Did you know that more than 70% of financial organizations today use Machine learning in finance for predictive analysis?

The world of finance is using technologies to completely transform the way things work. So, AI and ML are making the primary contributions to solving complexity in the finance industry. With rising data volumes, it is high time for businesses to consider machine learning in finance. This will help them drive innovation and efficiency in the fintech market.

If you are thinking about investing here, then below we have it all sorted for you in detail. Read on as we talk about AI development companies that can help you shape the future of financial services.

Table of Contents

Machine Learning in Finance: A Market Analysis

Machine learning in finance is changing how financial institutions run, assess risk, engage with consumers, and follow rules. ML for Finance offers more accurate results, real-time decision-making, and services by using complex algorithms and enormous data sets. This change is not only improving operational efficiency but also creating fresh possibilities for expansion in an increasingly digital environment.

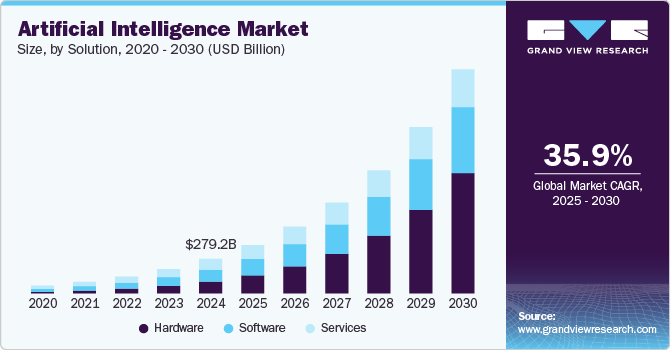

The growth of the worldwide Machine Learning in Finance industry is unmatched. Valued at USD 7.52 billion in 2022, the market is expected to grow to USD 38.13 billion by 2030, showing a strong CAGR of 22.5% from 2023 to 2030. Other projections point to even quicker expansion, with the market expected to rise from USD 2.7 billion in 2023 to USD 41.9 billion by 2033, hence indicating a compound annual growth rate (CAGR) of 31.8%. Below are the essential aspects that show how it will drive the market. Check it out:

- Improvements in data collecting and processing technology across banks and financial institutions.

- Increasing financial companies’ investments in artificial intelligence and machine learning.

- Increasing consumer desire for data-driven, tailored financial services.

- Navigating difficult worldwide markets calls for strong predictive analytics and real-time insights.

Financial institutions using Machine Learning for Finance claim remarkable outcomes. For instance, investment companies including ML into their analysis have reported a 20% increase in forecasting accuracy, hence affecting risk management and investment plans. ML-based fraud detection systems have also raised detection rates by 50 to 90% and cut investigation times by as much as 70%.

Large banks are no longer the only ones leveraging Machine Learning in FinTech. In fact, from established enterprises to emerging FinTech startups, organizations across the board are now adopting machine learning. As a result, they are disrupting traditional models, streamlining operations, and delivering innovative products tailored to evolving customer needs.

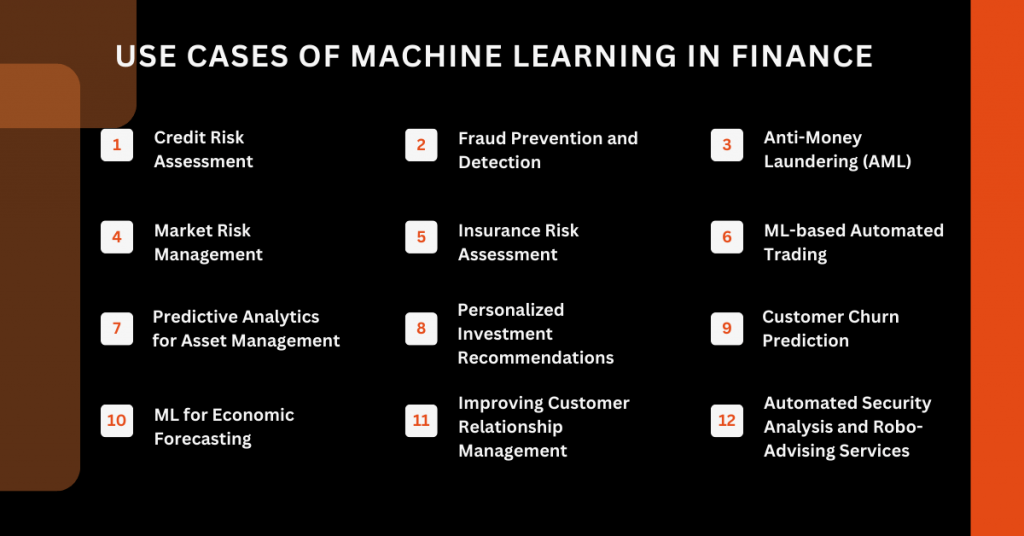

Exploring the Use Cases of Machine Learning in Finance

When you are investing in the world of Machine Learning in Finance, you must know that it comes with a wide range of applications. Every single application comes with its own set of challenges and opportunities in the sector. Below are the most impactful ML Use Cases in Finance:

1. Credit Risk Assessment

ML algorithms more precisely evaluate than conventional models by sifting through enormous information, including non-traditional data sources. ML for Finance lowers human bias and enhances default predictions by finding subtle patterns and nonlinear correlations. This allows creditors to increase credit availability to underprivileged groups and enable quicker, more educated choices.

