. Customer Behavior Analysis in Trading

ML helps brokers and platforms customize services and identify abnormalities by examining user preferences, transaction history, and trading habits. Understanding client trends helps companies to customize product offers, enhance user experience, and spot any fraud or anomalous conduct. Higher customer happiness, improved risk management, and more efficient marketing plans follow from this.

12. Hedge Fund Strategy Optimization

Hedge funds find new sources of alpha, tweak parameters, and backtest trading ideas using machine learning. ML models can process huge volumes of historical and alternative data to improve investing strategies, change with changing markets, and increase risk-adjusted returns. Hedge funds are competitive in fast changing financial settings because to this ongoing optimization.

13. Pattern Recognition in the Stock Market

Machine learning is particularly good at spotting recurring patterns, anomalies, and regime changes in stock market data. ML gives traders practical ideas for timing entrances and exits by use of technical formations, price cycles, and outlier events. Pattern identification helps to provide early warning of market reversals, hence enhancing general trading performance.

14. Real-Time Market Monitoring

ML allows real-time tracking of market conditions, liquidity, and volatility. These models can quickly identify developing threats or opportunities by means of streaming data analysis, hence activating automated alerts or responses. High-frequency trading, risk management, and sustaining operational resilience in fast-moving markets all depend on real-time monitoring.

15. ML-Driven Wealth Management

Wealth management systems and robo-advisors provide tailored investment recommendations, automate portfolio rebalancing, and maximize tax strategies using machine learning. Driven by ML, wealth management changes to fit client objectives, risk profiles, and market situations, hence offering effective, affordable, and scalable solutions for investors looking for long-term development and financial security.

Advantages of Machine Learning in Trading

Machine learning for trading offers several powerful advantages that are transforming the financial sector:

1. Enhanced Data Analysis and Pattern Recognition

ML models can process and analyze enormous amounts of structured and unstructured data, uncovering intricate patterns and relationships that are often invisible to human analysts. This leads to more informed trading decisions and the discovery of unique trading opportunities.

2. Improved Prediction Accuracy

By learning from historical trends and adapting to new data, machine learning algorithms often achieve higher prediction accuracy than traditional models. This is especially valuable for stock price prediction, risk assessment, and market trend forecasting.

3. Automation and Speed

Machine learning enables the automation of trading strategies, allowing for rapid execution, reduced human error, and the ability to capitalize on fleeting market opportunities. Automated trading bots can operate continuously, ensuring constant market participation.

4. Dynamic Risk Management

ML models assess and manage risk in real time by monitoring market conditions, volatility, and counterparty behavior. This proactive risk management helps minimize losses and optimize returns.

5. Personalization and Customization

Machine learning in trading allows for tailored investment strategies and personalized recommendations based on individual risk profiles, investment goals, and market outlooks.

Machine Learning for Trading: Addressing the Challenges & Solutions

The application of machine learning in trading involves a number of problems, despite the fact that it has the potential to be transformative:

Data Quality and Availability

When it comes to the success of machine learning models, having data that is not only extensive but also of high quality is absolutely necessary. Data that is either erroneous or incomplete can lead to approaches that are not optimal and poor forecasts. This can also be the result of data that is incomplete. Among the solutions are the execution of severe data validation and cleaning procedures, as well as the procurement of data from a wide range of suppliers.

Model Overfitting and Instability

In the event where models perform well on historical data but fail to perform well in live trading due to excessive complexity, this is an example of overfitting. Cross-validation on a regular basis, robust backtesting, and the utilization of models that are simpler and easier to read are all helpful in mitigating this risk.

Interpretability and Transparency

Complex machine learning models, particularly deep learning networks, can be tricky to interpret, which makes it difficult to comprehend the decision-making process. When it comes to building confidence and meeting regulatory standards, the utilization of explainable AI techniques and transparent algorithms is beneficial.

Market Volatility and Unpredictability

The financial markets are subject to the influence of unforeseeable occurrences that may not be reflected in the data’s historical records. It is possible to improve resilience by combining machine learning with expert judgment and scenario analysis.

Ethical and Regulatory Considerations

There are concerns regarding fairness, transparency, and accountability that are brought up by the application of machine learning in trading. When it comes to the deployment of artificial intelligence in a responsible manner, it is necessary to adhere to regulatory rules and build effective governance frameworks.

Machine Learning: Reshaping the Future of Trading

Fundamentally changing the financial scene, machine learning for trading is ML is helping investors and traders to negotiate more complicated markets by automating difficult analyses, enabling real-time decision-making, and finding new sources of alpha.

Machine learning in trading is being expanded by the inclusion of additional data sources such sentiment analysis and satellite images, therefore enabling more sophisticated and flexible tactics.

Predictive analytics, risk management, and automated trading will all see even more developments as artificial intelligence development services and consulting services keep innovating. Intelligent systems that learn, adapt, and continuously optimize will define the future of trading, hence driving efficiency, transparency, and profitability across the sector.

How A3Logics is Revolutionizing Trading with Machine Learning

Leading machine learning development company A3Logics is at the forefront of changing trade operations with AI-driven solutions. A3Logics enables financial institutions to create bespoke trading algorithms, real-time risk management systems, and smart trading bots suited to their particular needs by using the most recent developments in machine learning for trade.

Our artificial intelligence development services guarantee smooth acceptance and scalability by means of end-to-end model development, data integration, and deployment. A3Logics helps customers choose the appropriate machine learning frameworks, maximize trading methods, and negotiate regulatory constraints by means of AI consulting services.

A3Logics helps customers to get more profits, lower operational risks, and remain ahead in the competitive arena of trading by integrating domain knowledge with modern technology.

Final Takeaway

Hopefully, you are clear about all the aspects related to how Machine learning for trading is completely transforming the world of finance. As a crucial part of Machine Learning in Finance, it helps you in the process of decision-making and makes it easy for you to implement automation.

Not only this, it also helps in the process of predictive analysis and you can take all the aspects in terms of algo-trading to stock price movements. But, implementing this requires proper knowledge and expertise. If you are looking for expertise to help you with AI development and consulting services, then you can connect with A3Logics. We have the required skills and knowledge to deliver as per your custom needs. Consult now!