Table of Contents

FinTech applications are gaining in popularity worldwide due to the increasing use of mobile phones. This is why the demand for Fintech app development companies is increasing every day. In 2023, research shows that around 6.92 billion smartphone users will exist, or 86% of all the world’s people.

Building a financial application can be challenging, requiring a lot of technical expertise and knowledge. This article will highlight the top FinTech app developers and explain how you can choose the best financial app partner to ensure cost-effective and timely development.

Market Overview

Developing global FinTech app is growing and could reach a value of around 305 billion in 2025. This growth is a result of several factors. First is the wide adoption of smartphones. Second, technological advances, like AI and Blockchain, have created new opportunities for fintech innovation and accelerated the market’s growth. Thanks to regulatory changes, fintech companies can compete with traditional financial institutions on an equal playing field.

- Fintech app development companies are expected to reach 11,651 in the United States by May 2023. This is the largest number of fintech startups anywhere.

- The United States will have five times as many fintech unicorns in 2023 than the United Kingdom.

- Seven out of 10 of the largest fintech firms in the world are located in China and the United States.

- According to Deloitte, global FinTech revenue is increasing at a Compound annual Growth Rate (CAGR), of 11.7%.

- The global FinTech revenue, approximately EUR 92 billion (USD 188 billion) in 2018, is expected to increase to EUR 188 billion (USD 188 billion) by 2025.

- Fintech apps have revolutionized traditional banking in countries other than the USA. Numerous mobile app development companies in the USA have contributed to this revolution.

List of Top Fintech App Development Companies in the USA

Below we explore the top Fintech app development companies you can consider approaching and getting the work done.

1. A3Logics

A3Logics, a prominent Fintech software development company, excels in providing customized solutions committed to swift, reliable, and technical debt-free practices–facilitating seamless technology for scalable business growth. They are passionate about helping organizations in diverse industries, as shown by their award-winning solutions.

A3Logics is renowned for its scalable, robust, and agile applications. This allows project managers to transform business processes efficiently.

A3Logics is one of the USA’s most reliable Fintech software development companies. We offer expertise that will elevate your business.

A3Logics’ Financial Software Development Offerings:

- Custom FinTech Software

- Wealth Management Software

- P2P Lending Software

- Crowdfunding Portal

- Alternative Financing Solutions

- Software for loan management

Why choose A3Logics to develop your financial software?

- Quality Solutions

- Digital Advanced Solutions

- Different Engagement Models

- Sustainability and Scalability

- Agile Methodology

- End-to-end security and compliance for FinTech apps

2. Nimble AppGenie

Nimble AppGenie is a leading Fintech app development company with ample years of experience in delivering the best Fintech Solution. They understand the ever-evolving needs of the market, which is why they develop solutions that meet user demands and anticipate future trends.

Besides, their teams of experts are passionate about serving businesses by utilizing cutting-edge technology with innovative design that drives user engagement & loyalty.

Service Provided includes developing:

- Custom Fintech App Solution.

- Fintech API integration services.

- Loan Lending Platform.

- Insurance Apps.

- Digital Wallet App Solution.

- Blockchain

- Stock Trading Platform

- Fintech App Maintenance and Support.

3. KindGeek

KindGeek is a fintech software company that offers a wide range of offerings. They are driven by their business philosophy and values, which include transparency and trust. KindGeek provides end-to-end fintech app development services, including everything from concept to deployment.

They emphasize a product-oriented strategy while advocating a discovery phase that can save as much as 20% on development time. KindGeek’s commitment to design-thinking ensures that digital banking and FinTech software is customer-centric and offers an excellent user experience.

Offerings:

- Digital Banking Solutions

- E-Banking Systems

- Mobile Banking

- Cybersecurity services

- Blockchain Platform

- Fintech mobile apps, Fintech web applications

- Insurance Software

- Payment Solutions

4. Altamira

Altamira is a leader in customizing digital solutions to meet the unique needs of companies worldwide. The firm has a proven track record of providing more than 700 solutions worldwide. It prioritizes building lasting commercial relationships.

Altamira, a FinTech company, excels at various offerings, including web and software development. It also offers user experience design and development of mobile applications. Altamira’s key focus areas include healthcare, finance, and real estate. These sectors demonstrate the company’s commitment to excellence within the IT industry.