2. Fraud Prevention and Detection

Fraud detection is being revolutionized by machine learning in finance. Unlike static rule-based systems, ML models discover developing fraud tendencies in real time by continuously learning from new data. Major banks utilize machine learning to examine transaction characteristics including time, location, device, and user behavior, detecting questionable activity right away and lowering false positives. ML-based systems can identify as much as 95% of fraudulent activities, hence greatly reducing financial losses and inquiry expenses.

3. Anti-Money Laundering (AML)

By improving pattern identification and anomaly detection, machine learning and deep learning are changing AML tactics. Even when criminals change their methods, ML-driven transaction monitoring systems scan enormous amounts of data to find unusual actions and possible money laundering plots.

4. Market Risk Management

ML algorithms simulate scenarios, forecast price changes, and evaluate risk exposures using sophisticated market data. This capacity lets financial organizations react quickly to market developments, maximize portfolios, and reduce losses. In high-frequency trading settings, where milliseconds can have a major impact, ML for Finance is very important.

5. Insurance Risk Assessment

Insurers now deploy multi-modal ML models that analyze IoT sensor data (telematics in vehicles, smart home devices) alongside traditional underwriting factors to dynamically adjust premiums. Graph neural networks expose organized fraud rings by mapping relationships between claimants, medical providers, and repair shops. Reinforcement learning automates claims adjudication, with some systems achieving sub-minute settlement times while maintaining >90% accuracy in fraud detection through anomaly detection algorithms that flag inconsistencies in claim narratives and supporting documentation.

6. ML-based Automated Trading

Quantitative funds utilize convolutional neural networks to analyze limit order book dynamics and news sentiment for microsecond-level arbitrage opportunities. Reinforcement learning enables self-adjusting strategies that shift between momentum and mean-reversion approaches based on volatility clustering patterns. Latency-sensitive ML architectures now execute trades within 5 microseconds of signal detection, with ensemble models combining macroeconomic indicators, satellite imagery, and social media trends to achieve 15-20% annualized returns in volatile markets.

7. Predictive Analytics for Asset Management

Asset managers employ Transformer-based architectures to process earnings call transcripts, SEC filings, and geopolitical news for alpha generation. Federated learning models analyze distributed datasets (e.g., retailer transaction aggregates) without centralized data pooling, preserving privacy while predicting consumer sector trends. Neural ODEs (Ordinary Differential Equations) model non-linear market responses to interest rate shocks, enabling proactive portfolio rebalancing during economic policy shifts

8. Personalized Investment Recommendations

Next-gen robo-advisors use Bayesian optimization to modify portfolios depending on real-time life events identified via spending patterns (e.g., marriage, home purchase). While NLP-driven interfaces clarify complicated tactics using natural language generation according to client financial literacy levels, deep reinforcement learning simulates 10,000+ market crash scenarios to adapt risk exposure. For values-based portfolio tailoring, hybrid models increasingly mix conventional risk-return criteria with ESG measures.

9. Customer Churn Prediction

Banks utilize survival analysis ML, incorporating:

- Behavioral biometrics: Mobile app navigation patterns and session duration analytics

- Economic stress signals: Overdraft frequency and paycheck deposit timing variances

- Competitor activity: Real-time analysis of rival promotional campaigns

- Advanced gradient-boosted models trigger hyper-personalized retention offers (e.g., pre-approved loan rate reductions) when clients exhibit early attrition signals, achieving 15-20% churn reduction in retail banking segments.

10. ML for Economic Forecasting

Nowcasting systems blend high-frequency data (credit card transactions, web search trends) with traditional indicators using mixed-data sampling (MIDAS) architectures. Causal ML disentangles supply chain shocks from demand-side inflation drivers through counterfactual analysis. Central banks now test neural differential equation models that simulate non-linear interactions between labor markets, monetary policy, and commodity prices, outperforming DSGE models in post-crisis recovery forecasting.

11. Improving Customer Relationship Management

Predictive CRM engines employ temporal fusion transformers to anticipate needs: flagging unusual medical expenses to offer insurance top-ups automatically. Sentiment-aware routing directs frustrated clients to specialized agents using real-time voice tone analysis. Graph ML maps client influence networks to identify key opinion leaders for targeted loyalty programs, while reinforcement learning optimizes cross-sell timing based on life-stage triggers detected in transaction data.

12. Automated Security Analysis and Robo-Advising Services

Using domain-specific LLMs to cross-reference financial disclosures against 10,000+ SEC rules, regulatory compliance bots highlight inconsistencies in real-time. Under IPCC climate scenarios, climate stress-testing models use Monte Carlo simulations to forecast portfolio resilience. While GPT-class interfaces produce plain-language audit reports for stakeholder evaluations, multi-modal learning uses satellite imagery (factory emissions), earnings call sentiment, and supply chain data for ESG grading.

