“The challenge for financial firms isn’t getting DIGITAL; It’s enhancing customer’s confidence in availing digital banking services.” The modern consumer wants many more services available from the comfort of their own home. This is why money lending app platforms which provide easy, instant credit and loan facilities that require only minimal physical documentation and speedy loan approvals are gaining popularity.

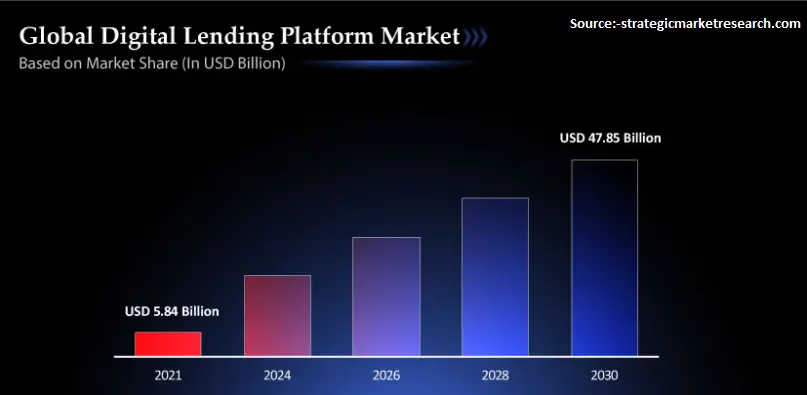

The data reveal that the world’s market for digital lending platforms was 5.84 billion dollars in 2021. It is projected to increase at an annual rate of compound growth (CAGR) that is 25.9 percent between 2022 and 2030.

In this post, we’ll give you the most important details to build a lending application along with the basic attributes it should include and the technology stack that is required and a few examples.

Learn about developing a money lending app as per the information by on demand app development company experts.

What is a Money Lending App?

A mobile application for money lending is a program which allows users to get loans or to borrow instantaneously on demand with digital technology.

Money lending applications connect borrowers and lenders. They offer a variety of loans like business, personal, auto loans, or mortgages. They are also separated according to the kind of lender that provides loans to both organizations and individuals:

- Banks

- Credit Unions

- Individuals

Banks, as a classic supplier of financial products, are able to develop loan lending applications since they facilitate the process, thereby improving the service quality and the amount of loans. There is a rising demand for alternative platforms, such as the peer-to-peer lending app. Through these apps, people can lend money and invest in exciting projects, or receive more lucrative loans than what they could get through banks.

Most of the time P2P lending platforms can also be effective for fundraising and charity. Before we can answer the query “how to create a loan app?”. Let’s look at the present situation in the world market of loans on mobile devices.

The global economy is expanding every year. There is a trend upward of 3.2 percent in 2022. Digitalization can also help the financial sector expand, since it boosts the amount of loans issued as well as reduces risk and enhances customer services. The 2021 world market for platforms that lend money was close to six billion dollars. Analysts anticipate this amount to increase by 25% annually until 2030.

Money Lending App: Present Market Status

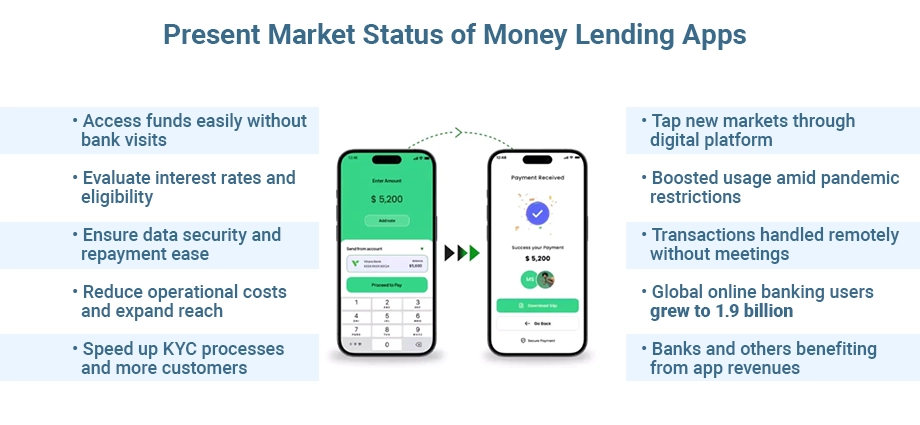

The app for money lending is a solution in digital form as per custom mobile application development company. It allows you to take funds from any financial institution in your nation.