Offerings:

- Cyber Security

- IoT Development

- Insurance software for banking

5. Fireart Studio

Fireart Studio is a leader in the financial technology industry, with a team of more than fifty JS experts and designers. They are well-versed in the technical aspects of creating reliable tech products and contribute to the company’s success.

Fireart Studio is known for its ability to create digital products right from the start. It also demonstrates its expertise in providing comprehensive software solutions in the financial sector.

Offerings:

- Exchange-traded funds

- App for Banking

- Software development

- Cryptocurrency

6. IT Craft

IT Craft is the premier destination for robust online trading software. They specialize in enterprise mobile application development and ensure compliance with regulatory standards.

Their expertise includes creating platforms for currency and cryptocurrency exchange. IT Craft has a proven track record and is a trusted partner to those who want to master the complexities of online trading.

Offerings include developing:

- Mobile Apps

- Custom Software

- IT Staff Augmentation

7. MIQUIDO

Miquido is a fintech software company that offers end-to-end solutions, including strategy, market research and design, development, and support. They can deliver products that meet the needs of their customers thanks to this holistic approach.

Miquido, one of the best mobile app development companies in the USA, specializes in Machine Learning and Data Science integration, integrating advanced features such as chatbots, voice assistants, and insurance products using these technologies. The company is experienced in developing diverse financial products, such as trading platforms and investment apps. It also has experience creating banking applications and digital wallets.

Offerings include developing:

- Banking Apps

- Digital Wallets

- Mobile Banking Apps

- Insurance Apps

- Financial Apps

- Financial Mobile Platform

8. DMI Finance

DMI Finance combines technology with personalized investment strategies and diversified portfolios and is a major wealth-building player. The company provides tailored lending solutions for both businesses and individuals. The company’s customer-centric focus extends to specially designed portfolios and investment options.

The addition of personalized digital advice improves the experience. DMI Finance is a global leader in finance, delivering consistently exceptional customer service.

Offerings:

- Corporate Governance

- Data Science Solutions

- Apps for mobile banking

- Cloud Engineering

- Bank project development

9. S-Pro

S-Pro is a leading software engineering and IT consulting service provider for startups, banks, and financial firms. For fintech experts, S-Pro provides dedicated teams with domain expertise that fuels their client’s growth.

S-Pro is recognized as one of the leading fintech software companies. Their expertise spans digital banking solutions, lending software, crypto wallet exchange platforms, stock trading, insurance, and other financial services. They are experts in blockchain technology and deliver both white-label and custom solutions.

Offerings:

- Developing Digital Banking Software

- Building Loan Management Tools

- Creating E-Commerce Payment Systems

- Crypto-Exchange Platform Development

- Nft marketplaces

- Crypto Wallets and Extensions

- Insurance

- Blockchain Development

- Stock Trading Platforms Development

10. Geniusee

Geniusee is a leading mobile app development firm that caters to companies of all sizes – from startups to large market players. They are committed to creating sharp, seamless software tailored to the needs of every client. Geniusee’s expertise spans sectors like FinTech, EdTech, and Retail. They provide tech solutions that are aligned with the requirements of different businesses.

Offerings:

- Website development

- Building Custom software

- Developing AI

- Cloud Consulting

- Mobile app development

11. Codemech Solutions

Codemech Solutions is a leader in integrating agile methodologies such as Scrum and Kanban into ongoing projects, which ensures rapid contributions to project acceleration. The team is not only proficient in JavaScript but also agile practices. They value transparency at every stage of the process.

Codemech Solutions is committed to a safe, clean work environment fostering professional growth.

Offerings:

- Cloud Consulting

- Application testing

- Online payments

- Trading platform

What are the challenges in developing fintech apps and how to resolve it?

Cash advance apps Like Empower have changed the way people interact with money. From Coinbase to Chime, MoneyLion to Robinhood.

Here are some statistics showing why investing in fintech software companies is smart.

- Deloitte estimates that the fintech sector will be worth $180 billion by 2022. This number is expected to rise to 213 billion dollars by 2024.

- Since 2015, fintech app investment has grown by 3.5x. The total investment at the end of the last year was $210 Billion.