Key Benefits of Applying Machine Learning in the Financial Industry

The adoption of Machine Learning in Finance delivers a multitude of benefits:

Enhanced Decision-Making

ML algorithms analyze complex datasets, uncovering patterns and insights that improve forecasting, risk assessment, and investment strategies.

Operational Efficiency

Automation of routine tasks-such as data entry, fraud detection, and compliance checks-reduces costs and frees up human resources for higher-value activities.

Improved Risk Management

ML models provide real-time risk assessments, enabling institutions to respond swiftly to market changes and emerging threats.

Superior Fraud Detection

Machine Learning for Finance detects sophisticated fraud schemes that evade traditional systems, safeguarding assets and reputation.

Personalized Services

ML-driven solutions deliver tailored financial advice, product recommendations, and customer support, enhancing satisfaction and retention.

Regulatory Compliance

Automated monitoring and reporting streamline compliance with evolving regulations, reducing the risk of penalties and reputational damage.

Now, when you are clear with the benefits, let’s understand how you can implement it right to make the most of it.

Implementing Machine Learning in FinTech: Challenges and Solutions

Although the advantages are significant, applying Machine Learning in FinTech and more general financial services presents significant difficulties:

- Data Quality and Integration: ML models require large volumes of high-quality, structured, and unstructured data. Integrating disparate data sources and ensuring data accuracy can be complex and resource-intensive.

- Model Risk and Validation: The complexity of ML models can amplify existing model risks. Financial institutions must develop robust validation frameworks to ensure reliability and transparency.

- Regulatory and Ethical Concerns: The use of ML in decision-making raises questions about fairness, accountability, and explainability. Regulators increasingly demand transparency in how ML models make predictions and decisions.

- Cybersecurity and Data Privacy: As ML systems process sensitive financial data, robust cybersecurity measures and privacy controls are essential to prevent breaches and comply with regulations.

- Talent Shortage: There is a growing demand for skilled professionals with expertise in ML for Finance, data science, and regulatory compliance.

Solutions

- Partnering with an AI Development Company or leveraging AI Consulting Services can help address technical, regulatory, and operational challenges.

- Investing in Machine Learning Development Services ensures access to the latest tools, frameworks, and best practices.

- Continuous training and upskilling of staff, along with fostering a culture of innovation and compliance, are critical for successful ML adoption.

The Future of Finance: Powered by Machine Learning

Machine learning in finance will drive future financial development just as much as anything else will. Among the main trends influencing the next ten years:

- Explainable AI and Ethical ML: As regulatory scrutiny intensifies, financial institutions will prioritize explainable and ethical ML models to ensure transparency, fairness, and compliance.

- Integration with Blockchain and IoT: ML will increasingly intersect with blockchain for secure transactions and IoT for real-time data collection, expanding the scope of ML Use Cases in Finance.

- Hyper-Personalization: Enhanced data analytics will enable hyper-personalized financial products and services, driving customer loyalty and differentiation.

- Real-Time Analytics and Decision-Making: Advances in ML algorithms and computing power will enable real-time analysis of vast data streams, supporting instant decision-making in trading, risk management, and customer service.

- Democratization of Financial Services: ML-driven robo-advisors and digital platforms will make sophisticated financial services accessible to a broader population, fostering financial inclusion.

What Expertise does A3Logics Offer for Implementing Machine Learning in the Financial Sector?

A3Logics, a top AI development company, specializes in machine learning in finance. A3Logics provides end-to-end Machine Learning Development Services customized to the particular requirements of banks, FinTechs, insurers, and asset managers using a staff of seasoned data scientists, engineers, and financial professionals. The following are the necessary skills we can assist you with. Take a look.

A3Logics’ expertise includes:

- Custom ML Model Development: Designing and deploying ML models for credit risk assessment, fraud detection, AML, trading, and more.

- AI Consulting Services: Strategic advisory on ML adoption, regulatory compliance, and digital transformation.

- Data Integration and Management: Ensuring seamless integration of structured and unstructured data from multiple sources.

- Regulatory Compliance Solutions: Implementing explainable and auditable ML models to meet global financial regulations.

- Ongoing Support and Optimization: Continuous monitoring, retraining, and optimization of ML models to ensure peak performance.

Working with A3Logics helps financial companies speed their digital transformation, open fresh income sources, and remain ahead in a fast-changing industry.

Final Thoughts: Machine Learning in Finance

In this blog we took a deep dive into the use of Machine Learning in Finance and how it is reshaping the industry. Not only this, it plays a key role in driving innovation, efficiency, and security across different industries that includes banking, insurance, asset management, and FinTech. So, if you are thinking about making the most out of this technology in the respective market, then you can always consider connecting with the top AI Development Companies in the business.

In fact, if you are looking for a reliable name in the business to help you with AI Consulting Services then you can always consider connecting with A3Logics. You get all the assistance you need. Good luck!