This app enables users to access money easily and without the need to visit the banks or loan broker or other financial institutions or borrow money from family members or friends.

It lets you evaluate the interest rates available and determine which one is suitable for your needs best, and determine whether you’re eligible to receive the loan. The greatest benefit is that you are certain that your data is safe, and you will be able to repay the loan on a similar application.

Lending mobile application consulting services is advantageous not only for customers. However, it can also help lenders to reduce their operational expenses, speed up the KYC process, and simultaneously provide many clients, and tap into new markets.

Alongside pushing digitalization, the coronavirus epidemic has also affected the business of loan lending mobile applications. The number of people using the best money lending apps has grown by 25% because more people are capable of handling administrative tasks without needing to meet face-to-face. In the year 2020, the number of people who utilize online banking services around the world has risen to 1.9 billion.

In the past few years, banks as well as other financial institutions, such as credit unions, insurance companies and associations took part in the gains from the lending app market.

What Global FinTech Market Report Says?

The future of fintech is an interesting one as per top mobile app development companies in USA. Here are some fascinating Global FinTech Market Statistics for creating a clear picture. According to Statista;

- Between 2023-2027, the total amount of revenue generated by the world’s FinTech sector is predicted to grow annually in the amount of 125.18 million U.S. dollars.

- The projected revenue estimate for the global FinTech sector will be 294.5 million U.S. dollars by 2027.

- International FinTech market forecast of 2023-2028, with a CAGR 16.8 percent, to be USD 492.81 billion in 2028.

A global FinTech market research report shows an enormous opportunity for entrepreneurs working in the FinTech area. E-wallets, banking wallets, and various other FinTech applications are quickly growing. This is the reason why we’re seeing an increase in the demand of FinTech application development for mobile devices, as well as similar services.

Types Of FinTech Business Applications

The above global FinTech market statistics reflects the potential of the same in the present and in the near future. However, before you begin looking to find “how to develop a FinTech app” it is necessary to have a clear idea of what kind of FinTech business applications you would like to create. In this section, we’ve provided the most well-known FinTech business app types to make it easier for you.

Banking App

Instant money lending apps like Dave and web-based portals improve customer experience by providing assistance 24/7. They allow users to handle everything effortlessly by using a mobile application. Furthermore, the upgraded security features enhance users’ confidence when it comes to transfer funds as well as utilizing other internet-based banking options. The most popular banking apps are:

- Revolut

- Chime

- Monobank

Stock Market App

This app for the stock market is one type of FinTech application that allows users to keep an eye on what’s happening at an exchange. With advanced capabilities, these apps allow users to get valuable information for making informed choices before making investments in or trading stocks. Stock trading apps that are popular include;

- Robinhood

- Wealthfront

- Webull

Insurance (InsurTech)App

These kinds of FinTech applications are created to meet the needs of insurance for customers. The integration of modern technologies such as AI & ML empowers businesses to provide customized insurance plans to consumers based on their preferences and requirements. The most popular insurance apps are:

- Jerry

- myCigna

- MyHumana

Hire A3Logics Now and Get your Money Lending App Developed to Perfection!

Lending App

The process of creating and evaluating loans has been transformed into loan applications. Digital software for lending makes it simple to manage loan requests efficiently and simple transactions between borrowers and lenders. This is a great opportunity for financial institutions to invest in FinTech apps to broaden their customer base. This can improve the lending experience of their customers as per fintech app development company experts.