- Fintech adoption is rapidly increasing. Digital banking in the USA has been steadily on the rise. In 2018, 61% of Americans were using digital banking. In 2022, will reach 65.3%.

- Visa is one of the leading fintech app developers. It is the leader, with a market cap of 477.95 billion.

Statistics clearly show that custom mobile app development companies will play a major role in the future of finance. If your company hasn’t yet invested in custom app development firms, now is the time.

Must-Have Features for Fintech Applications

After examining the different types of apps and the possible challenges in creating them, we can now discuss the development of financial apps. The best way to begin is by listing the FinTech app development features that these apps must have. We won’t discuss every feature, as they can vary greatly depending on the type of app. Instead, we’ll focus on those aspects that are essential for any finance app, as per the top fintech mobile app development company.

Clear UI/UX

The design of an application is just as important, if not more, than its functionality. The finance industry is no exception. People tend to stick with visually appealing and easy to use apps. The application should also be easy to use. It should be designed per the customer’s expectations and contain informational content to streamline navigation.

Here are some general guidelines to optimize UI/UX Design:

- Avoid using symbols or colors that are too vibrant for your customers. This will most likely make your customers feel uncomfortable and ultimately drive them away.

- Overcomplicating things is a bad idea. Even if your app has advanced features, it should still be simple to use.

- The download speed should be high. In a highly competitive market, loading anything that takes longer than 2 seconds will not be successful.

- Transferring money and accessing your bank account shouldn’t be a lengthy process. The more intuitive and simple the process is, the better.

App Security

Fintech software ROI, as we have mentioned, must meet security requirements to protect customer data from unauthorized access and breaches. Your app should include biometric authentication or two-factor verification, encryption, blockchain, or other advanced security protocols to safeguard sensitive data.

Voice Assistance

Digital experiences are constantly improving. Voice technology is a great way to achieve inclusivity. Voice technology can be used in fintech apps and banking to provide a more intuitive experience for your customers. It can also help you increase your customer base by removing barriers.

Payment Gateway

Fintech mobile applications have one thing in common: they all involve payments. A secure and efficient payment gateway is essential for any transaction, whether paying bills or transferring money from one account to another. When building mobile fintech apps, consider the offerings to make money transfers quick and easy. You can use APIs, PayPal, Stripe, or other services.

Dashboards

Dashboards are a part of UI design. The dashboards are a great way to give customers a visual representation of their expenditures. Consider what you would like to see on your dashboard. Payment history, account balances, and upcoming bills can all be displayed. Savings goals, investment portfolios, or FinTech business ideas for 2025 in the past may also be included. A well-organized dashboard will give users an overview of their financial status at a glance and can boost engagement.

Alerts and Notifications

Financial applications should take full advantage of notifications. Alerts and notifications allow users to stay on top of their finances and act quickly in the event of any discrepancies. They also allow businesses to interact with users and increase conversions and retention rates.

QR Code Scanner

The QR code scanner can be essential in mobile banking app development. A QR code scanner is a great alternative to users entering numbers, which can be a pain for many people. Instead, the QR scan allows quick and easy transactions by simply touching the screen. This feature can make the app more attractive to customers by improving the user experience.

Machine Learning (ML)

Machine learning solutions have become a necessity for fintech app developers. It can predict users’ future behavior and preferences by analyzing large amounts of data. It will then offer them tailored financial advice, whether they plan to sell, buy, or invest.

Integration with Banks

Fintech is not an independent bank. The banks are a big factor. A large majority of fintech companies integrate with banks via APIs. This allows them to access users’ accounts, transaction history, and other important financial data.

Before you begin coding, make sure you have gone through your pre-flight checklist. The development process is roughly divided into the below steps.

How to Develop a Fintech App?

Below are the steps that you must consider when investing in top FinTech app development companies. Check it out:

Choose your Niche

You should have figured it out by now — or you wouldn’t even be reading this article. A business analyst may be needed to search the market for niches or opportunities others may have missed. You are ready to begin once you have an idea.

Define your Monetization Model

Do not try to include as many monetization options in the MVP. Select the best model for your pilot, and then add others as you discover new opportunities and identify new revenue streams. For now, choose the option that makes the most sense to you and requires the least effort.

Understanding Compliance

Compliance in custom mobile app development for fintech goes beyond Google Play and Apple App Store guidelines. You must do compliance research based on the target market to identify legal obstacles and restrictions. Once compliance is identified, you can adjust your development processes to ensure compliance. It may also mean more stringent quality control practices emphasizing security.

MVP Features to be Agreed Upon

Define key values and the user stories that form the functional scope for the first release. Don’t allow scope creep to create delays. Keep your app lean and freeze it. You can expand the app’s functionality based on customer feedback, A/B tests, and your evolving vision.

Partner with a Vendor

Hiring fintech app developers is a good idea if you do not have the internal resources or expertise to deliver your product. They can suggest open-source software components to get you up and running quickly and efficiently.

Launch and Get Feedback to Improve

The chances of getting the software right on the first attempt are low, whether it’s a budgeting app, an innovative payment app, or another type of financial application. Iterative software product development is an important part of the process. Be prepared to revisit your scope to make improvements and optimize it.

Fintech App Development Cost

The average cost of developing a basic fintech app ranges between $15,000 to $50,000. This includes user registration/authentication, account management, basic financial calculations, etc.

Adding more features and complexity can increase the cost. For example, an app with online money transfer, bill payment, integration of multiple bank & credit card accounts, etc., costs between $50,000 to $150,000.

An advanced app offering financial investment options, budgeting tools, expense tracking, etc., developed natively for both Android and iOS, requires $150,000 – $350,000 on average. This includes the cost of a dedicated development team, which could consist of 5-10 developers working full-time for 3-6 months.

Other costs involve app design, ongoing development & maintenance in the later stages. Integrating advanced tools like AI for personalized recommendations and blockchain for transactions increases cost significantly. The use of technologies like AR/VR also impacts the budget.

The geography of the development team also determines the cost, as offshore teams from countries like India charge much less than using local resources. Regular bug testing, feature enhancements, and security audits are required, too, for smooth app functioning in the long run. The budget depends on various technical requirements, platform choices, and targeted features.

Role of App Development Partner in Fintech Startup

Fintech mobile app development is essential for any business investing in the fintech sector. Finance software companies with experience can develop top-notch apps and solutions in the finance sector, emphasizing security and user engagement.

Fintech companies that are aware of the latest trends and use cutting-edge technology can create products that are not only user-friendly but also highly engaging for users while maintaining safety and efficiency.

Our next section will help you find the top fintech app development companies to keep in mind.

>Tips & Tricks on Choosing the Right Finance App Development Companies

These tips will help to select the best fintech app developers to achieve exceptional results with financial app development.

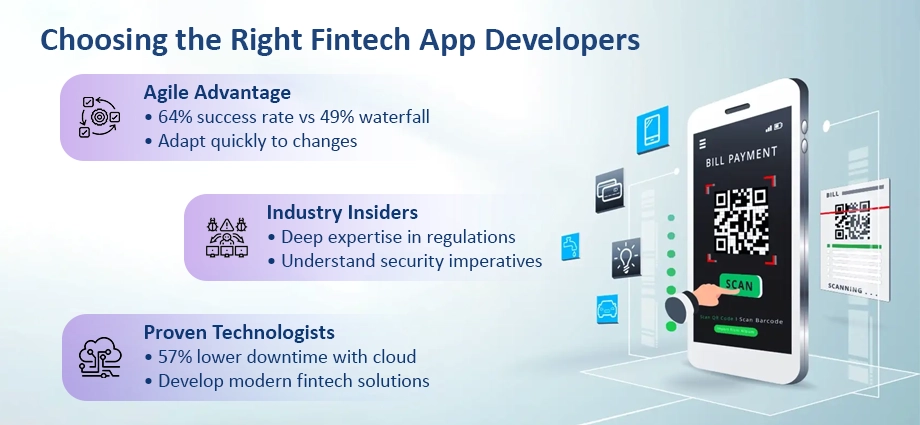

Agile Development Approach

Digital products can be built using a variety of models, including Agile, Waterfall, and Scrum. FinTech is known for its fast pace of innovation and change, so payment businesses must embrace innovation to stay competitive.