- Brigit

- Payday Advance Apps Earnin

- MoneyLion

Personal Finance Management Apps

These kinds of FinTech software are made to aid users in effectively managing their finances. In conjunction with the most powerful technology like AI and ML, the apps that lend you money are able to provide investment advice based on data. This is done to assist users in achieving their financial goals that they have set. Most popular financial management apps are:

- YNAB

- Intuit Mint

- Goodbudget

Decentralized Finance (DeFi) Apps

Like the name implies, financial apps that are decentralized eliminate the requirement for a central financial system to access financial services. DeFi apps are developed to empower users and give the user more control over their financial affairs. The most popular decentralized finance apps are the following:

- Coinbase Wallet

- Binance

- Nexo

Tax Filing And Management Apps

Tax filing is usually thought of as to be one of the more difficult tasks that a common person can undertake. Software for tax management and filing tax eliminates the requirement for taxpayers to comprehend the complex tax system, and efficiently complete tax returns without a single error. Simple user interface and simple-to-use features simplify the entire tax filing procedure. Tax management and filing applications include the following:

- Tax Filing Apps TurboTax

- TaxAct

- H&R Block

E-Wallet App

Many people love using e-wallets such as Apple Pay, Paypal, and so on. for fast as well as secure transactions. Businesses who want to start getting on the first step of creating solid financial systems must figure out the eWallet App Development costs. E-wallet apps that are popular include:

- eWallet App PayPal

- Samsung Pay

- Alipay

Investment Apps

These are the latest FinTech software development solutions that are revolutionizing the way people make their money. Investment apps do away with the requirement for intermediaries to help make investments, thereby giving lower commissions and speedier changes.

The integrated AI along with ML tools help users in making informed financial decisions and efficiently manage the risks associated with an investment. Most popular investment apps include the following:

- Acorns

- Robinhood

- NerdWallet

How Do Lending Apps Work?

The process of the best loan lending apps is fairly simple and operates by utilizing the credit card idea.

There are several elements involved in a lending application as per companies providing mobile app development services in USA.

Step #1: Onboarding

When you download the lending app on your device via the app store and then open it, you’ll land on the homepage of the app.

The initial step to take (app users on this page) is to sign-up by clicking here. Then, you can create your account as a user. It is necessary to enter specific information including names, your phone numbers as well as email address and social handles.

Once you have done this, you are able to sign in using your credentials and begin exploring the application.

Step #2: Select The Loan Details

You will be presented with an option screen for loans. Here, you will be able to review the various loan categories the app provides.

Choose the loan category you prefer. Then, add the interest rate for the amount you’d like to borrow. Then choose the one that is most suitable. Finalize the term that you will be able to repay the loan.

Step #3: Verification & Validation

This is a process which determines your creditworthiness for the loan Your credit score, as well as other financial information.

It will then take you to a screen on which you can input details such as address as well as education and employment history as well as earnings details.

Step #4: Connect Your Bank Account to The App

You must connect your bank account to the app to ensure that the loan amount gets transferred automatically to your bank and the app will notify you.

In the same way in the event of the repayment of a loan, a predetermined amount will be taken from your bank account when the due date approaches.

How to Create a Lending App?

Before you design the app for lending to your company, you need to know the market trends and what you expect to see. Then, you should list the different features that you think are MVP (minimum acceptable product) attributes your app needs to have and select the appropriate technology stack to build the features at a cost-effective rate.

The competitiveness in fintech is becoming more intense. It is essential to create a niche for your company and create a dependable lending application.

Here are the different steps involved in creating an app that lends money as per iOS app development companies.

1. Discovery

The Discovery phase is about creating the application’s scope. It starts by defining the idea and concept behind the app. Then, it creates the foundation for the subsequent phases in the development of apps.

Start by defining the kind of loans the app will help, what kind of issue the app will solve, its capabilities and the intended customers are.

The initial discovery phase of your app should address the following aspects:

The concept behind the app is to get the perspective of the founder by speaking with them and understanding the idea. Then, you can structure your idea.

The target audience should be identified What group of users will this app target and what pain points and issues this app will help to solve.