Agile methodologies are flexible and efficient, allowing companies to quickly adapt to market changes.

Agile software development principles for FinTech application development :

- The people-centered approach instead of process-centric

- Customers and their feedback are important to improve.

- Work in small sections (usually called sprints).

According to Ambysoft’s 2013 Survey on Project Success Rates, the agile approach has a success rate of 64%, which compares with the 49% of the waterfall method.

Technology Experience

You would trust your life in the hands of an experienced pilot. You want your project to be in capable hands with a FinTech software provider who has extensive experience developing FinTech apps. A technology partner who understands the intricacies of financial technology will be able to navigate the regulatory landscape, implement the latest security measures, and create a user-friendly platform tailored to the needs of the industry.

FinTech Development

Develop your PayTech product more quickly with A3Logics.

According to a report by McKinsey, cloud computing can reduce the downtime for migrated applications by up to 57% and reduce costs related to technical breaches.

FinTech iOS app development companies should, therefore, adopt the latest technologies and develop modern products.

Domain Expertise

Fintech apps need to adhere to industry standards and best practices. An experienced development partner is aware of the latest innovations and trends in the financial sector and will ensure that your app remains relevant and competitive.

This expertise is more than just technical knowledge; it also includes a thorough understanding of the challenges and opportunities unique to the financial industry. In the financial sector, regulatory compliance and security are paramount. A development partner who has expertise in this field must have a thorough understanding of regulations and be able to implement robust security measures.

A3Logics’ team has years of experience in developing FinTech software . They can help you bring your vision for a financial product to life. Our development team is dedicated to FinTech and understands it from the inside out. They anticipate challenges, develop innovations, and are part of a highly skilled and experienced team.

User-oriented App Development

The user-centered design method places the user in the center of design and goes beyond aesthetics, focusing on usability and accessibility.

Custom fintech app development companies often place the technical development process above business goals and user needs. However, the main objective of any app development project is to solve users’ problems. It is important to select an app developer who focuses on creating solutions that are tailored to the needs of the users, rather than just focusing on the wishes of the client.

Airbnb is a great example of successful user-centered design. Airbnb’s app was developed with the user in mind, making it easy to search listings, contact hosts, and book.

Portfolios and Case Studies

Reviewing previous projects and case studies can give valuable insight into the expertise and capabilities of a company. If you want to be sure that a company is experienced in your niche, look for a portfolio with various financial applications.

A3Logics is a FinTech company that will facilitate mobile money payment, leverage telecom wallets, and improve the financial inclusion of the unbanked. A3Logics successfully collaborated and developed a solution with mobile network providers.

Conclusion

FinTech apps are growing in popularity, and choosing the best fintech app developer is important. You should consider key factors when choosing, such as the company’s development approach, technological expertise, experience, and commitment to user-centered designs.

A3Logics has over a decade of experience in FinTech app development. Our offerings can help you accelerate the launch of your product.

FAQ

What is the cost of developing a fintech application?

>/span>

The Fintech software development cost depends on many factors, including the complexity of your project, team size, where you are located, technology stack, and type of application.

You can use pre-developed software to save time and money and speed up development. A3Logics provides a Platform that can be used to build Fintech products.

What are the challenges in developing Fintech applications?

FinTech apps must adhere to strict financial regulations, including data security standards. FinTech apps must comply with strict financial regulations and data security standards.

How do you choose the best Fintech company to work with?

Prioritize technological experience when choosing the best fintech Android app development companies in the business. Also, look for a partner who understands the fintech industry. Be sure they are knowledgeable and familiar with trends, regulations, and the financial industry’s security. Check the company’s portfolio and case studies to determine their experience.

How do you develop a fintech app with Flutter?

Flutter is an ideal choice for developing fintech apps because it can write business logic once and build apps for iOS and Android simultaneously. Developers can use Flutter’s material widgets to create an intuitive UI and plugins for integrating financial services like payments.

How do you develop a fintech app with React Native?

React Native enables building cross-platform fintech mobile apps using JavaScript and React. Developers can leverage React Native’s large ecosystem to incorporate payment gateways and banking APIs. The framework facilitates quick development and easy maintenance of feature-rich, high-performance fintech apps.