Conduct market research and study your competitors’ business. Learn from their successes and their failures.

Design the application blueprint. Define the scope of the project including budget, time estimation and deliverables. Determine priorities and set deadlines.

Find out which laws that the prototype is expected to be able to comply with. – assemble all laws governing the prototype and create the requirements specifications document that is based on it.

2. Lending App-Specific Essentials

Begin by choosing an entity that is legal. For instance for example, a Limited Liability Company (LLC) or a corporation could be a good choice. Both can protect your assets from creditors in the event of bankruptcy or force majeure. But, they are taxed in a different way.

The taxation of an LLC can be viewed as a pass-through entity, meaning that its earnings and losses are recorded on the owner’s tax return. However corporations are considered a legally-formed entity which is able to earn income.

In the next step, you’ll need to apply for a trademark registration within the country in which you plan to establish your business. Be aware that the trademark name must be distinct from the legal name and must be registered on the uspto.gov register of trademarks.

It is best if you secured the capital you need for your app for peer-to-peer money lending development as well as the initial loans. Investors are attracted by FinTech platforms that have real-world users seek loans, and so you’ll need funds in order to get started before investors’ money starts to flow in.

You can obtain the initial capital via Initial Coin Offering (ICO) or Initial Public Offering (IPO). You may also choose Venture Capital (VC) or bank loans.

Finally, you need to select the bank to store operating capital.

3. Finalize Technology Stack

It is essential to select the appropriate technology stack when creating a fintech application. The technology stack or the stack of solutions defines the mix of technologies needed to create and manage your application.

It is helpful to consider a variety of factors in this moment including security of data, performance and future scalability, the ability to integrate as well as the ease of adding more features and so on.This is where the best tech stack is crucial.

The below-mentioned techniques to create your mobile lending app.

Framework: Java 8 +, Lagom, Play, Akka, Spring, Slick, Spring Boot, JSON

Front End: Bootstrap, JavaScript, React, HTML5, CSS, JQuery, Angular, React

Mobile Platforms: React Native, Android, iOS, Swift, Objective-C

Web Services: SOAP, REST

Programming Language: JSON, Core JAVA

Database: MongoDB, PostgreSQL, SQL

Blockchain Framework: Hyper ledger Fabric, Ethereum, Corda, Stellar

4. Gather The Team

Based on the design of your app as well as the technology stack that you have chosen it is possible to hire loan lending app developers including, UI/UX developers, iOS and Android developers, front-end developers, back-end developers, QA specialists, as well as an account manager.

You can choose to build an entire team or outsource the entire project to an experienced loan lending app development company such as the A3Logics.

5. Design

This phase of design is vital because it provides the initial conception of the founder’s concept.

After this stage, you are able to see the wireframe, or a prototype app that illustrates how users will experience the app for money lending.

Every executable action and icon displayed on the wireframe is programmed as distinct functions by the programmers.

The design phase should concentrate on improving the appearance of your app, while increasing its engagement with users speed, responsiveness, and effectiveness.

6. Development and Testing

Testing and development is a crucial part of the development of a money lending app.

This process produces the development of MVP or fully functional fully scaled application with all features.

An MVP or short form for an initial product that is viable, is a software application that includes basic features that are released to test the concept’s viability within a specific market.

When you have reached a satisfactory satisfaction level for your MVP solution, you can begin developing the upgraded app, which will include more features that cater to customers.

Are there any other factors to think about when creating money earning apps?

Well, actually, yes.

Other things can help you greatly in the process of creating an application for money lending. While having a team of developers is among the most important requirements, it is not enough to make progress. You’ll need other units to develop the application, for example:

- The financial advisor will ensure you adhere to the numerous legal and regulatory laws and conditions in the country.

- Legal adviser to advise you on financial issues of the application.

- A banker who lends the amount of your loan to the end-users.

- Marketing firm for reaching the users you want to reach.

Must-have Features for FinTech Applications

Different kinds of FinTech applications require various features that directly affect the total cost of loan lending mobile app development. This article will highlight some important and essential features that are required by FinTech applications.

Registration

This basic feature enables users to sign-up on the platform and then create an account in order to access financial services.

Authentication

FinTech apps should be coupled with advanced authentication features like biometric authentication, MFA, and 2FA to provide greater security.

Multi-Payment Mode

This feature allows users to transfer money and pay with debit card, credit card, the online wallet Paypal account and various other options according to their convenience.

Push Notifications

The administrator can issue push notifications about discounts, renewals deals, transactions, offers and offers.

Manage Card

This feature lets customers connect multiple credit or debit card accounts and control them all from one FinTech application.

Chatbots

The integration of AI-powered chatbots enables FinTech applications to provide 24×7 customer support, and promptly answer frequently asked questions.

ML Algorithm

Implementing machine-learning algorithms into FinTech applications helps in providing individualized recommendations to users in accordance with their investment, spending and income pattern.

Risk Assessment

The integration with risk management software improves the capability for FinTech applications. Users can benefit from this feature to better comprehend the risk of investing and make more informed choices.

Digital Analytics

Digital analytics is a crucial and effective function of fintech apps. Monitoring the financial records of users and providing relevant insights is more important than ever. This feature in the fintech app allows users to quickly access and track their financial transactions directly through an app.

Financial Audit

Insurance, banking and other FinTech applications are incorporated with automated financial auditing tools that alert users if there are any suspicious or suspicious financial transactions. This is a crucial feature for FinTech applications because it boosts the interest of users and provides more transparency in the system.

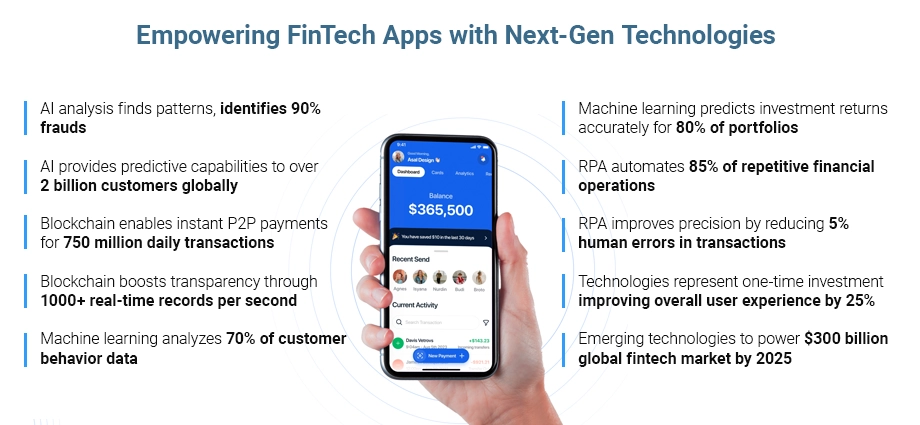

Next-Gen Technologies Powering Our FinTech Applications

Implementing the latest technologies in the framework of a FinTech application can enhance the overall capabilities of the system. But, it also impacts the overall FinTech outsource app development costs. Think of these technologies as a one-time investment since their application improves overall user experience and will help develop the future security of FinTech applications.

Artificial Intelligence (AI)

The age of Artificial Intelligence is here to remain, and startups are able to harness its power to offer smart services to their customers. Integrating AI in the fintech application lets you analyze the financial records of your customers, find patterns, identify frauds, and perform predictive analysis. Artificial Intelligence as a useful feature allows you to make use of the capabilities of emerging technologies.

Blockchain

In the context of developing fintech apps, Blockchain development services is also a vital feature that deserves attention. The inclusion of blockchain in the app could provide a lot of transparency to users and allow transactions to be completed in just moments. With a blockchain integrated for the fintech application, you can boost Peer-to-Peer payments. Blockchain technology is capable of enabling the quick sharing of data across various platforms using an interface that is similar to banking and banks.

Machine Learning

The implementation of machine learning technology allows FinTech applications to analyse customer behavior using data analysis. Also, utilizing these machine learning algorithms can provide predictive analysis and recommend investing opportunities. This can yield higher returns.

Robotic Process Automation

Utilization of RPA technology can help automate and improve financial operations, and increase overall system precision. Also, the use of robotic process automation can be effective in automating repetitive financial procedures.

Money Lending App Development: Costing

After gaining knowledge on how to create a loan application, you should know the cost involved in money lending app development. The overall price of the app is different due to various factors like:

App Platform

Making the right choice between iOS and Android for your app platform is not an easy task because it impacts both your budget and the base.

App Design

The design of the app must be appealing and captivating enough to attract the client’s attention. Therefore, you must employ a designer who will provide you with an application that includes interactive UI/UX. However, be aware since it can increase the cost of the app and also make it more complex.

App Features

Features are an integral aspect of the application. Also, the inclusion of the basic features won’t impact the total cost, but advanced features can be integrated in certain ways. So, be sure to choose carefully.

Location & Experience of the Company

When hiring an enterprise mobile app development company, it is essential to evaluate their past prior experience before deciding on the cost. It is also important to consider whether you’re using outsourcing or in-house services, it will have a direct effect on the development costs.

So, we estimate that the total cost of developing a loan lending app is between $45,000 and $95,000 as per Android app development companies. Like we said, it is subject to these factors. Keeping these things in mind will help you in all ways and will allow you to have mobile application development within your budget, and not overdo it for unneeded factors.

Final Thoughts

The apps for money lending (if developed with thought) are performing pretty good these days. The people are seeking simpler and less complicated options that aren’t as expensive as traditional banks for needs with loans.

If, like a lot of other startups, you are planning to put your money into creating a lending application that is customized, contact us.

A3Logics can design and build a revolutionary technology solution that is perfect for your needs. We’ll reduce the technical burden off your shoulders, and build an experience that your customers will be sure to love.

So, A3Logics is a prestigious mobile and web app development company that has vast experience. You get complete help in creating remarkable digital success stories for a variety of organizations. Let’s talk.

Book 30 Minutes Free Consultations with A3Logics Experts to Start Your App Journey Today!

Frequently Asked Questions

What is a Lending App?

Sometimes we require funds to cover different financial issues ranging from the payment of mortgages and car loans.

The app for money lending is a solution in digital form that lets you get funds from any financial institution within your country.

This app allows users to access money easily and without needing to physically go to lenders, banks or other financial institutions, or borrow money from family members or your family.

It allows you to look at the various interest rates to determine which one fits your needs best, and determine whether you’re eligible to receive the loan. The most beneficial part is that you are sure that your personal information is safe, and you will be able to repay the loan on this same form of application.

Also, the benefits of a lending app are not only for the borrower. However, it can help the lenders cut their operational expenses, speed up the KYC procedure, while simultaneously serving many clients, and tap into new markets.

What is the time it takes to create an app that grants loans?

The cost and the time required to create loan lending applications depend on a variety of aspects. This includes the amount of steps required and how crucial these features will be.

Also, the time is between six and nine months to develop free money lending apps.

We have been in the business of development for more than decades. We’ve the expertise to match the fintech solutions you need. Don’t be deceived by our claims and trust us to deliver our mission!

How Much Does It Cost To Develop A Loan Lending App?

Although you won’t be able to find exact prices. You can anticipate the price of building an app for loan lending to range from $25,000 to $65,000.

If you’re looking for an accurate dollar cost, it is recommended to consult with a mobile app development firm. They can provide an overview of the subject.

Why Should I Develop A Loan Lending App With A3Logics?

A3Logics is a leading mobile application Development Company with years’ of expertise. We have the expertise to provide effective Cash Advance Apps Like Empowerl that can aid your business in growing and produce record-breaking revenues.

![10 Top IoT Security Solution Providers in USA [2024]](https://www.a3logics.com/wp-content/uploads/2024/04/New-Project-4-2.webp)